Question: Help soon please, need help, thank you I will rate up :) Boran Stockbrokers, Inc., selects four stocks for the purpose of developing its own

Help soon please, need help, thank you I will rate up :)

Help soon please, need help, thank you I will rate up :)

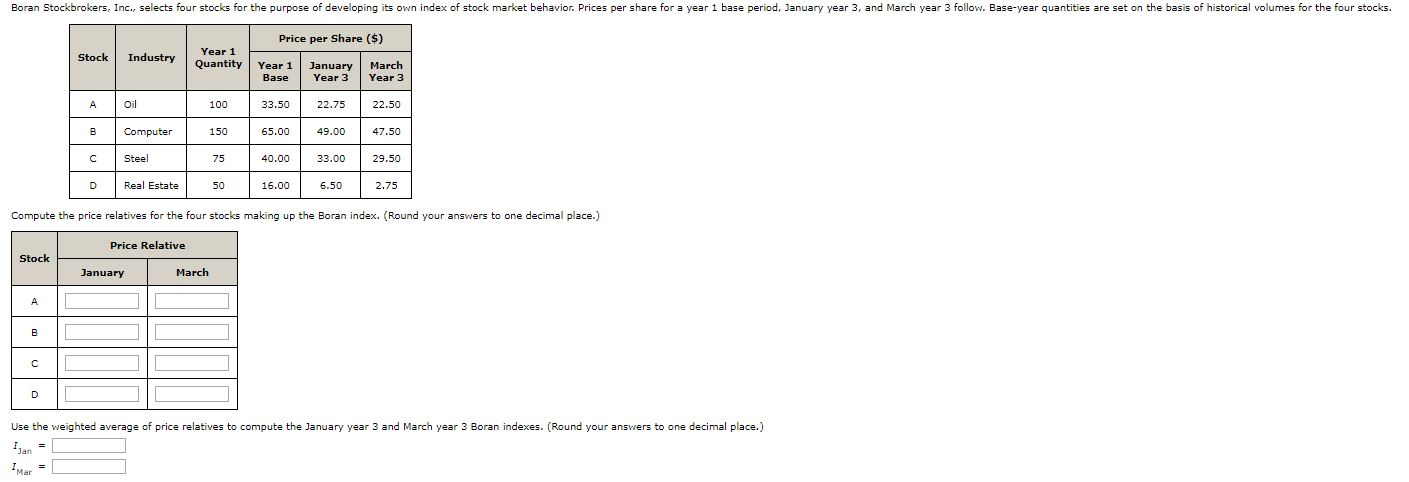

Boran Stockbrokers, Inc., selects four stocks for the purpose of developing its own index of stock market behavior. Prices per share for a year 1 base period, January year 3, and March year 3 follow. Base-year quantities are set on the basis of historical volumes for the four stocks. Price per Share ($) Stock Industry Year 1 Quantity Year 1 Base January Year 3 March Year 3 A oil 100 33.50 22.75 22.50 49.00 47.50 Computer Steel 65.00 40.00 75 33.00 29.50 2.75 Real Estate 50 16.00 6.50 Compute the price relatives for the four stocks making up the Boran index. (Round your answers to one decimal place.) Price Relative Stock January March Use the weighted average of price relatives to compute the January year 3 and March year 3 Boran indexes. (Round your answers to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts