Question: Help solve the problem. Show work, thanks! Exercise 4: Gross Profit Method for Estimating Cost of Goods Sold and Ending Inventory (first read pages 466-468)

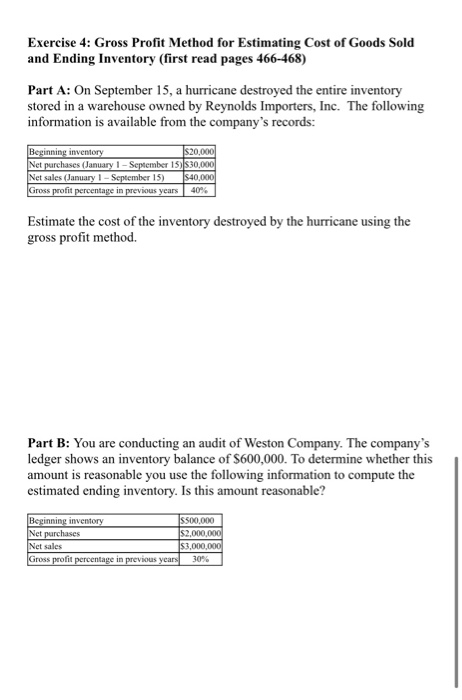

Exercise 4: Gross Profit Method for Estimating Cost of Goods Sold and Ending Inventory (first read pages 466-468) Part A: On September 15, a hurricane destroyed the entire inventory stored in a warehouse owned by Reynolds Importers, Inc. The following information is available from the company's records: Beginning inventory S20.000 Net purchases (January 1 - September 1530,000 Net sales (January 1- September 15) $40,000 Gross profit percentage in previous years 40% Estimate the cost of the inventory destroyed by the hurricane using the gross profit method. Part B: You are conducting an audit of Weston Company. The company's ledger shows an inventory balance of $600,000. To determine whether this amount is reasonable you use the following information to compute the estimated ending inventory. Is this amount reasonable? Beginning inventory S500,000 Net purchases $ 2.000.000 Net sales $3.000.000 Gross profit percentage in previous years 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts