Question: HELP. This problem is based on the transactions for the Stam Consulting Company in your text. Prepare journal entries for each transaction and identify the

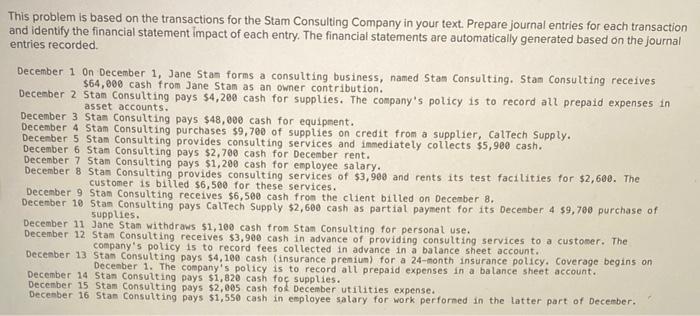

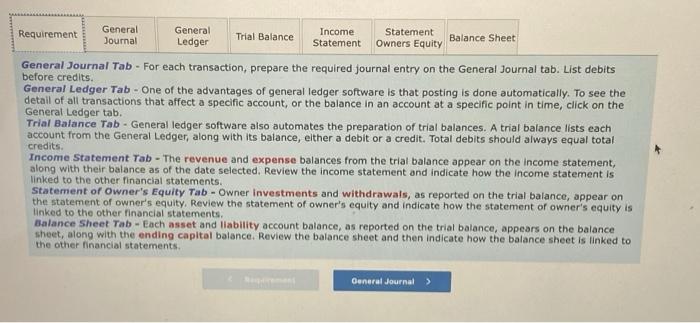

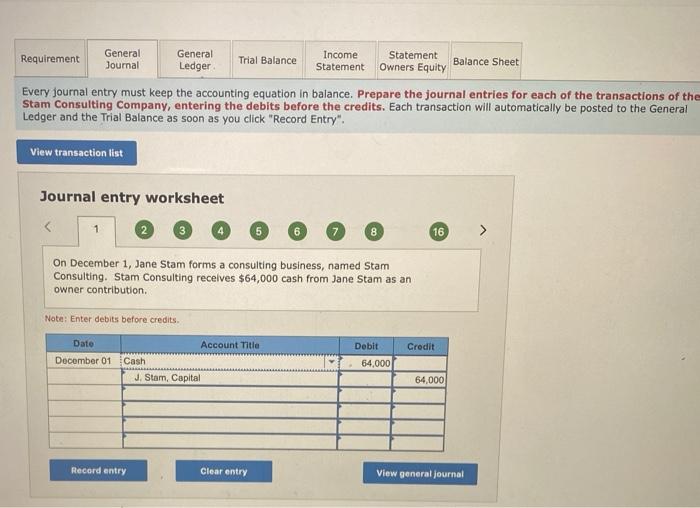

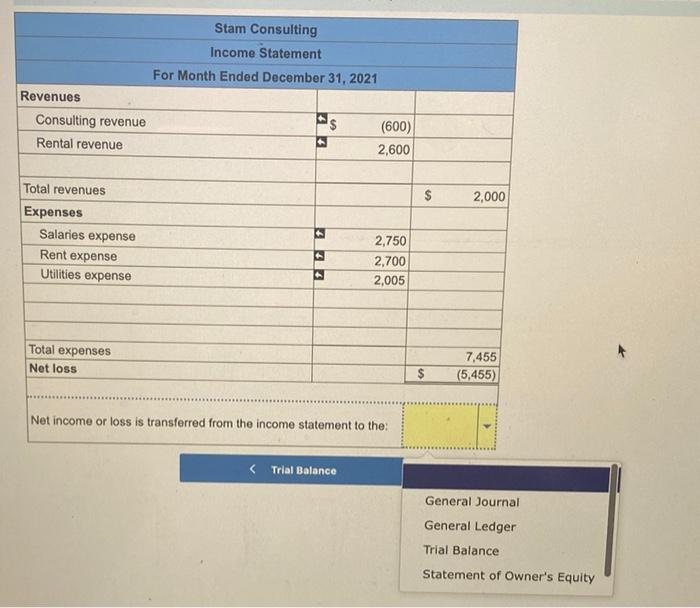

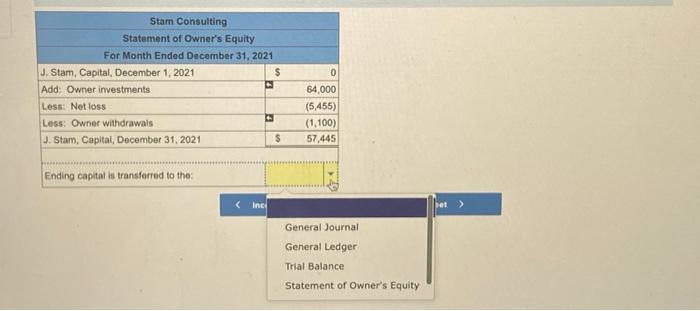

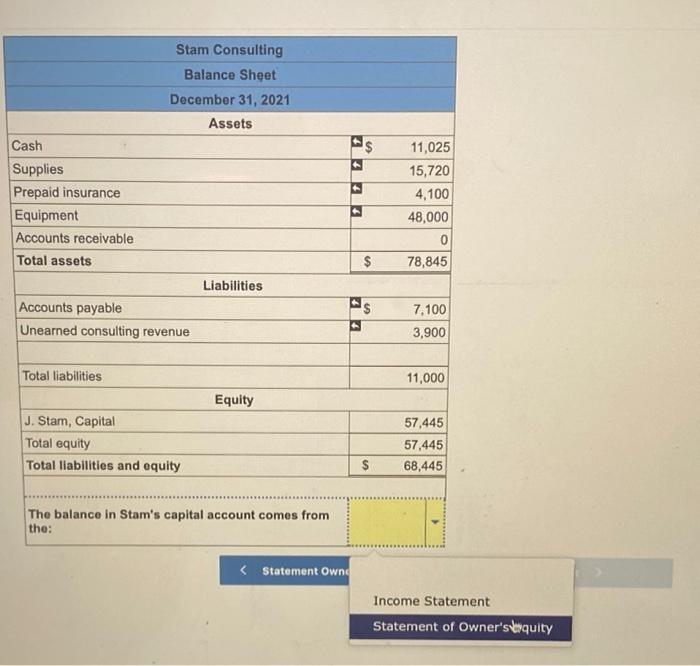

This problem is based on the transactions for the Stam Consulting Company in your text. Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded December 1 on December 1, Jane Stan forms a consulting business, named Stan Consulting. Stan Consulting receives $64,000 cash from Jane Stan as an owner contribution. December 2 Stan Consulting pays $4,200 cash for supplies. The company's policy is to record all prepaid expenses in asset accounts. December 3 Stan Consulting pays $48,000 cash for equipment. December 4 Stan Consulting purchases $9,700 of supplies on credit from a supplier, CalTech Supply. December 5 Stan Consulting provides consulting services and immediately collects $5,900 cash. December 6 Stan Consulting pays $2,700 cash for December rent. December 7 Stam Consulting pays $1,200 cash for employee salary. December 8 Stan Consulting provides consulting services of $3,900 and rents its test facilities for $2,600. The customer is billed $6,500 for these services. December 9 Stan Consulting receives $6,500 cash from the client billed on December 8. December 10 Stan Consulting pays CalTech Supply $2,600 cash as partial payment for its December 4 $9,700 purchase of December 11 Jane Stan withdraws $1,100 cash from Stan Consulting for personal use. December 12 Stam Consulting receives $3,900 cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account. December 13 Stan Consulting pays $4,100 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. The company's policy is to record all prepaid expenses in a balance sheet account. December 14 Stan Consulting pays $1,820 cash foc supplies. December 15 Stan Consulting pays $2,005 cash fod December utilities expense. December 16 Stan Consulting pays $1,550 cash in employee salary for work performed in the latter part of December. Requirement General Journal General Ledger Trial Balance Income Statement Statement Owners Equity Balance Sheet General Journal Tab - For each transaction, prepare the required journal entry on the General Journal tab. List debits before credits General Ledger Tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance Tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits Income Statement Tab - The revenue and expense balances from the trial balance appear on the income statement, along with their balance as of the date selected. Review the income statement and indicate how the income statement is linked to the other financial statements Statement of Owner's Equity Tab - Owner Investments and withdrawals, as reported on the trial balance, appear on the statement of owner's equity, Review the statement of owner's equity and indicate how the statement of owner's equity is linked to the other financial statements Balance Sheet Tab - Each asset and liability account balance, as reported on the trial balance, appears on the balance sheet, along with the ending capital balance. Review the balance sheet and then indicate how the balance sheet is linked to the other financial statements. General Journal > General General Income Statement Requirement Journal Balance Sheet Trial Balance Ledger Statement Owners Equity Every Journal entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions of the Stam Consulting Company, entering the debits before the credits. Each transaction will automatically be posted to the General Ledger and the Trial Balance as soon as you click "Record Entry". View transaction list Journal entry worksheet 1 2 3 6 16 > On December 1, Jane Stam forms a consulting business, named Stam Consulting. Stam Consulting receives $64,000 cash from Jane Stam as an owner contribution Note: Enter debits before credits Dato Credit Account Title Cash J. Stam, Capital Debit 64,000 December 01 64,000 Record entry Clear entry View general journal Stam Consulting Income Statement For Month Ended December 31, 2021 Revenues Consulting revenue (600) Rental revenue 2,600 $ 2,000 Total revenues Expenses Salaries expense Rent expense Utilities expense ETE 2,750 2,700 2,005 Total expenses Net loss 7,455 (5,455) $ Net income or loss is transferred from the income statement to the General Journal General Ledger Trial Balance Statement of Owner's Equity Stam Consulting Balance Sheet December 31, 2021 Assets 11 + Cash Supplies Prepaid insurance Equipment Accounts receivable Total assets 11,025 15,720 4,100 48,000 0 78,845 $ Liabilities Accounts payable Unearned consulting revenue 7.100 3,900 Total liabilities 11,000 Equity J. Stam, Capital Total equity Total liabilities and oquity 57,445 57,445 68,445 $ The balance in Stam's capital account comes from the:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts