Question: help w empty spots please Cullumber Batteries is a division of Enterprise Corporation. The division manufactures and sells a long-life battery used in a wide

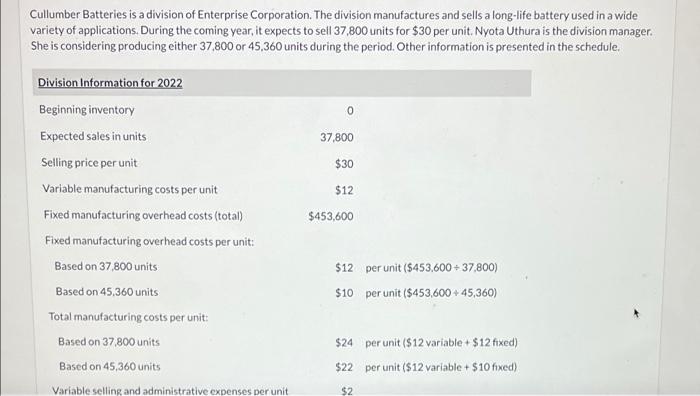

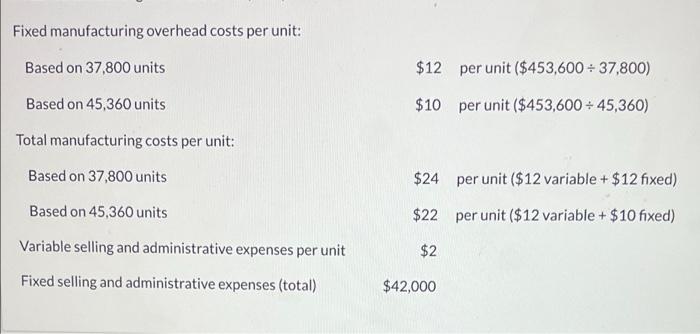

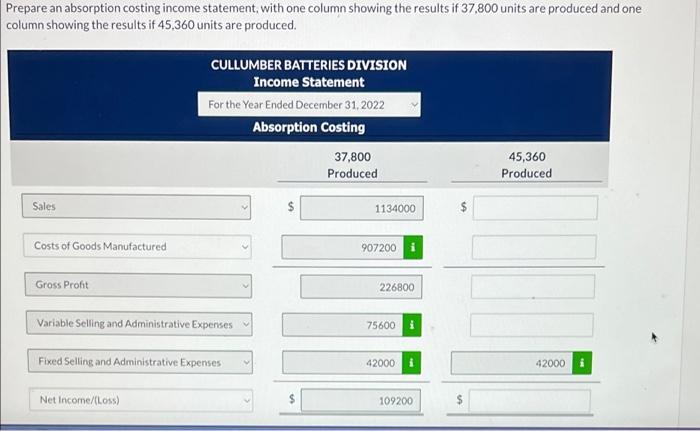

Cullumber Batteries is a division of Enterprise Corporation. The division manufactures and sells a long-life battery used in a wide variety of applications. During the coming year, it expects to sell 37,800 units for $30 per unit. Nyota Uthura is the division manager. She is considering producing either 37,800 or 45,360 units during the period. Other information is presented in the schedule. 0 37,800 $30 $12 $453,600 Division Information for 2022 Beginning inventory Expected sales in units Selling price per unit Variable manufacturing costs per unit Fixed manufacturing overhead costs (total) Fixed manufacturing overhead costs per unit: Based on 37,800 units Based on 45,360 units Total manufacturing costs per unit: Based on 37,800 units Based on 45,360 units $12 per unit ($453,600 + 37.800) $10 per unit ($453,600 45,360) $24 per unit ($12 variable + $12 fixed) $22 per unit ($12 variable + $10 fixed) Variable selling and administrative expenses per unit $2 Fixed manufacturing overhead costs per unit: Based on 37,800 units $12 per unit ($453,600 = 37,800) $10 per unit ($453,600 45,360) Based on 45,360 units Total manufacturing costs per unit: Based on 37,800 units $24 per unit ($12 variable + $12 fixed) $22 per unit ($12 variable + $10 fixed) Based on 45,360 units Variable selling and administrative expenses per unit Fixed selling and administrative expenses (total) $2 $42,000 Prepare an absorption costing income statement with one column showing the results if 37,800 units are produced and one column showing the results if 45,360 units are produced. CULLUMBER BATTERIES DIVISION Income Statement For the Year Ended December 31, 2022 Absorption Costing 37,800 Produced 45,360 Produced Sales 1134000 Costs of Goods Manufactured 907200 i Gross Profit 226800 Variable Selling and Administrative Expenses 75600 i Fixed Selling and Administrative Expenses 42000 42000 Net Income/(Loss 109200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts