Question: Help, will thumbs up! Problem 23-3A Hill Industries had sales in 2016 of $7,120,000 and gross profit of $1,121,000. Management is considering two alternative budget

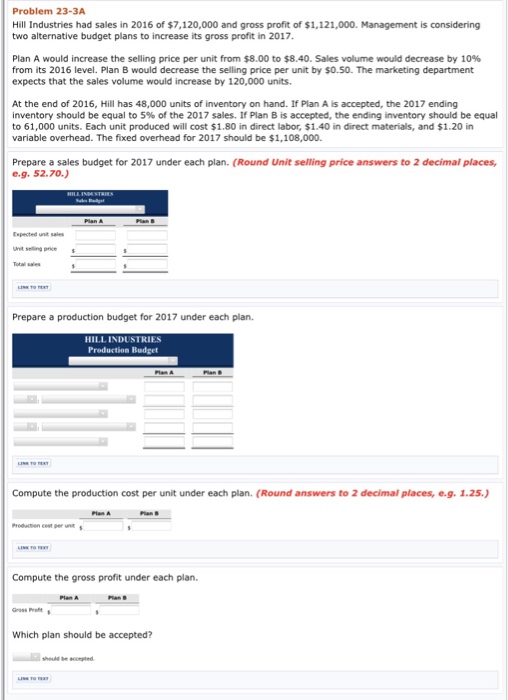

Problem 23-3A Hill Industries had sales in 2016 of $7,120,000 and gross profit of $1,121,000. Management is considering two alternative budget plans to increase its gross profit in 2017 Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2016 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 120,000 units. At the end of 2016, Hill has 48,000 units of inventory on hand. If Plan A is accepted, the 2017 ending inventory should be equal to 5% of the 2017 sales. If Plan B is accepted, the ending inventory should be equal to 61,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2017 should be $1,108,000. Prepare a sales budget for 2017 under each plan. (Round Unit selling price answers to 2 decimal places, e.g. 52.70.) Espected unit sales Unit selling price Total sales Prepare a production budget for 2017 under each plan. HILL INDUSTRIES Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) Compute the gross profit under each plan Gress Proft Which plan should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts