Question: help w part 2 and 3 please. will give thumbs up Intro You anticipate the receipt of money in 170 days, which you will use

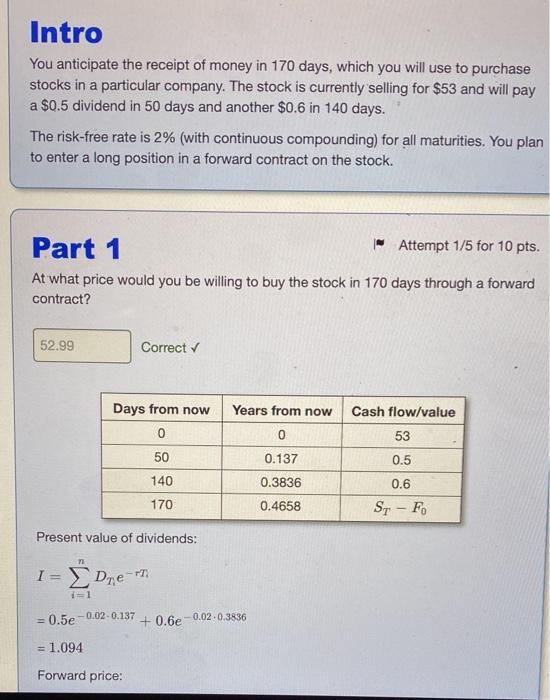

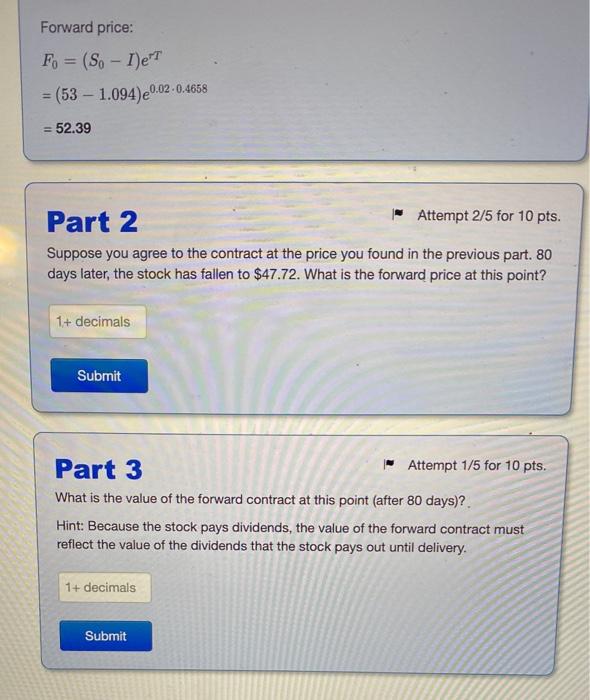

Intro You anticipate the receipt of money in 170 days, which you will use to purchase stocks in a particular company. The stock is currently selling for $53 and will pay a $0.5 dividend in 50 days and another $0.6 in 140 days. The risk-free rate is 2% (with continuous compounding) for all maturities. You plan to enter a long position in a forward contract on the stock. Part 1 - Attempt 1/5 for 10 pts. At what price would you be willing to buy the stock in 170 days through a forward contract? 52.99 Correct Days from now Years from now Cash flow/value 0 0 53 50 0.137 140 0.3836 0.5 0.6 Sr - F. 170 0.4658 Present value of dividends: n I = Dre = 0.5e -0.02-0.137 + 0.6 -0.02.0.3836 = 1.094 Forward price: Forward price: Fo= (So - IET = (53 - 1.094) 20.02-0.4658 = 52.39 Part 2 - Attempt 2/5 for 10 pts. Suppose you agree to the contract at the price you found in the previous part. 80 days later, the stock has fallen to $47.72. What is the forward price at this point? 1+ decimals Submit Part 3 - Attempt 1/5 for 10 pts. What is the value of the forward contract at this point (after 80 days)? Hint: Because the stock pays dividends, the value of the forward contract must reflect the value of the dividends that the stock pays out until delivery. 1+ decimals Submit Intro You anticipate the receipt of money in 170 days, which you will use to purchase stocks in a particular company. The stock is currently selling for $53 and will pay a $0.5 dividend in 50 days and another $0.6 in 140 days. The risk-free rate is 2% (with continuous compounding) for all maturities. You plan to enter a long position in a forward contract on the stock. Part 1 - Attempt 1/5 for 10 pts. At what price would you be willing to buy the stock in 170 days through a forward contract? 52.99 Correct Days from now Years from now Cash flow/value 0 0 53 50 0.137 140 0.3836 0.5 0.6 Sr - F. 170 0.4658 Present value of dividends: n I = Dre = 0.5e -0.02-0.137 + 0.6 -0.02.0.3836 = 1.094 Forward price: Forward price: Fo= (So - IET = (53 - 1.094) 20.02-0.4658 = 52.39 Part 2 - Attempt 2/5 for 10 pts. Suppose you agree to the contract at the price you found in the previous part. 80 days later, the stock has fallen to $47.72. What is the forward price at this point? 1+ decimals Submit Part 3 - Attempt 1/5 for 10 pts. What is the value of the forward contract at this point (after 80 days)? Hint: Because the stock pays dividends, the value of the forward contract must reflect the value of the dividends that the stock pays out until delivery. 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts