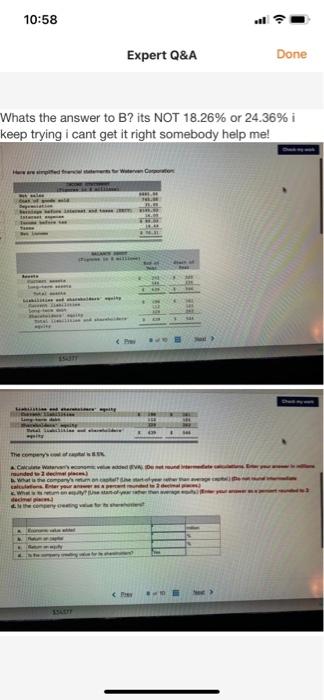

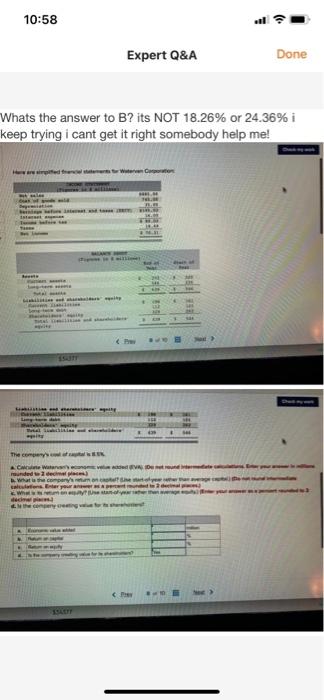

Question: help tried both answers its wrong please help. both of the answers for B is incorrect, so what is the right answer? HELP! 10:58 Expert

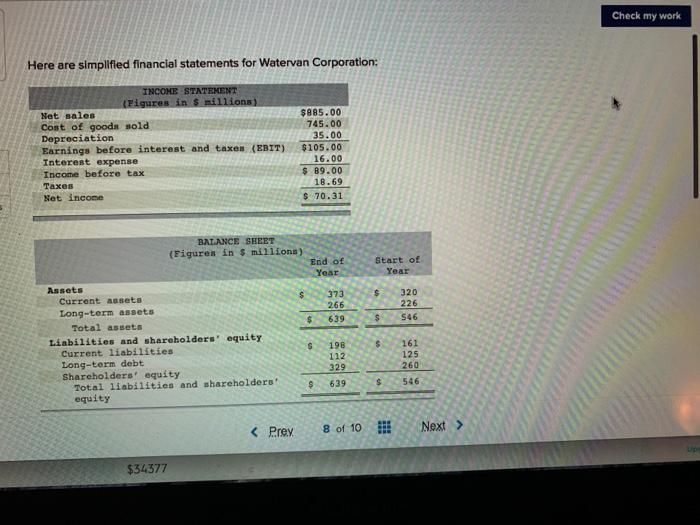

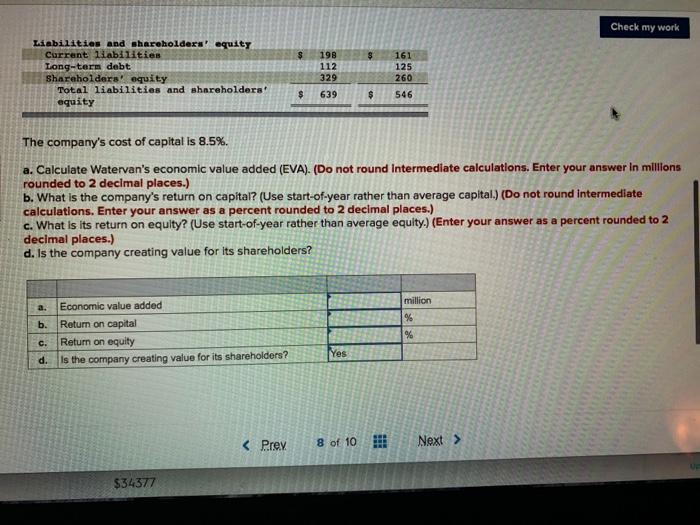

10:58 Expert Q&A Done Whats the answer to B? its NOT 18.26% or 24.36% i keep trying i cant get it right somebody help me! traw Wewe De INT - Le BE - The com AC Watch munded) como Enter your WIU ce 10:58 Expert Q&A Done Whats the answer to B? its NOT 18.26% or 24.36% i keep trying i cant get it right somebody help me! traw Wewe De INT - Le BE - The com AC Watch munded) como Enter your WIU ce Check my work Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in 6 millions) Net sales Cont of goods sold Depreciation Earnings before interest and taxen (EBIT) Interest expense Income before tax Taxes Net Income $885.00 745.00 35.00 $105.00 16.00 $ 89.00 18.69 $ 70.31 Start of Year $ 320 226 S46 $ BALANCE SHEET (Figures in $ millions) End of Year Assets Current assets 373 266 Long-term assets Total assets $ 639 Liabilities and shareholders' equity Current liabilities $ 198 112 Long-term debt Shareholders' equity 329 Total liabilities and shareholders $ 639 equity $ 161 125 260 $ 546 $34377 Check my work $ Liabilities and shareholders equity Currant Habilities Long-term debt Shareholders' equity Total liabilities and shareholders! equity 198 112 329 161 125 260 $ 639 $ 546 The company's cost of capital is 8.5%. a. Calculate Watervan's economic value added (EVA). (Do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? a b. million % Economic value added Return on capital Return on equity Is the company creating value for its shareholders? % C. Yes d. $34377 10:58 Expert Q&A Done Whats the answer to B? its NOT 18.26% or 24.36% i keep trying i cant get it right somebody help me! traw Wewe De INT - Le BE - The com AC Watch munded) como Enter your WIU ce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts