Question: help whats the answer? A. B. C. Prepare the December 31 year-end journal entry(les) to record product sales for the year. Journal entry worksheet Note:

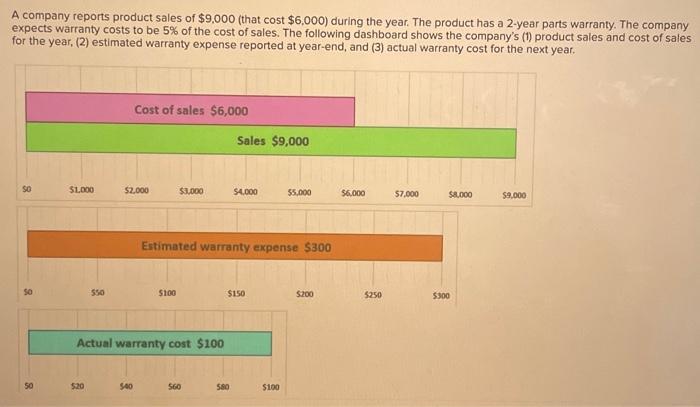

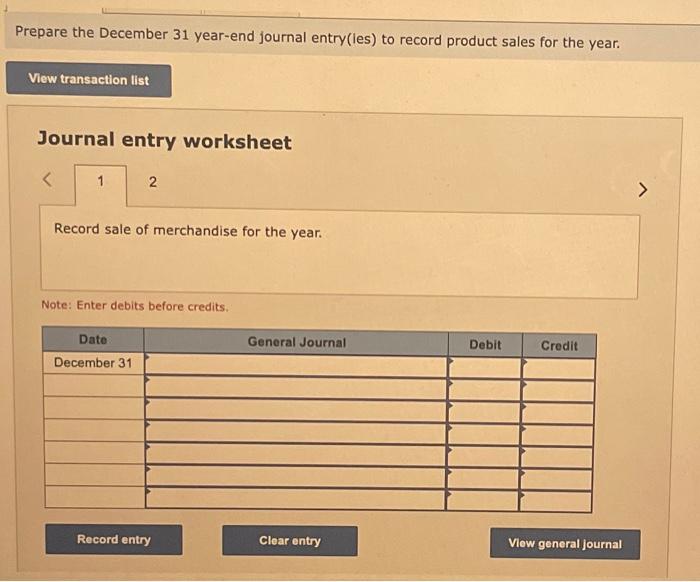

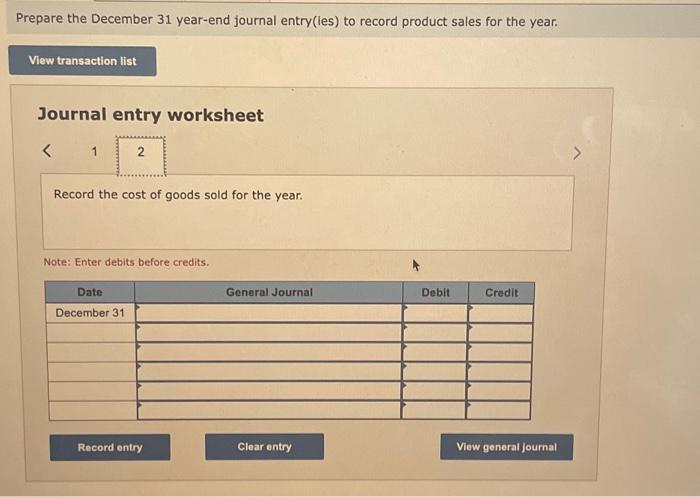

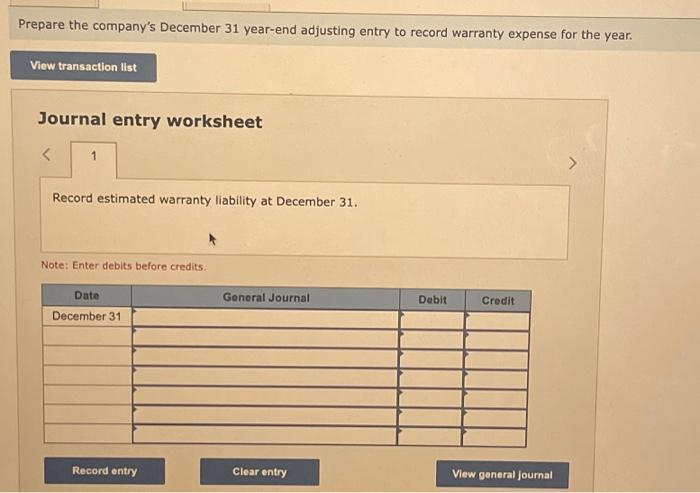

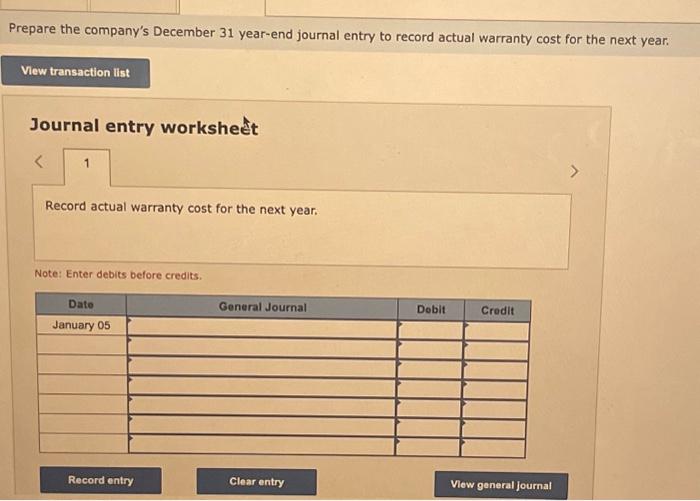

Prepare the December 31 year-end journal entry(les) to record product sales for the year. Journal entry worksheet Note: Enter debits before credits. Prepare the company's December 31 year-end journal entry to record actual warranty cost for the next year. Journal entry workshet Record actual warranty cost for the next year. Note: Enter debits before credits. A company reports product sales of $9,000 (that cost $6,000 ) during the year. The product has a 2 -year parts warranty. The company expects warranty costs to be 5% of the cost of sales. The following dashboard shows the company's (1) product sales and cost of sales for the year, (2) estimated warranty expense reported at year-end, and (3) actual warranty cost for the next year. Prepare the December 31 year-end journal entry(les) to record product sales for the year. Journal entry worksheet Note: Enter debits before credits. repare the company's December 31 year-end adjusting entry to record warranty expense for the year. Journal entry worksheet Record estimated warranty liability at December 31. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts