Question: Help What is the total standard deduction amount that Brian should claim on his 2017 tax return? a. $7,400 b. $13,000 c. $9,750 d. $12,000

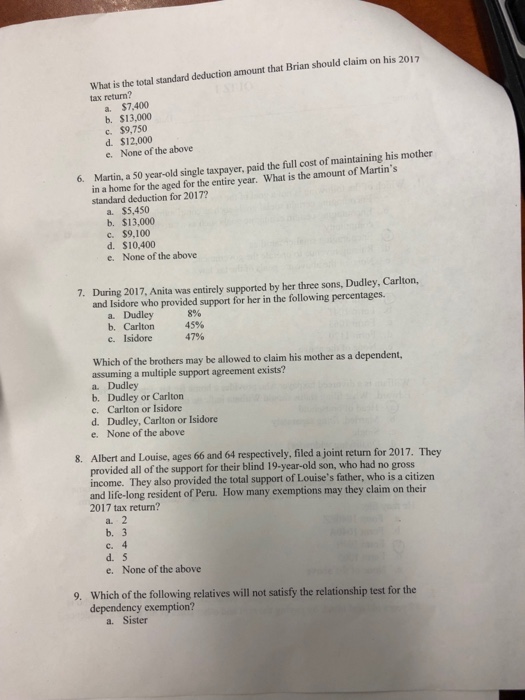

What is the total standard deduction amount that Brian should claim on his 2017 tax return? a. $7,400 b. $13,000 c. $9,750 d. $12,000 e. None of the above 6. Martin, a 50 year-old single taxpayer, paid the full cost of maintaining his mother What is the amount of Martin's in a home for the aged for the entire year. standard deduction for 2017? a. $5,450 b. $13,000 c. $9,100 d. $10,400 e. None of the above During 2017, Anita was entirely supported by her three sons, Dudley, Carlton, and Isidore who provided support for her in the following percentages 7. a. Dudley 896 45% 47% b. Carlton c. Isidore Which of the brothers may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists? a. Dudley b. Dudley or Carlton c. Carlton or Isidore d. Dudley, Carlton or Isidore e. None of the above 8. Albert and Louise, ages 66 and 64 respectively, filed a joint return for 2017. They provided all of the support for their blind 19-year-old son, who had no g income. They also provided the total support of Louise's father, who is a citizen and life-long resident of Peru. How many exemptions may they claim on their 2017 tax return? ross a. 2 b. 3 c. 4 d. 5 e. None of the above Which of the following relatives will not satisfy the relationship test for the dependency exemption? 9. a. Sister

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts