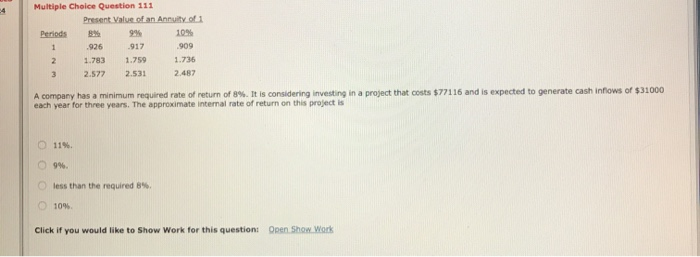

Question: help! timed test Multiple Choice Question 111 Present Value of an Annuity of Periods B9% 10% 925 -917 .909 1.783 1.759 2.577 2.531 2.487 1.736

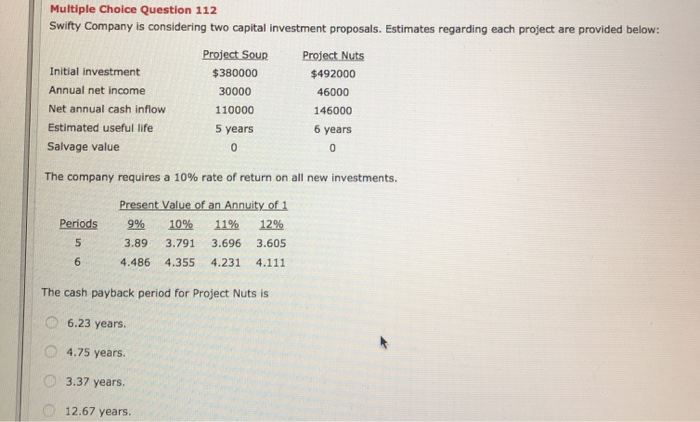

Multiple Choice Question 111 Present Value of an Annuity of Periods B9% 10% 925 -917 .909 1.783 1.759 2.577 2.531 2.487 1.736 A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $77116 and is expected to generate cash inflows of $31000 each year for three years. The approximate internal rate of return on this project is O 11%. 9%. less than the required 8%. 10% Click if you would like to Show Work for this question Open Show Work Multiple Choice Question 112 Swifty Company is considering two capital investment proposals. Estimates regarding each project are provided below: Initial investment Annual net income Net annual cash inflow Estimated useful life Salvage value Project Sour $380000 30000 110000 5 years Project Nuts $492000 46000 146000 6 years The company requires a 10% rate of return on all new investments Periods Present Value of an Annuity of 1 9% 10% 11% 12% 3.89 3.791 3.696 3.605 4.486 4.355 4.231 4.111 The cash payback period for Project Nuts is 6.23 years. 4.75 years. 3.37 years. 12.67 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts