Question: help solving A factory costs $880,000. You reckon that it will produce an inflow after operating costs of $178,000 a year for 12 years. If

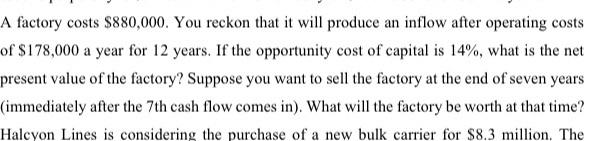

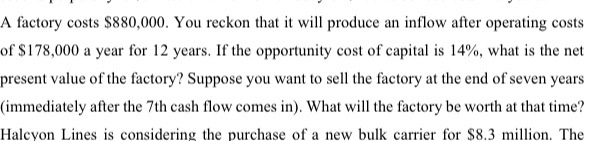

A factory costs $880,000. You reckon that it will produce an inflow after operating costs of $178,000 a year for 12 years. If the opportunity cost of capital is 14%, what is the net present value of the factory? Suppose you want to sell the factory at the end of seven years (immediately after the 7th cash flow comes in). What will the factory be worth at that time? Halcyon Lines is considering the purchase of a new bulk carrier for $8.3 million. The A factory costs $880,000. You reckon that it will produce an inflow after operating costs of $178,000 a year for 12 years. If the opportunity cost of capital is 14%, what is the net present value of the factory? Suppose you want to sell the factory at the end of seven years (immediately after the 7th cash flow comes in). What will the factory be worth at that time? Halcyon Lines is considering the purchase of a new bulk carrier for $8.3 million. The Gregg Snead has been offered four investment opportunities, all equally priced at $45,000. Because the opportunities differ in risk, Gregg's required returns (i.e., applicable discount rates) are not the same for each opportunity. The cash flows and required returns for each opportunity are summarized below. 1 Opportunity Cash Flows Required Return A 7500 at the end of the year 5 12% Year CF 15% 10000 2 12000 B 3 18000 4 10000 5 13000 6 9000 5000 at the end of each year 10% for the next 30 years D 7000 at the beginning of each 18% year for the next 20 years a) Find the present value of each of the four investment opportunities. b) Which, if any, opportunities are acceptable? Which opportunity should Gregg take? c) Calculate the NPV. Is the decision of Gregg still the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts