Question: help The old machine can be sold today for $35,000. The firm's tax rate is 35%, and the appropriate cost of capital is 16%. 1.

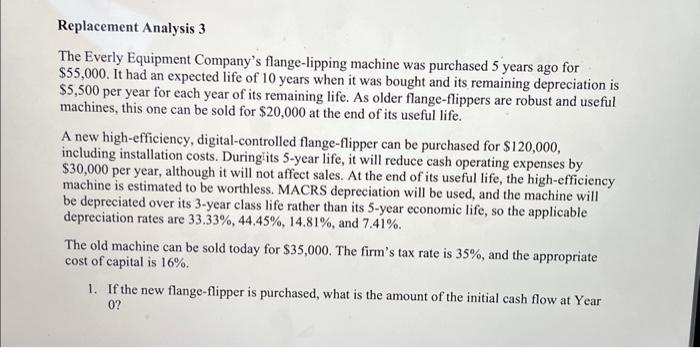

The old machine can be sold today for $35,000. The firm's tax rate is 35%, and the appropriate cost of capital is 16%. 1. If the new flange-flipper is purchased, what is the amount of the initial cash flow at Year 0 ? 2. What are the incremental net cash flows that will occur at the end of Years 1 through 5 ? 3. What is the NPV of this project? Should Everly replace the flange-flipper? Replacement Analysis 3 The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $55,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $5,500 per year for each year of its remaining life. As older flange-flippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life. A new high-efficiency, digital-controlled flange-flipper can be purchased for $120,000, including installation costs. Duringits 5-year life, it will reduce cash operating expenses by $30,000 per year, although it will not affect sales. At the end of its useful life, the high-efficiency machine is estimated to be worthless. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%,44.45%,14.81%, and 7.41%. The old machine can be sold today for $35,000. The firm's tax rate is 35%, and the appropriate cost of capital is 16%. 1. If the new flange-flipper is purchased, what is the amount of the initial cash flow at Year 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts