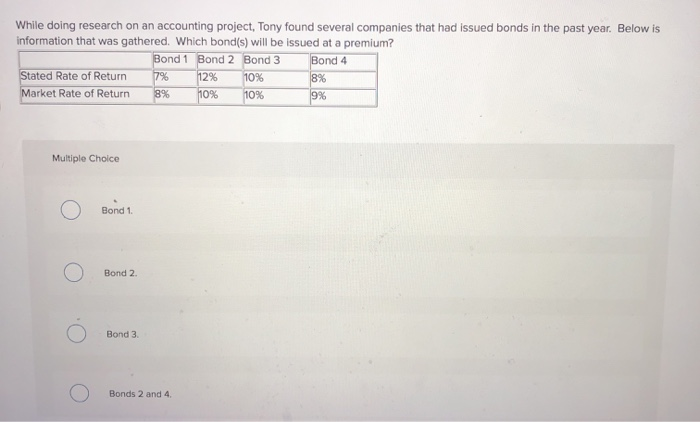

Question: HELP?!? While doing research on an accounting project, Tony found several companies that had issued bonds in the past year. Below is information that was

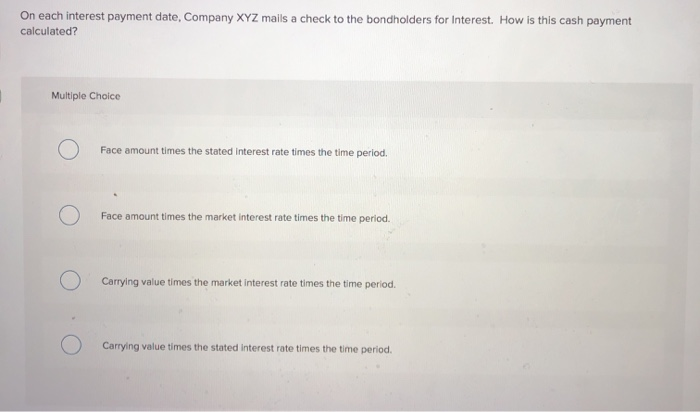

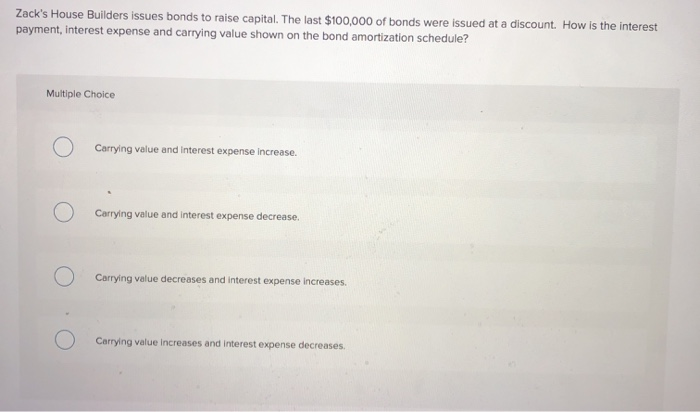

While doing research on an accounting project, Tony found several companies that had issued bonds in the past year. Below is information that was gathered. Which bond(s) will be issued at a premium? Bond 1 Bond 2 Bond 3 Bond 4 Stated Rate of Return 7% 12% 10% Market Rate of Return 8 10% 10% 8% Multiple Choice Bond 2. Bond 3. Bonds 2 and 4 On each interest payment date, Company XYZ malls a check to the bondholders for Interest. How is this cash payment calculated? Multiple Choice Face amount times the stated interest rate times the time period. 0 Face amount times the market interest rate times the time period. 0 0 Carrying value times the market interest rate times the time period. 0 Carrying value times the stated interest rate times the time period. Zack's House Builders issues bonds to raise capital. The last $100,000 of bonds were issued at a discount. How is the interest payment, interest expense and carrying value shown on the bond amortization schedule? Multiple Choice Carrying value and interest expense increase O O Carrying value and interest expense decrease. Carrying value decreases and interest expense increases. O. Carrying value increases and interest expense decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts