Question: help to complete this journal please i am going to fail the class begin{tabular}{|l|l|l|} hline A & B hline 33. & A review of

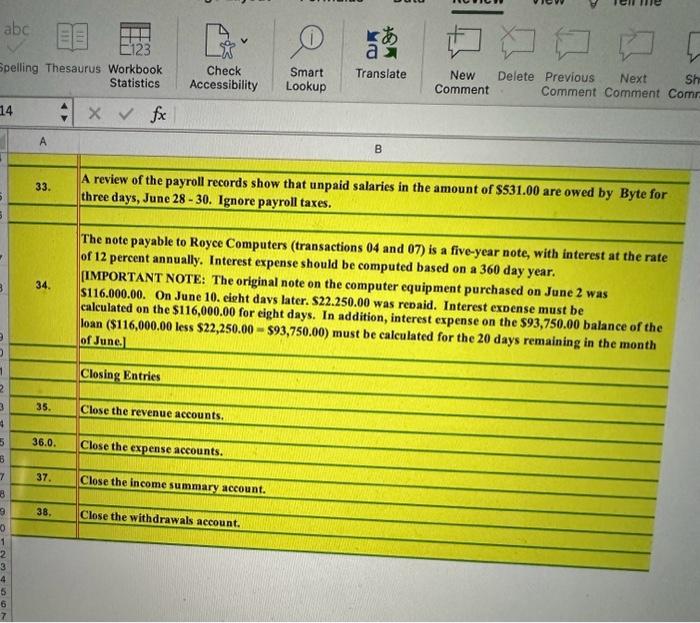

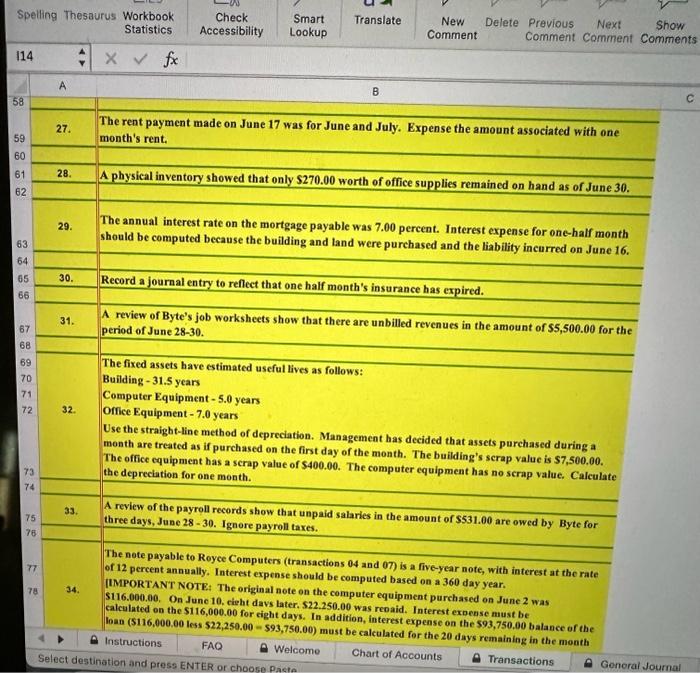

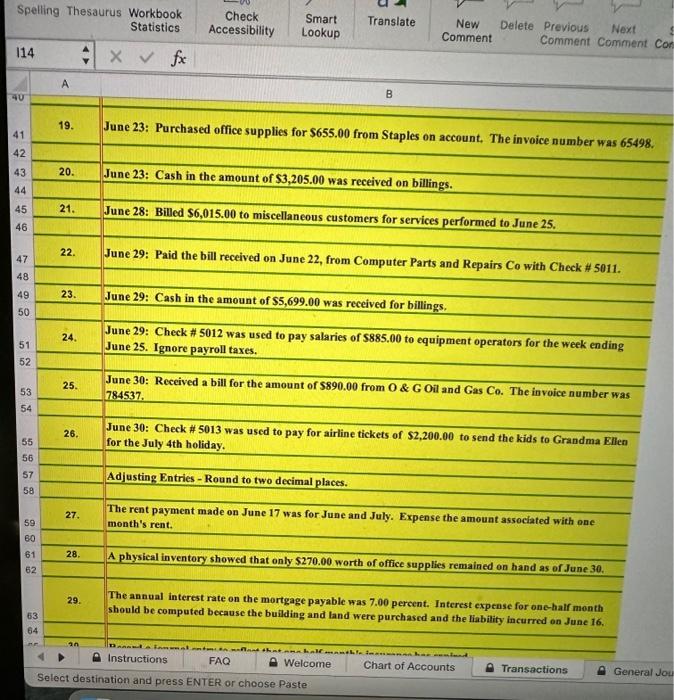

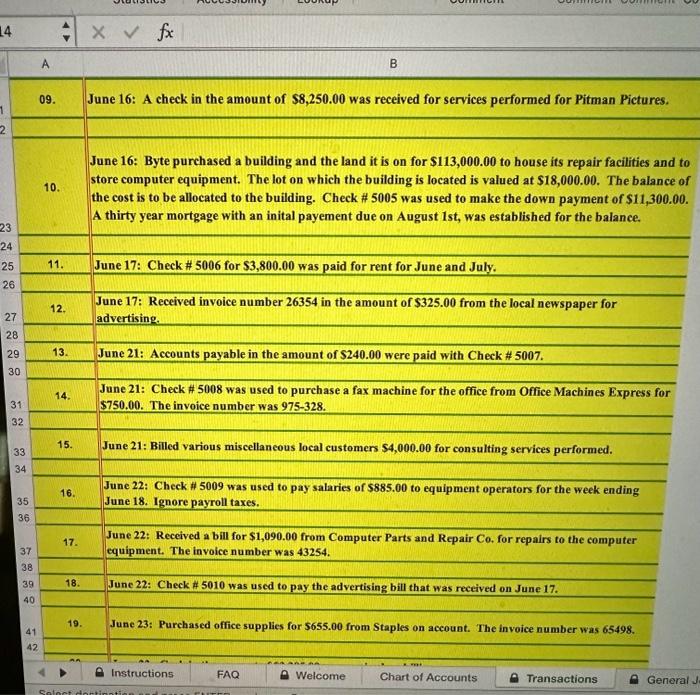

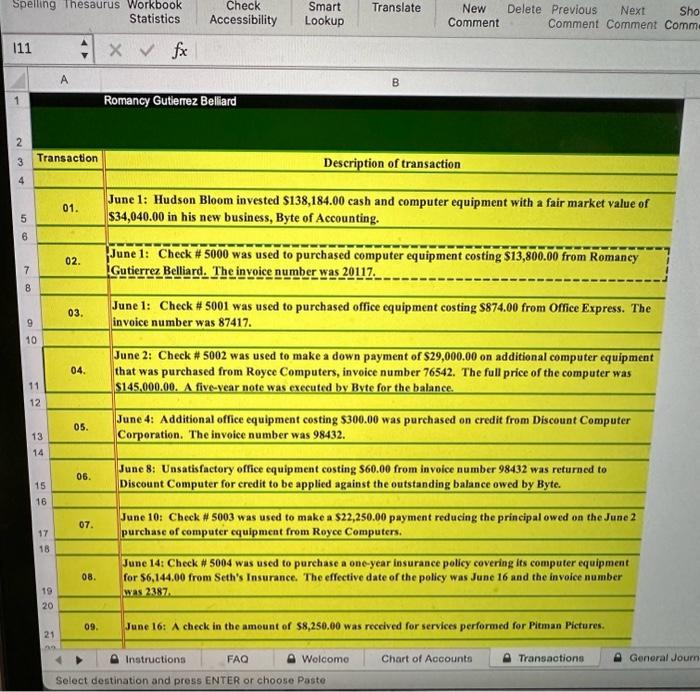

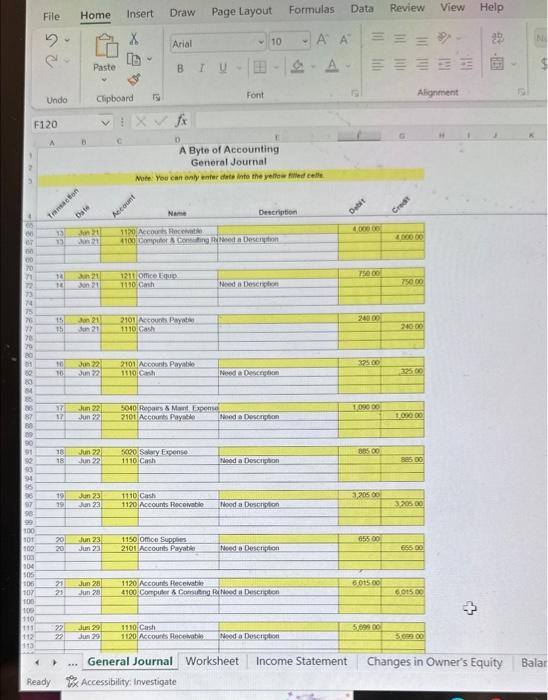

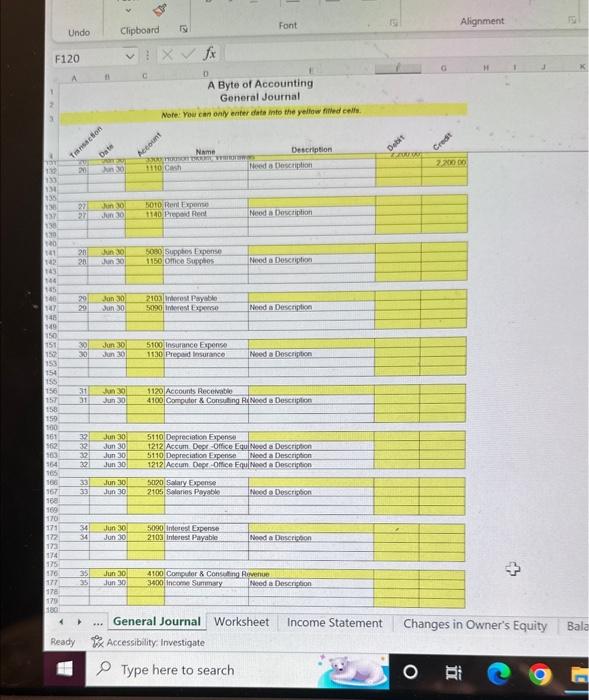

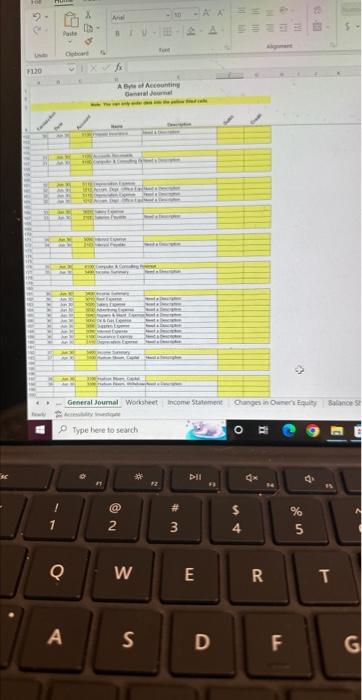

\begin{tabular}{|l|l|l|} \hline A & B \\ \hline 33. & A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 2830. Ignore payroll taxes. \\ \hline \end{tabular} of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$116.000.00. On June 10. eight davs later. $22.250.00 was rebaid. Interest expense must be calculated on the $116,000.00 for eight days. In addition, interest expense on the $93,750.00 balance of the loan ($116,000.00 less $22,250.00=$93,750.00) must be calculated for the 20 days remaining in the month of June.] \begin{tabular}{|l|l|l} \hline & Closing Entries \\ \hline & \\ \hline 35. & Close the revenue accounts. \\ \hline & \\ \hline 36.0. & Close the expense accounts. \\ \hline & \\ \hline 37. & Close the income summary account. \\ \hline & \\ \hline 38. & Close the withdrawals account. \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|} A \\ \hline 09. June 16: A check in the amount of $8,250.00 was received for services performed for Pitman Pictures. \\ \hline . \end{tabular} 3. Note: Yoe can only enter dote inte the yehod filled cetis. 4.... General Journal Worksheet Income Statement Changes in Owner's Equity Bala Ready Rx2 Accessibility: Investigate Type here to search \begin{tabular}{|l|l|l|} \hline A & B \\ \hline 33. & A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 2830. Ignore payroll taxes. \\ \hline \end{tabular} of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$116.000.00. On June 10. eight davs later. $22.250.00 was rebaid. Interest expense must be calculated on the $116,000.00 for eight days. In addition, interest expense on the $93,750.00 balance of the loan ($116,000.00 less $22,250.00=$93,750.00) must be calculated for the 20 days remaining in the month of June.] \begin{tabular}{|l|l|l} \hline & Closing Entries \\ \hline & \\ \hline 35. & Close the revenue accounts. \\ \hline & \\ \hline 36.0. & Close the expense accounts. \\ \hline & \\ \hline 37. & Close the income summary account. \\ \hline & \\ \hline 38. & Close the withdrawals account. \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|} A \\ \hline 09. June 16: A check in the amount of $8,250.00 was received for services performed for Pitman Pictures. \\ \hline . \end{tabular} 3. Note: Yoe can only enter dote inte the yehod filled cetis. 4.... General Journal Worksheet Income Statement Changes in Owner's Equity Bala Ready Rx2 Accessibility: Investigate Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts