Question: Help Solve Chuck Wagon Grills, Inc, makes a single product-a handmade specialty barbecue grill that it sells for $200. Data for last year's operations follow:

Help Solve

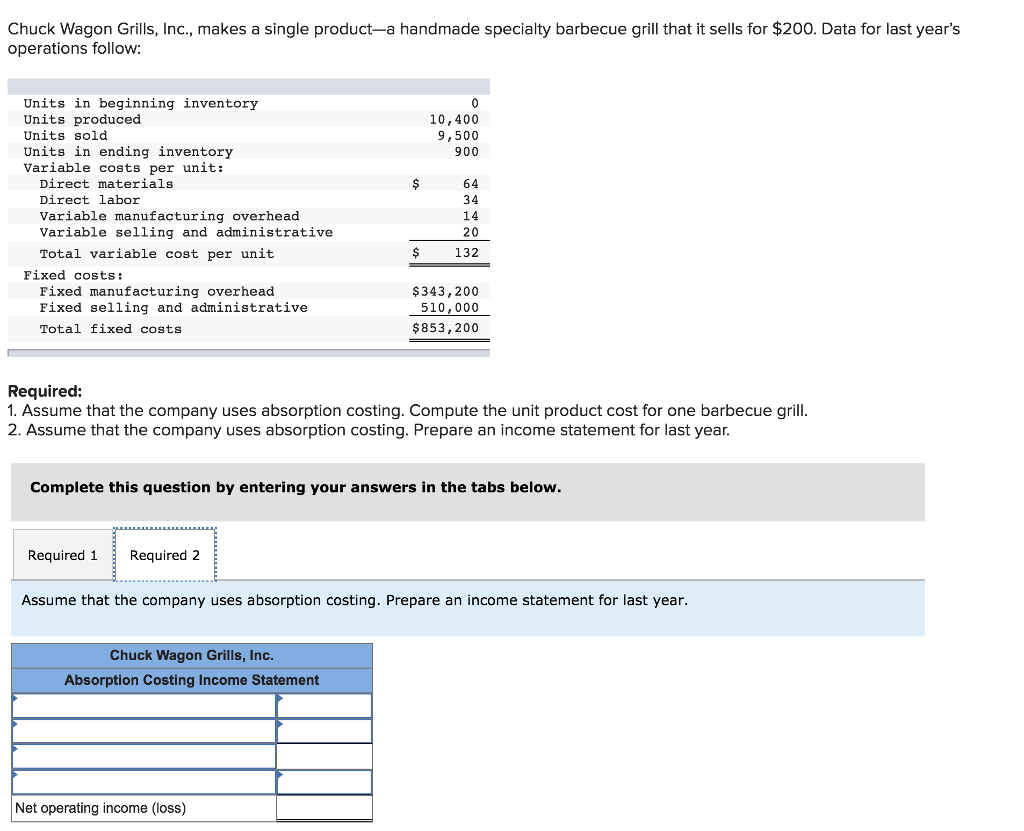

Chuck Wagon Grills, Inc, makes a single product-a handmade specialty barbecue grill that it sells for $200. Data for last year's operations follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: 10,400 9,500 900 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit 64 34 14 20 132 $ Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs $343,200 510,000 $853,200 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill 2. Assume that the company uses absorption costing. Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Required1 Required2 Assume that the company uses absorption costing. Prepare an income statement for last year Chuck Wagon Grills, Inc Absorption Costing Income Statement Net operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts