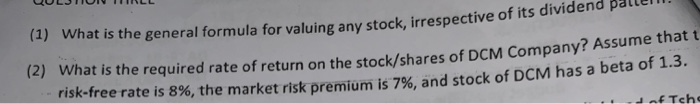

Question: help solution the required rate of return can be computed from 8% plus 1.3 times risk premium 7% (3) Assume that DCM Company is a

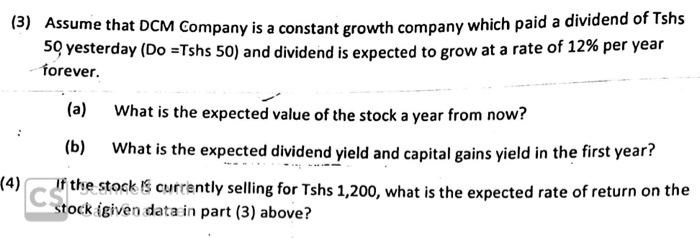

(3) Assume that DCM Company is a constant growth company which pa any is a constant growth company which paid a dividend of Tshs 59 yesterday (Do =Tshs 50) and dividend is expected to grow at a rate of 12% per year forever. (a) What is the expected value of the stock a year from now? (b) What is the expected dividend yield and capital gains yield in the first year? (4) If the stock is currently selling for Tshs 1,200, what is the expected rate of return on the stock (given data in part (3) above? QULJTUN TILL (1) What is the general formula for valuing an is the general formula for valuing any stock, irrespective of its dividend pattern. (2) What is the required rate of return on the stock/shares of DCM Company on the stock/shares of DCM Company? Assume that t risk-free rate is 8%, the market risk premium is 7% and stock of DCM has a beta on of Tche

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts