Question: help solve this ? Suppose a bank manager provides you with the following data for a bank. Asset Value Return PD LGD%) EAD Category (FJD

help solve this ?

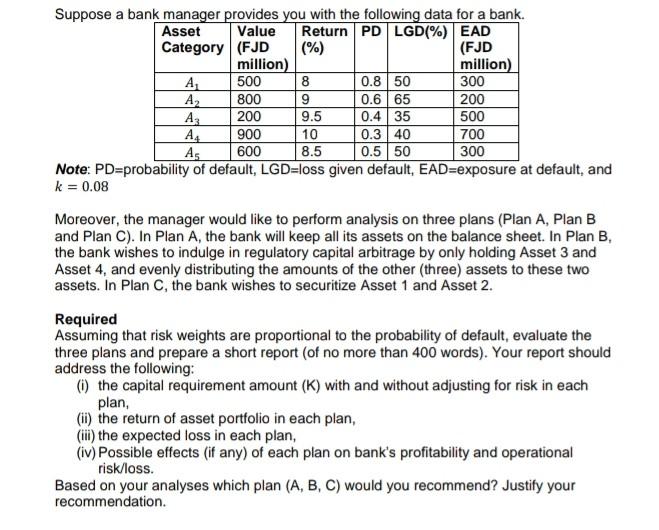

Suppose a bank manager provides you with the following data for a bank. Asset Value Return PD LGD%) EAD Category (FJD (%) (FJD million) million) A 500 8 0.8 50 300 A2 800 9 0.6 65 200 Az 200 0.4 35 A4 900 10 0.3 40 700 As 600 8.5 0.5 50 300 Note: PD=probability of default, LGD-loss given default, EAD=exposure at default, and k = 0.08 9.5 500 Moreover, the manager would like to perform analysis on three plans (Plan A, Plan B and Plan C). In Plan A, the bank will keep all its assets on the balance sheet. In Plan B, the bank wishes to indulge in regulatory capital arbitrage by only holding Asset 3 and Asset 4, and evenly distributing the amounts of the other (three) assets to these two assets. In Plan C, the bank wishes to securitize Asset 1 and Asset 2. Required Assuming that risk weights are proportional to the probability of default, evaluate the three plans and prepare a short report of no more than 400 words). Your report should address the following: (1) the capital requirement amount (K) with and without adjusting for risk in each plan, (ii) the return of asset portfolio in each plan, (iii) the expected loss in each plan, (iv) Possible effects (if any) of each plan on bank's profitability and operational risk/loss. Based on your analyses which plan (A, B, C) would you recommend? Justify your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts