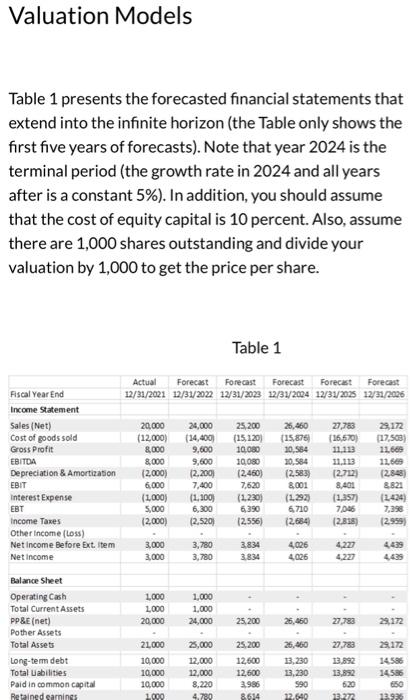

Question: help Table 1 presents the forecasted financial statements that extend into the infinite horizon (the Table only shows the first five years of forecasts). Note

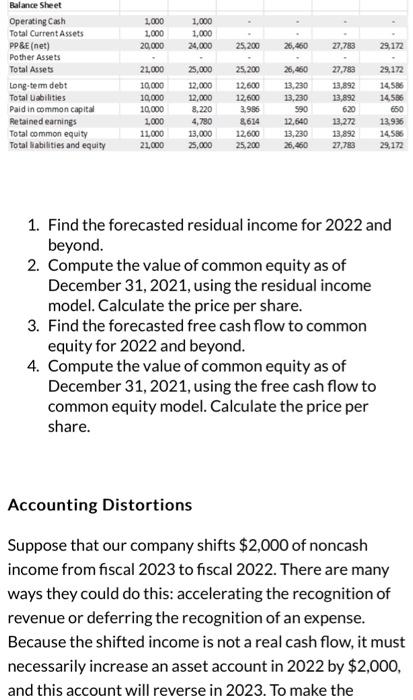

Table 1 presents the forecasted financial statements that extend into the infinite horizon (the Table only shows the first five years of forecasts). Note that year 2024 is the terminal period (the growth rate in 2024 and all years after is a constant 5\%). In addition, you should assume that the cost of equity capital is 10 percent. Also, assume there are 1,000 shares outstanding and divide your valuation by 1,000 to get the price per share. Table 1 1. Find the forecasted residual income for 2022 and beyond. 2. Compute the value of common equity as of December 31,2021 , using the residual income model. Calculate the price per share. 3. Find the forecasted free cash flow to common equity for 2022 and beyond. 4. Compute the value of common equity as of December 31, 2021, using the free cash flow to common equity model. Calculate the price per share. Accounting Distortions Suppose that our company shifts $2,000 of noncash income from fiscal 2023 to fiscal 2022. There are many ways they could do this: accelerating the recognition of revenue or deferring the recognition of an expense. Because the shifted income is not a real cash flow, it must necessarily increase an asset account in 2022 by $2,000, and this account will reverse in 2023 . To make the Table 1 presents the forecasted financial statements that extend into the infinite horizon (the Table only shows the first five years of forecasts). Note that year 2024 is the terminal period (the growth rate in 2024 and all years after is a constant 5\%). In addition, you should assume that the cost of equity capital is 10 percent. Also, assume there are 1,000 shares outstanding and divide your valuation by 1,000 to get the price per share. Table 1 1. Find the forecasted residual income for 2022 and beyond. 2. Compute the value of common equity as of December 31,2021 , using the residual income model. Calculate the price per share. 3. Find the forecasted free cash flow to common equity for 2022 and beyond. 4. Compute the value of common equity as of December 31, 2021, using the free cash flow to common equity model. Calculate the price per share. Accounting Distortions Suppose that our company shifts $2,000 of noncash income from fiscal 2023 to fiscal 2022. There are many ways they could do this: accelerating the recognition of revenue or deferring the recognition of an expense. Because the shifted income is not a real cash flow, it must necessarily increase an asset account in 2022 by $2,000, and this account will reverse in 2023 . To make the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts