Question: Help to solve all the questions please 3.1 Common Size Statements. Below are the most recent financial statements for Wildhack. Prepare a common-size income statement

Help to solve all the questions please

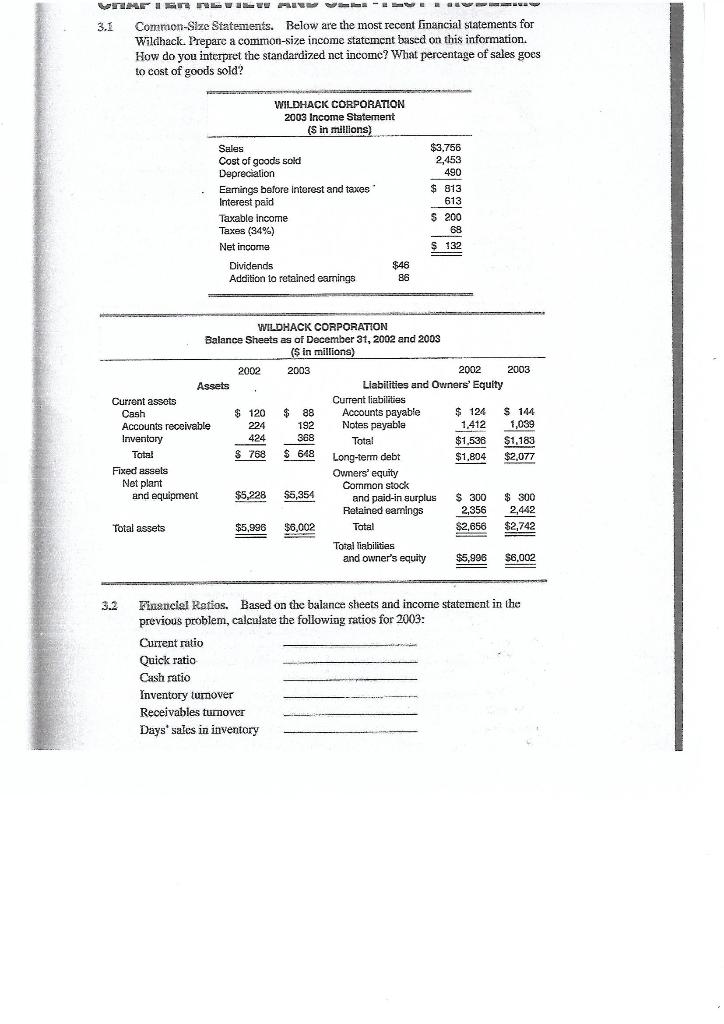

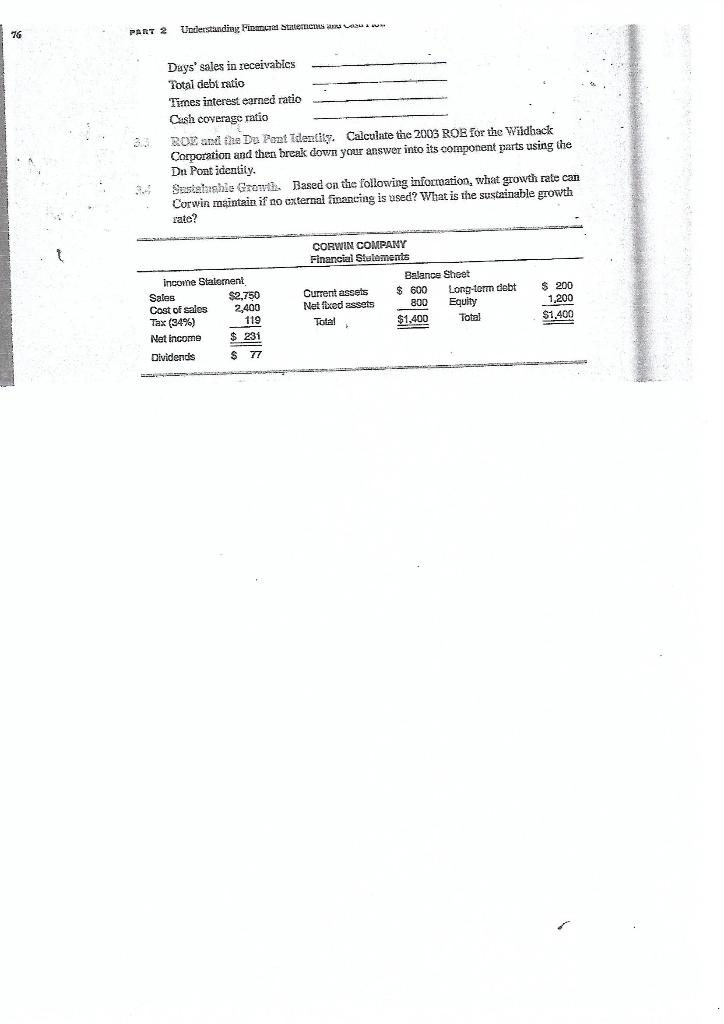

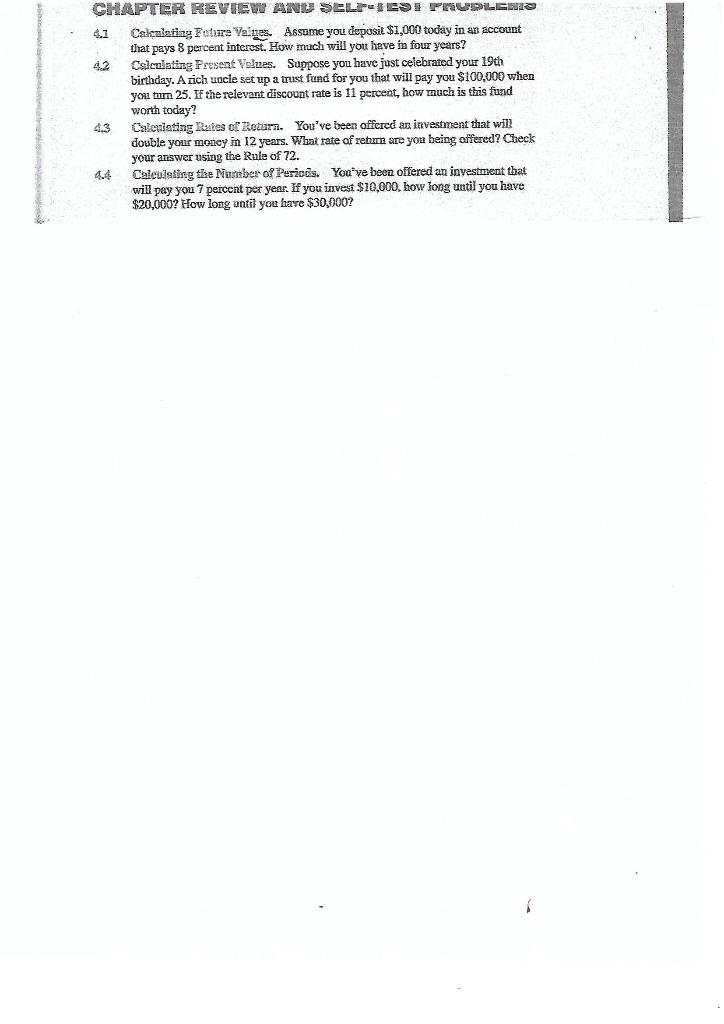

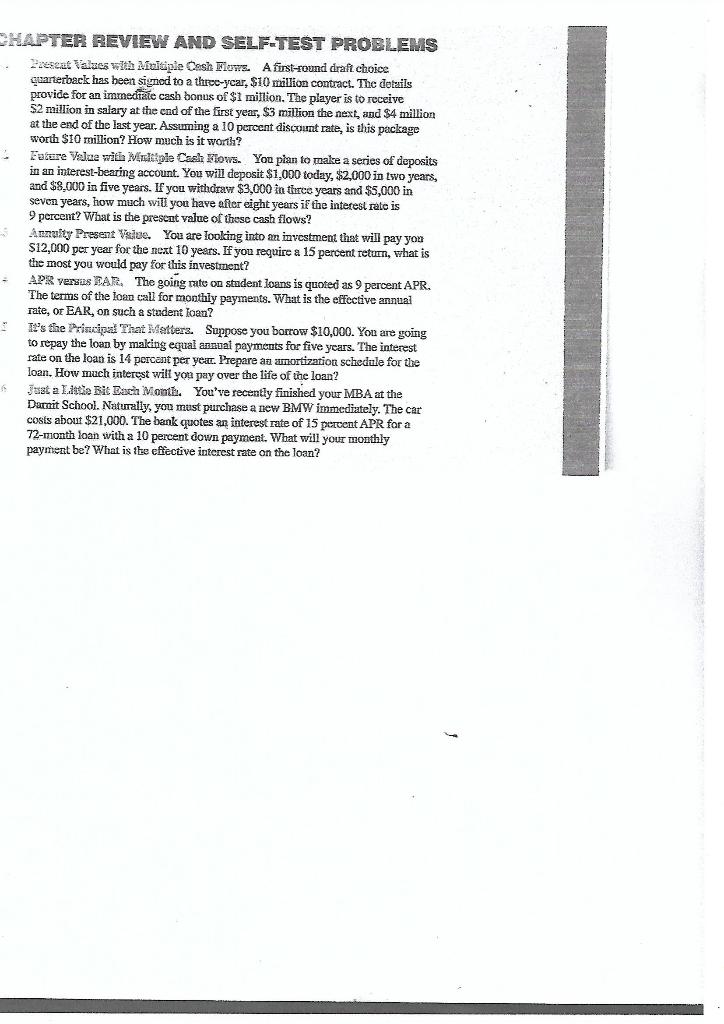

3.1 Common Size Statements. Below are the most recent financial statements for Wildhack. Prepare a common-size income statement based on this information. How do you interpret the standardized nct income? What percentage of sales goes to cost of goods sold? WILDHACK CORPORATION 2003 Income Statement (s in millions) Sales Cost of goods sold Depreciation Eemings before interest and taxes Interest paid Taxable income Taxes (34%) Net income Dividends $46 Addition to retained earnings 88 $3,756 2,453 490 $ 813 613 $ 200 68 $ 132 WILDHACK CORPORATION Balance Sheets as of December 31, 2002 and 2003 ($ in millions) 2002 2003 2002 2003 Assets Liabilities and Owners' Equity Current assots Current liabilities Cash $ 120 $ 88 Accounts payable $ 124 $ 144 Accounts receivable 224 192 Notes payable 1,412 1,039 Iriventory 424 368 Total $1,538 $1,183 Total $ 768 $ 648 Long-term debt $1,804 $2.077 Fixed assets Owners' equity Net plant Common stock and equipment $5,228 $5,354 and paid-in aurplus $ 300 $ 300 Retained earings 2,356 2,442 Total assets $5.996 $8.002 Tatal $2,656 $ $2,742 = Total liabilities and owner's equity $5,996 $6,002 Financial Ratios. Based on the balance sheets and income statement in the previous problem, calculate the following ratios for 2003: Current ratio Quick ratio Cash ratio Inventory turnover Receivables turnover Days' sales in inventory 76 PART 2 Understanding Financial Statements Days' sales in receivabies Total debt ratio Times interest earned ratio Cash coverage ratio ROE anti the Du Pont Tdentity. Calculate the 2005 ROB for the Wildhack Corporation and then break down your answer into its component parts using the Du Pont identity. Sustebshie Grons. Based on the following information, what growth rate can Corwin maintain if no external financing is used? What is the sustainable growth rate? Income Statement Sales $2,750 Cost of sales 2,400 Tax (34%) 119 Net income $ 231 Dividends $ 77 CORVIN COMPANY Financial Statements Balance Sheet Current assets $ 800 Long-term debt Netflxed assets 800 Equity Total $1,400 Total $ 200 1,200 $1,400 CHAPTER REVIEW AND SELF-TEST PROBLEMS Present Values with Multiple Cash Flows. Afirst-round draft choice quarterback has been signed to a three-ycar, $10 million contract. The details provide for an immediate cash bonus of $1 million. The player is to receive $2 million in salary at the end of the first year, $3 million the next, and $4 million at the end of the last year. Assuming a 10 percent discount rate, is this package worth $10 million? How much is it worth? Eature Value witla Miletple Cash Flows. You plan to make a series of deposits in an interest-bearing account. You will deposit $1,000 today, $2,000 in two years, and $8,000 in five years. If you withdraw $3,000 in terce years and $5,000 in seven years, how much will you have after eight years if the interest rate is 9 percent? What is the present value of those cash flows? Annuity Present Vside. You are looking into an investment that will pay you $12,000 per year for the next 10 years. If you require a 15 percent return, what is the most you would pay for this investiment? APR versus EAR. The going cute on student loans is quoted as 9 percent APR. " rate, or BAR, on such a student foauty payments. What is the effective annual It's tire Principal That Metters. Suppose you borrow $10,000. You are going to repay the loan by making equal annual payments for five years. The interest rate on the loan is 14 percent per year. Prepare au amortization schedule for the loan. How much interest will you pay over the life of the loan? Just a Little Bit Each Month. You've recently finished your MBA at the Darnit School. Naturally, you must purchase a new BMW immediately. The car costs about $21,000. The bank quotes an interest rate of 15 percent APR for a 72-month loan with a 10 percent down payment. What will your monthly payment be? What is the effective interest rate on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts