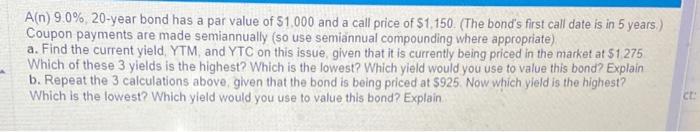

Question: help solve plz with steps A(n) 9.0%,20-year bond has a par value of $1,000 and a call price of $1,150. (The bond's first call date

A(n) 9.0%,20-year bond has a par value of $1,000 and a call price of $1,150. (The bond's first call date is in 5 years.) Coupon payments are made semiannually (so use seminnual compounding where appropriate) a. Find the current yield, YTM, and YTC on this issue, given that it is currently being priced in the market at $1275 Which of these 3 yields is the highest? Which is the lowest? Which yield would you use to value this bond? Explain b. Repeat the 3 calculations above, given that the bond is being priced at $925. Now which yield is the highest? Which is the lowest? Which yield would you use to value this bond? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts