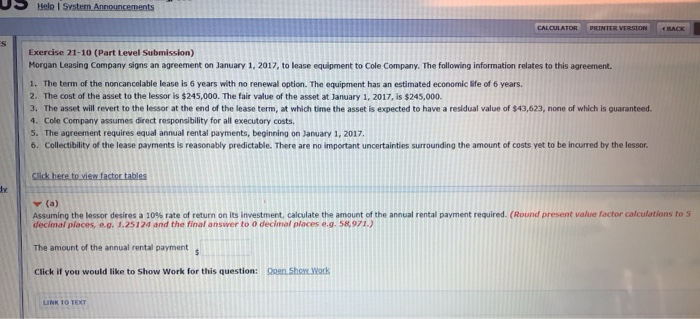

Question: Help System Announcements CALCULATOR PRINTER VERSION BACK Exercise 21-10 (Part Level Submission) Morgan Leasing Company signs an agreement on January 1, 2017, to lease equipment

Help System Announcements CALCULATOR PRINTER VERSION BACK Exercise 21-10 (Part Level Submission) Morgan Leasing Company signs an agreement on January 1, 2017, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the noncancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2. The cost of the asset to the lessor is $245,000. The fair value of the asset at January 1, 2017, is $245,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $43,623, none of which is guaranteed. 4. Cole Company assumes direct responsibility for all executory costs. 5. The agreement requires equal annual rental payments, beginning on January 1, 2017 6. Collectibility of the lease payments is reasonably predictable. There are no important uncertainties surrounding the amount of costs yet to be incurred by the lessor. Click here to view factor tables x (a) Assuming the lessor desires a 10% rate of return on its investment, calculate the amount of the annual rental payment required. (Round present value factor calculations to s decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971.) The amount of the annual rental payment $ Click if you would like to show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts