Question: help w/ interest capitalized using the specific interest method On January 1,2024 , a company began construction of an automated cattle feeder system. The system

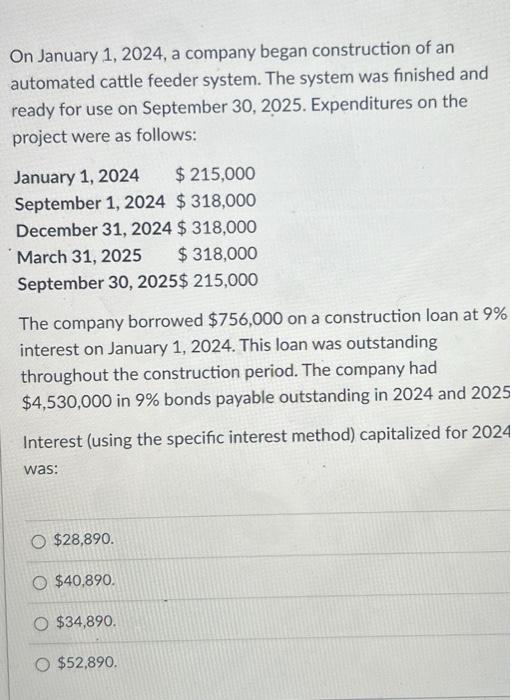

On January 1,2024 , a company began construction of an automated cattle feeder system. The system was finished and ready for use on September 30, 2025. Expenditures on the project were as follows: The company borrowed $756,000 on a construction loan at 9% interest on January 1, 2024. This loan was outstanding throughout the construction period. The company had $4,530,000 in 9% bonds payable outstanding in 2024 and 2025 Interest (using the specific interest method) capitalized for 2024 was: $28,890. $40,890. $34,890. $52,890

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts