Question: help solve part 1 part 2 part 3 During the year, Molly Manufacturing incurred $120,000 in actual manufacturing overhead costs. Manufacturing overhead is applied based

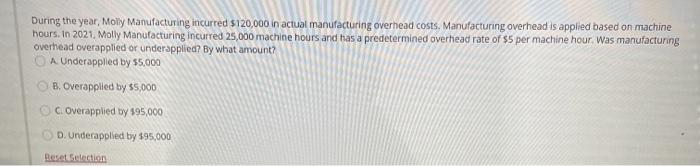

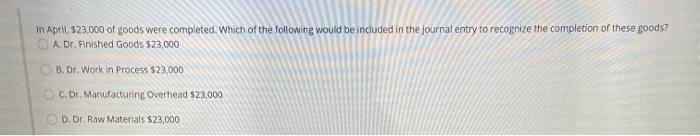

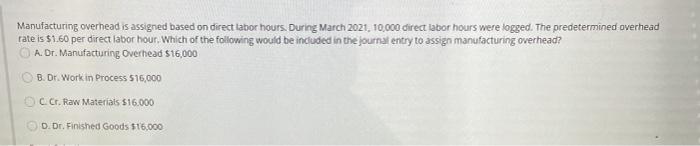

During the year, Molly Manufacturing incurred $120,000 in actual manufacturing overhead costs. Manufacturing overhead is applied based on machine hours. In 2021. Molly Manufacturing incurred 25,000 machine hours and has a predetermined overhead rate of $5 per machine hour. Was manufacturing overhead overapplied or underapplied? By what amount? A Underapplied by 55,000 B. Overapplied by 55,000 C. Overapplied by 195,000 D. Underapplied by 195.000 Reset Selection In Apell, 523,000 of goods were completed. Which of the following would be included in the journal entry to recognize the completion of these goods? A De. Finished Goods $23,000 B.Dr. Work in Process $23,000 C. DC. Manufactuning Overhead 523.000 D. Dr. Raw Materials $23,000 Manufacturing overhead is assigned based on direct labor hours. During March 2021. 10,000 direct labor hours were logged. The predetermined overhead rate is $1.60 per direct labor hour. Which of the following would be induded in the journal entry to assign manufacturing overhead? A. Dr. Manufacturing Overhead $15,000 B. Dr. Work in Process 516,000 C. Cr. Raw Materials $16.000 D. Dr. Finished Goods $16.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts