Question: help thanks Most changes in accounting principle require a disclosure justifying the change in the first set of financial statements after the change is made.

help thanks

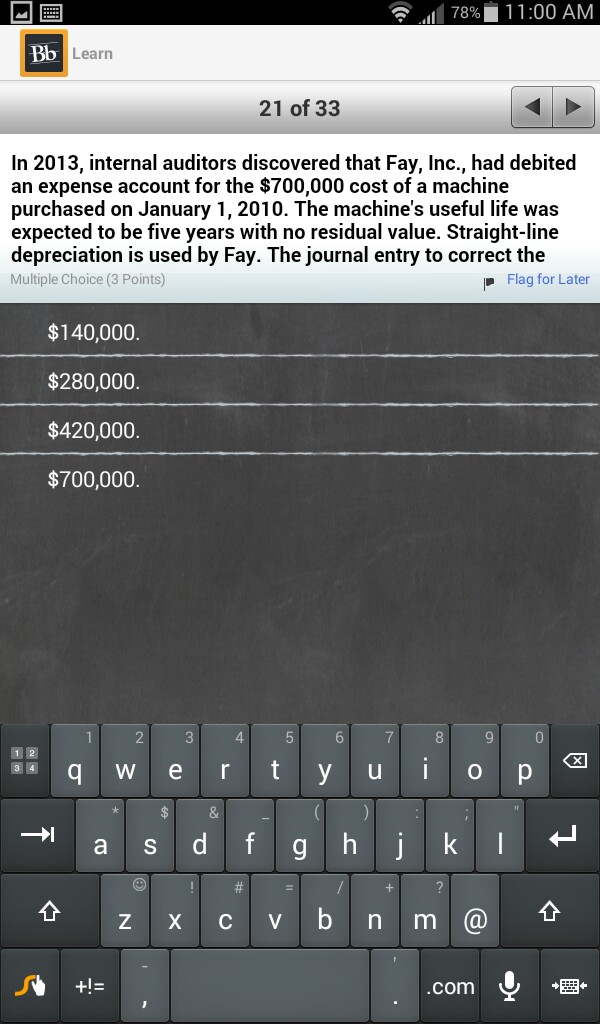

Most changes in accounting principle require a disclosure justifying the change in the first set of financial statements after the change is made. All changes reported using the retrospective approach require prior period adjustments. A change in reporting entity requires note disclosure in all subsequent financial statements prepared for the new entity. In 2013, internal auditors discovered that Fay, Inc. had debited an expense account for the $700,000 cost of a machine purchased on January 1, 2010. The machine's useful life was expected to be five years with no residual value. Straight-line depreciation is used by Fay. The journal entry to correct the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts