Question: Help! This is 1 question! ! Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Year

Help! This is 1 question!

![to the questions displayed below.] Simon Company's year-end balance sheets follow. Current](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717db2cd101d_6846717db2c6c58f.jpg)

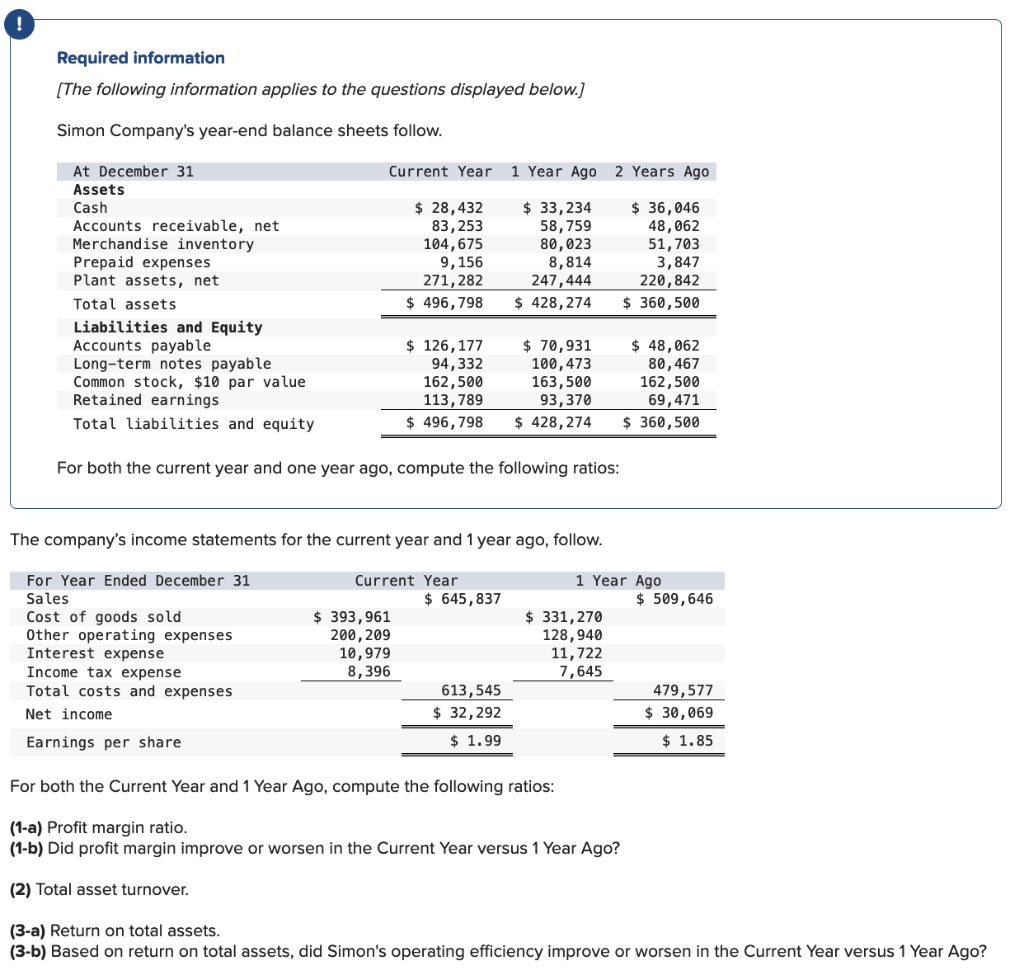

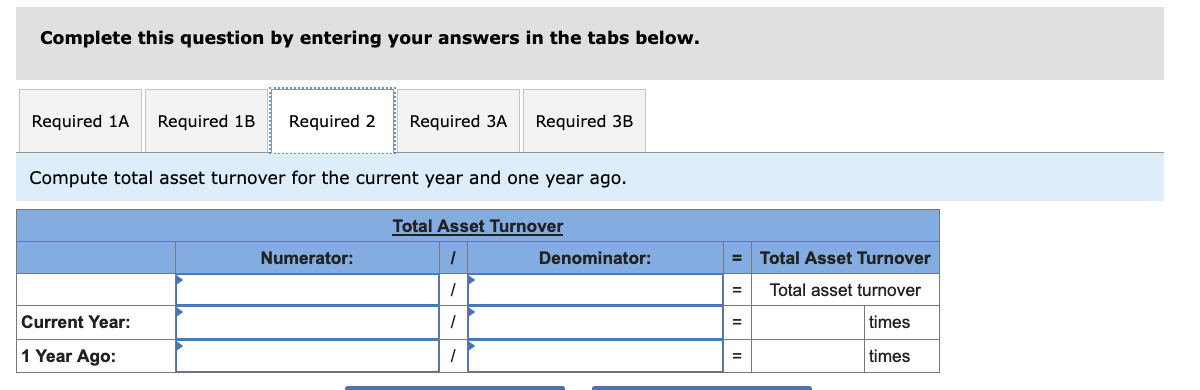

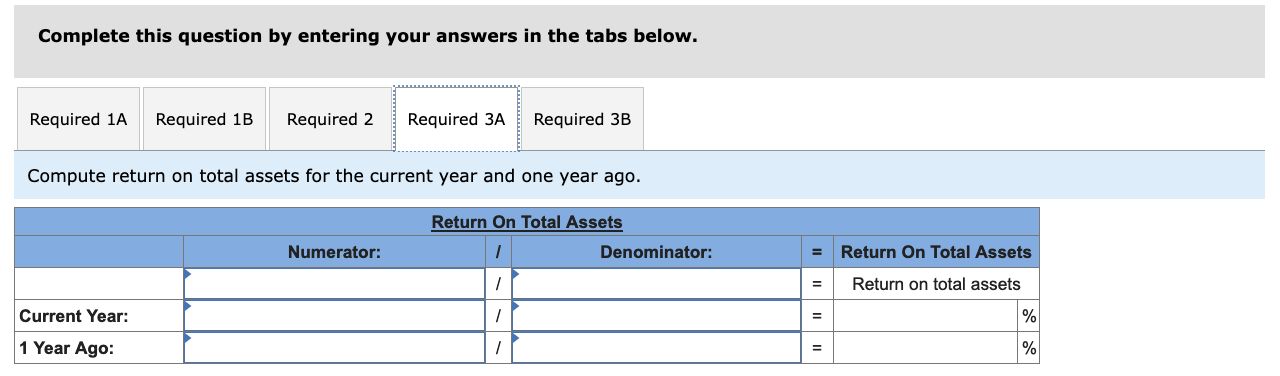

! Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 28,432 83, 253 104,675 9, 156 271,282 $ 496,798 $ 33, 234 58,759 80,023 8,814 247,444 $ 428,274 $ 36,046 48,062 51,703 3,847 220, 842 $ 360,500 $ 126, 177 94,332 162,500 113,789 $ 496,798 $ 70,931 100, 473 163,500 93, 370 $ 428,274 $ 48,062 80,467 162,500 69, 471 $ 360,500 For both the current year and one year ago, compute the following ratios: The company's income statements for the current year and 1 year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Year $ 645,837 $ 393,961 200,209 10,979 8, 396 613,545 $ 32,292 $ 1.99 1 Year Ago $ 509,646 $ 331,270 128, 940 11,722 7,645 479,577 $ 30,069 $ 1.85 Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? (2) Total asset turnover. (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3A Required 3B Compute profit margin ratio for the current year and one year ago. Profit Margin Ratio Numerator: / Denominator: Profit Margin Ratio Profit margin ratio / 1 % Current Year: 1 Year Ago: 1 = % Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3A Required 3B Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Profit margin Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3A Required 3B Compute total asset turnover for the current year and one year ago. Total Asset Turnover Numerator: 1 Denominator: Total Asset Turnover 1 Total asset turnover Current Year: / = times 1 Year Ago: 1 times Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3A Required 3B Compute return on total assets for the current year and one year ago. Return On Total Assets Numerator: 1 Denominator: Return On Total Assets 1 = Return on total assets Current Year: = % 1 Year Ago: = % Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3A Required 3B Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Return on total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts