Question: help!! urgent! due at 11:59!!! Consider bow Cherry Valley, a popular ski resort, could use capilal budgoting to deside whethor the $ million Waterfal Park

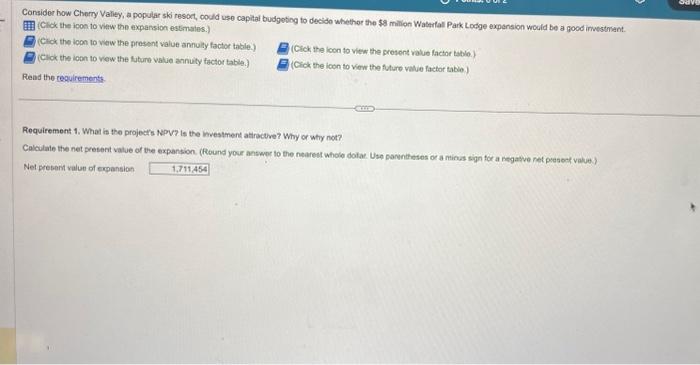

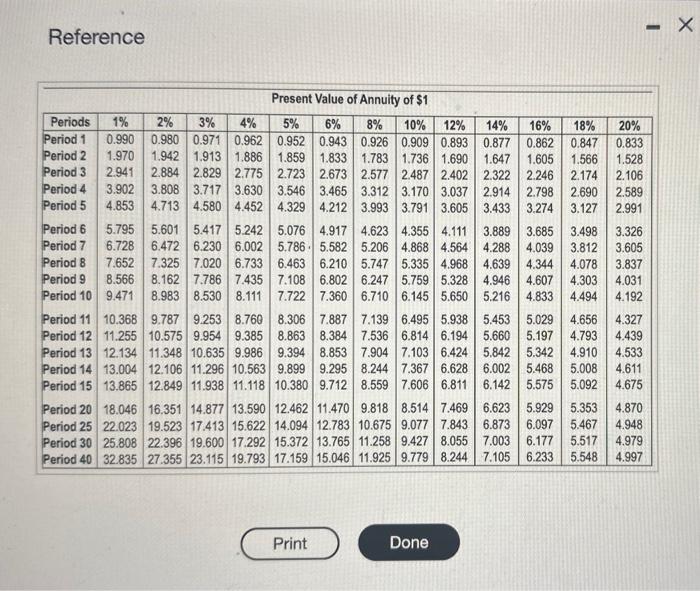

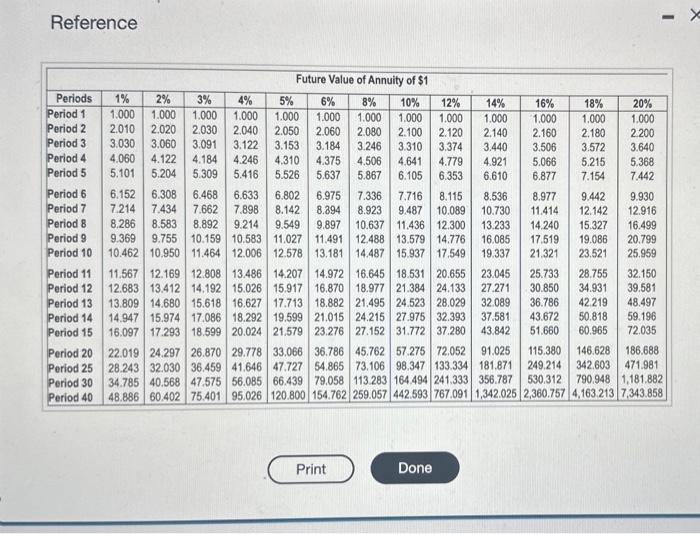

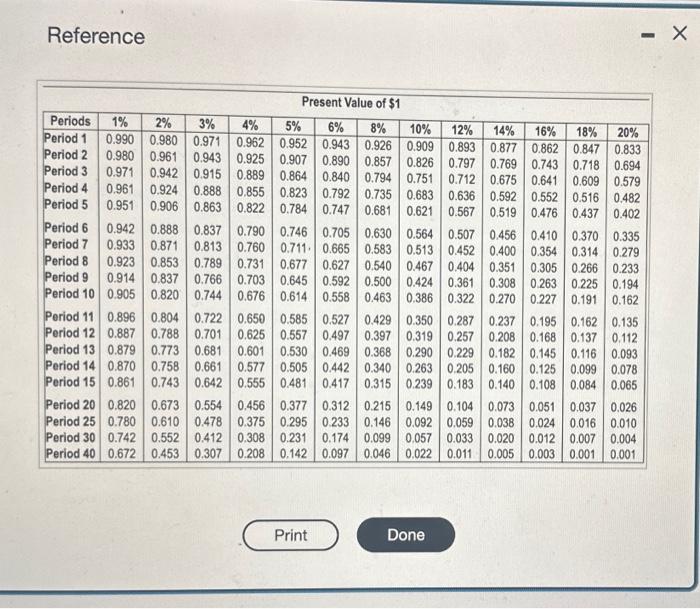

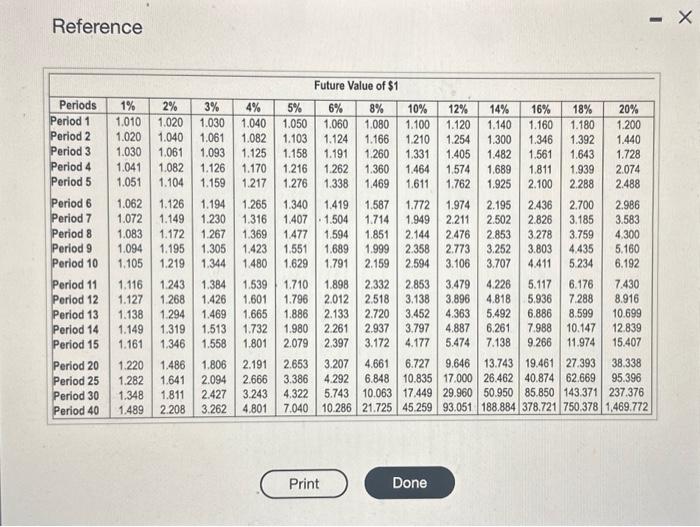

Consider bow Cherry Valley, a popular ski resort, could use capilal budgoting to deside whethor the $ million Waterfal Park Lodge expension would be a good imvestriant. (Clok the icon 10 vitw the expansion estinates.) (Clok the iocn to wew the present value aninulty factor table.) (Clok the ioon to vew the future value annuity factor table.) (Cick the icon to view the present value factar table.) Rend the requirements [Cick the icon to view the future value factor tabie.] Requirement 1. What is the projects NPP? is the mestment atiractive? Why or why not? Calculate the net present value of the expansion. (found your ahswer to the nearet wholo dolac. Use pannthetes or a minus sign for a regasve net presect value) Net prebent valun of expansion Requirements 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Reference Reference Reference Reference Consider bow Cherry Valley, a popular ski resort, could use capilal budgoting to deside whethor the $ million Waterfal Park Lodge expension would be a good imvestriant. (Clok the icon 10 vitw the expansion estinates.) (Clok the iocn to wew the present value aninulty factor table.) (Clok the ioon to vew the future value annuity factor table.) (Cick the icon to view the present value factar table.) Rend the requirements [Cick the icon to view the future value factor tabie.] Requirement 1. What is the projects NPP? is the mestment atiractive? Why or why not? Calculate the net present value of the expansion. (found your ahswer to the nearet wholo dolac. Use pannthetes or a minus sign for a regasve net presect value) Net prebent valun of expansion Requirements 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Reference Reference Reference Reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts