Question: Help ! Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest.

Help !

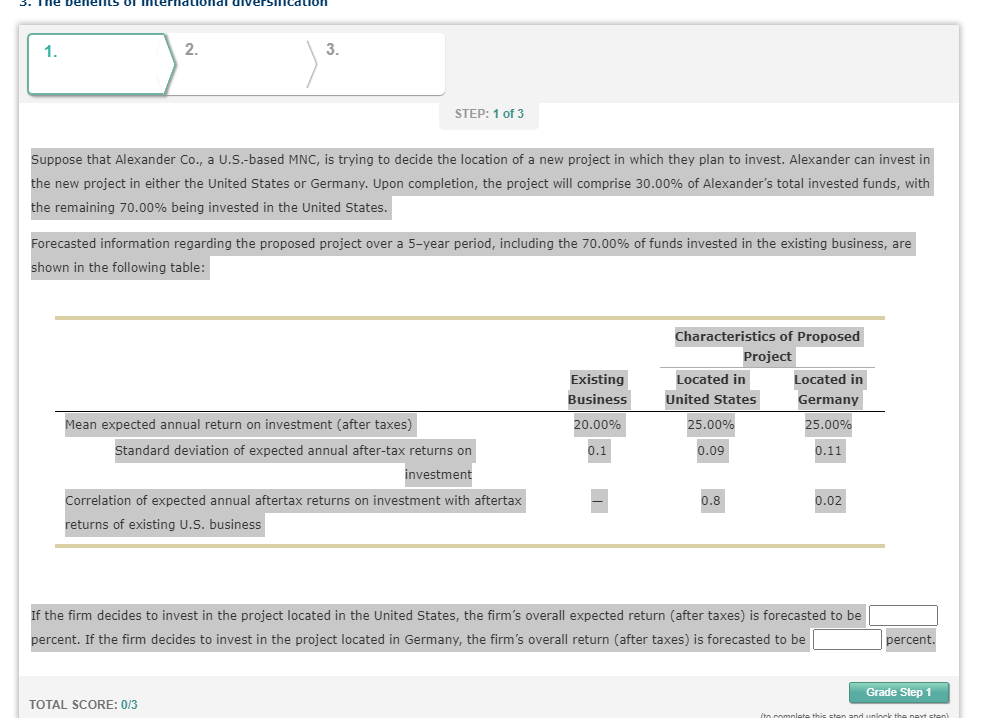

Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexanders total invested funds, with the remaining 70.00% being invested in the United States.

Forecasted information regarding the proposed project over a 5year period, including the 70.00% of funds invested in the existing business, are shown in the following table:

| Existing Business | Characteristics of Proposed Project | ||

|---|---|---|---|

| Located in United States | Located in Germany | ||

| Mean expected annual return on investment (after taxes) | 20.00% | 25.00% | 25.00% |

| Standard deviation of expected annual after-tax returns on investment | 0.1 | 0.09 | 0.11 |

| Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business | 0.8 | 0.02 | |

If the firm decides to invest in the project located in the United States, the firms overall expected return (after taxes) is forecasted to be ?

percent. If the firm decides to invest in the project located in Germany, the firms overall return (after taxes) is forecasted to be ?

Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States. Forecasted information regarding the proposed project over a 5 -year period, including the 70.00% of funds invested in the existing business, are shown in the following table: If the firm decides to invest in the project located in the United States, the firm's overall expected return (after taxes) is forecasted to be percent. If the firm decides to invest in the project located in Germany, the firm's overall return (after taxes) is forecasted to be Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States. Forecasted information regarding the proposed project over a 5 -year period, including the 70.00% of funds invested in the existing business, are shown in the following table: If the firm decides to invest in the project located in the United States, the firm's overall expected return (after taxes) is forecasted to be percent. If the firm decides to invest in the project located in Germany, the firm's overall return (after taxes) is forecasted to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts