Question: Help to answer this question please, thank you so much. Jet Roofing Bhd. found itself in financial difficulty due to the wide spread news of

Help to answer this question please, thank you so much.

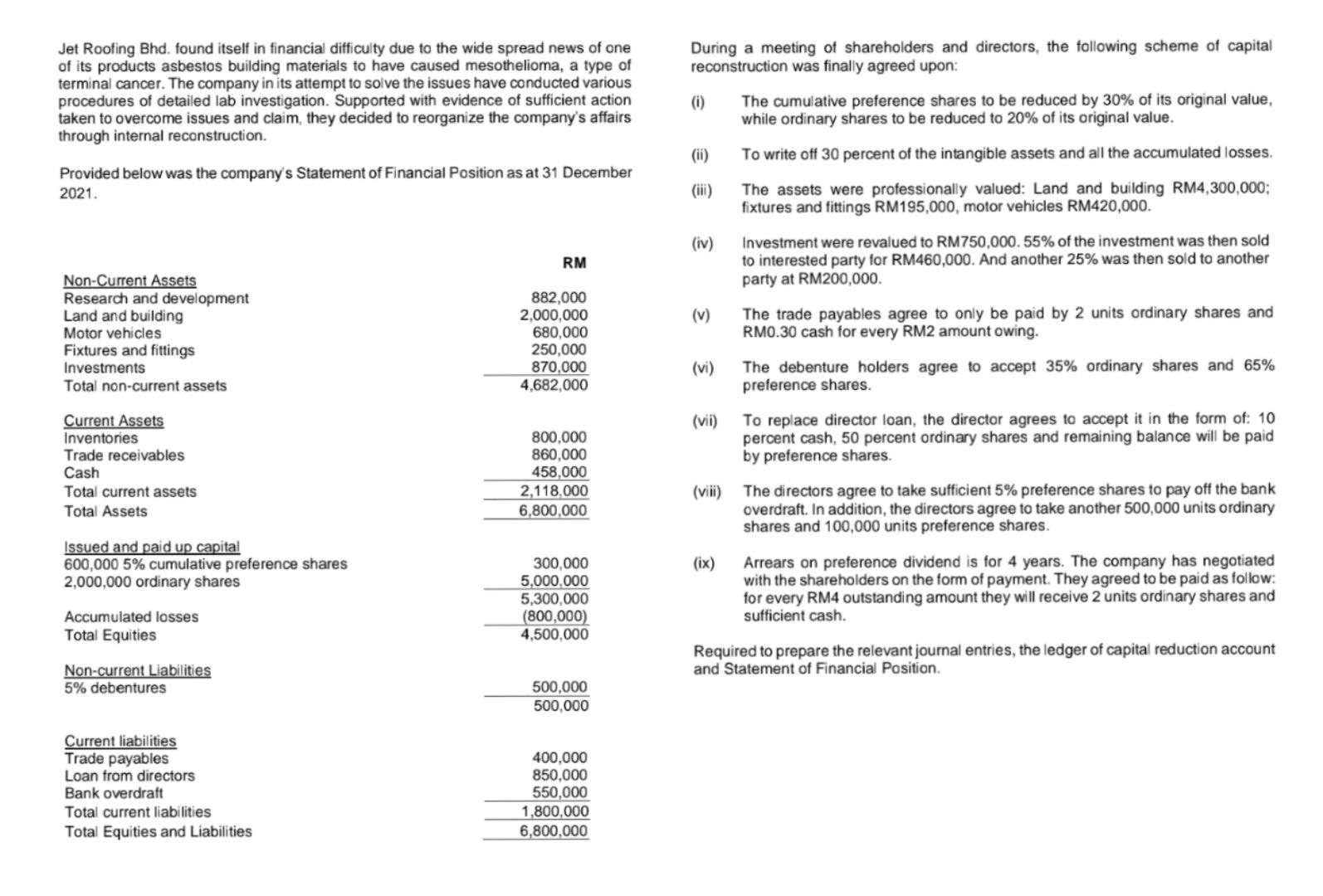

Jet Roofing Bhd. found itself in financial difficulty due to the wide spread news of one of its products asbestos building materials to have caused mesothelioma, a type of terminal cancer. The company in its attempt to solve the issues have conducted various procedures of detailed lab investigation. Supported with evidence of sufficient action taken to overcome issues and claim, they decided to reorganize the company's affairs through internal reconstruction. During a meeting of shareholders and directors, the following scheme of capital reconstruction was finally agreed upon: (1) The cumulative preference shares to be reduced by 30% of its original value, while ordinary shares to be reduced to 20% of its original value. (ii) To write off 30 percent of the intangible assets and all the accumulated losses. Provided below was the company's Statement of Financial Position as at 31 December 2021. (iii) The assets were professionally valued: Land and building RM4,300,000; fixtures and fittings RM195,000, motor vehicles RM420,000. (iv) RM Investment were revalued to RM750,000.55% of the investment was then sold to interested party for RM460,000. And another 25% was then sold to another party at RM200,000. The trade payables agree to only be paid by 2 units ordinary shares and RM0.30 cash for every RM2 amount owing. Non-Current Assets Research and development Land and building Motor vehicles Fixtures and fittings Investments Total non-current assets (v) 882,000 2,000,000 680,000 250,000 870,000 4.682,000 (vi) The debenture holders agree to accept 35% ordinary shares and 65% preference shares. (vii) Current Assets Inventories Trade receivables Cash Total current assets Total Assets To replace director loan, the director agrees to accept it in the form of 10 percent cash, 50 percent ordinary shares and remaining balance will be paid by preference shares. 800.000 860,000 458,000 2,118,000 6,800,000 Issued and paid up capital 600,000 5% cumulative preference shares 2,000,000 ordinary shares (viii) The directors agree to take sufficient 5% preference shares to pay off the bank overdraft. In addition, the directors agree to take another 500,000 units ordinary shares and 100,000 units preference shares. (ix) Arrears on preference dividend is for 4 years. The company has negotiated with the shareholders on the form of payment. They agreed to be paid as follow: for every RM4 outstanding amount they will receive 2 units ordinary shares and sufficient cash. 300,000 5,000,000 5,300,000 (800,000) 4,500,000 Accumulated losses Total Equities Required to prepare the relevant journal entries, the ledger of capital reduction account and Statement of Financial Position. Non-current Liabilities 5% debentures 500,000 500,000 Current liabilities Trade payables Loan from directors Bank overdraft Total current liabilities Total Equities and Liabilities 400,000 850,000 550,000 1,800,000 6,800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts