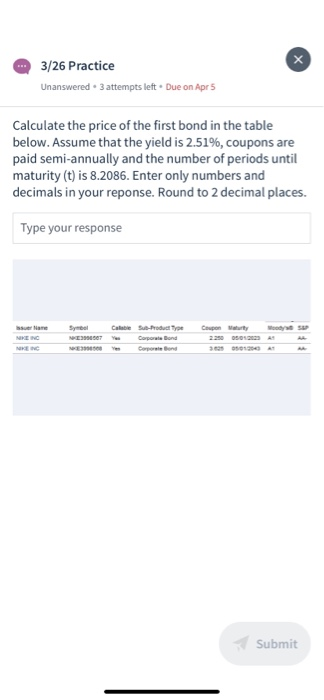

Question: Help solving these please 3/26 Practice Unanswered. 3 attempts left. Due on Apr 5 Calculate the price of the first bond in the table below.

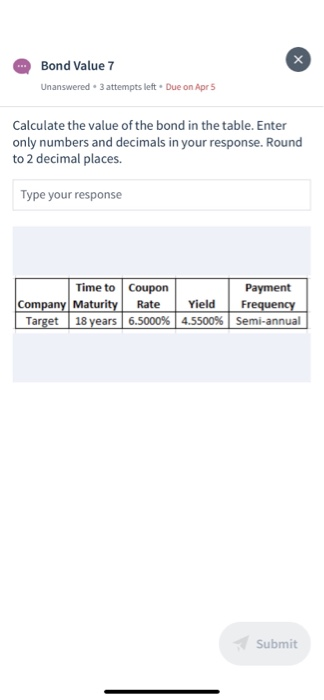

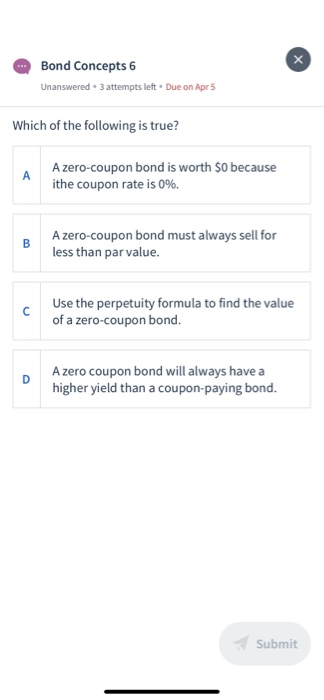

3/26 Practice Unanswered. 3 attempts left. Due on Apr 5 Calculate the price of the first bond in the table below. Assume that the yield is 2.51%, coupons are paid semi-annually and the number of periods until maturity (t) is 8.2086. Enter only numbers and decimals in your reponse. Round to 2 decimal places. Type your response Submit Bond Value 7 Unanswered. 3 attempts left. Due on Apr 5 Calculate the value of the bond in the table. Enter only numbers and decimals in your response. Round to 2 decimal places Type your response Time to Coupon Company Maturity Rate Target 18 years 6.5000% Yield 4.5500% Payment Frequency Semi-annual Submit . Bond Concepts 6 Unanswered 3 attempts left. Due on Apr 5 Which of the following is true? A zero-coupon bond is worth $0 because ithe coupon rate is 0%. A zero-coupon bond must always sell for less than par value. Use the perpetuity formula to find the value of a zero-coupon bond. A zero coupon bond will always have a higher yield than a coupon-paying bond. Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts