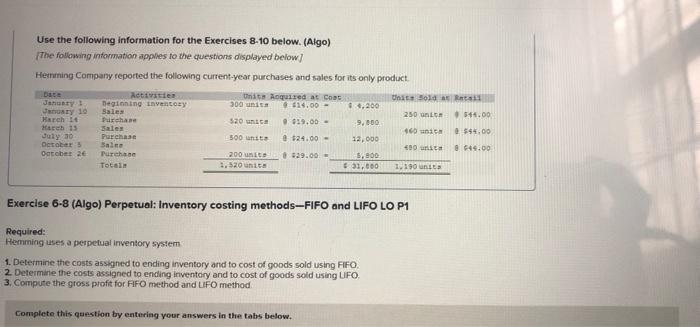

Question: help ! Use the following information for the Exercises 8-10 below. (Algo) The following information applies to the questions displayed below) Hemming Company reported the

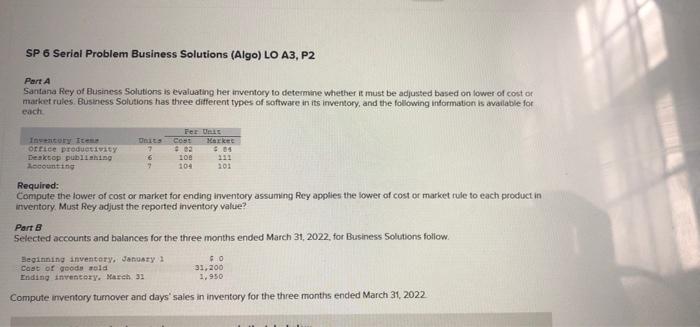

Use the following information for the Exercises 8-10 below. (Algo) The following information applies to the questions displayed below) Hemming Company reported the following current year purchases and sales for its only product Date On Aquired at Coat 500 unita $14.00 - Unit Sold 1,200 250 Lt 545.00 520 C. 9629.00 - 9,000 January 10 March 1 Here 15 July 30 October October 24 Activities Deginning inventory Sales Purchase Sales Purchase Baie Purchase Total Dit $45.00 500 units @ $24.00 - 12.000 400 549.00 200 units 1.520 Lt # $29.00 5,800 31,00 1.190 units Exercise 6-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO 3. Compute the gross profit for FIFO method and UFO method Complete this question by entering your answers in the tabs below. SP 6 Serial Problem Business Solutions (Algo) LO A3, P2 Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules. Business Solutions has three different types of software in its inventory, and the following information is available for each Inventor Item orrice productivity Desktop publishing Recounting Fer Uns Units Cost MAREC 7 309 5.65 16 100 111 7 104 101 Required: Compute the lower of cost or market for ending inventory assuming Rey applies the lower of cost or market rule to each product in inventory. Must Rey adjust the reported inventory value? Part 8 Selected accounts and balances for the three months ended March 31, 2022, for Business Solutions follow Beginning inventory, January 1 Cast of goods sold Ending inventory, March 31 fo 31,200 1,950 Compute inventory tumover and days' sales in inventory for the three months ended March 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts