Question: Help to code the following on R-Script: Pharmaceutical Industry. An equities analyst is studying the pharmaceutical industry and would like your help in exploring and

Help to code the following on R-Script:

Pharmaceutical Industry. An equities analyst is studying the pharmaceutical industry and would like your help in exploring and understanding the financial data collected by her firm. Her main objective is to understand the structure of the pharmaceutical industry using some basic financial measures.

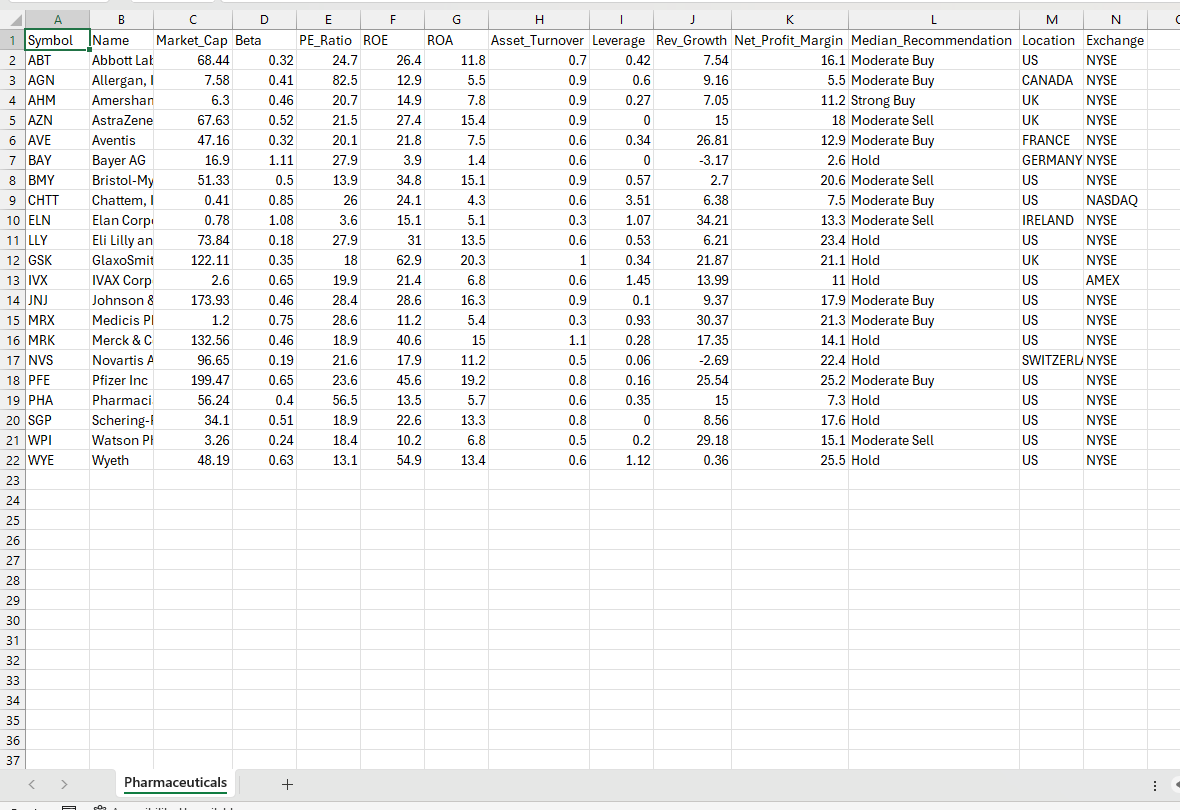

Financial data gathered on 21 firms in the pharmaceutical industry are available in the file Pharmaceuticals.csv. For each firm, the following variables are recorded:

1. Market capitalization (in billions of dollars) 2. Beta 3. Price/earnings ratio 4. Return on equity 5. Return on assets 6. Asset turnover 7. Leverage 8. Estimated revenue growth 9. Net profit margin 10. Median recommendation (across major brokerages) 11. Location of firm's headquarters 12. Stock exchange on which the firm is listed

Use cluster analysis to explore and analyze the given dataset as follows:

1 - Use only the numerical variables (1 to 9) to cluster the 21 firms. Justify the various choices made in conducting the cluster analysis, such as weights for different variables, the specific clustering algorithm(s) used, the number of clusters formed, and so on.

2 - Interpret the clusters with respect to the numerical variables used in forming the clusters. 3 - Is there a pattern in the clusters with respect to the categorical variables (10 to 12)? (those not used in forming the clusters) 4 - Provide an appropriate name for each cluster using any or all of the variables in the dataset.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts