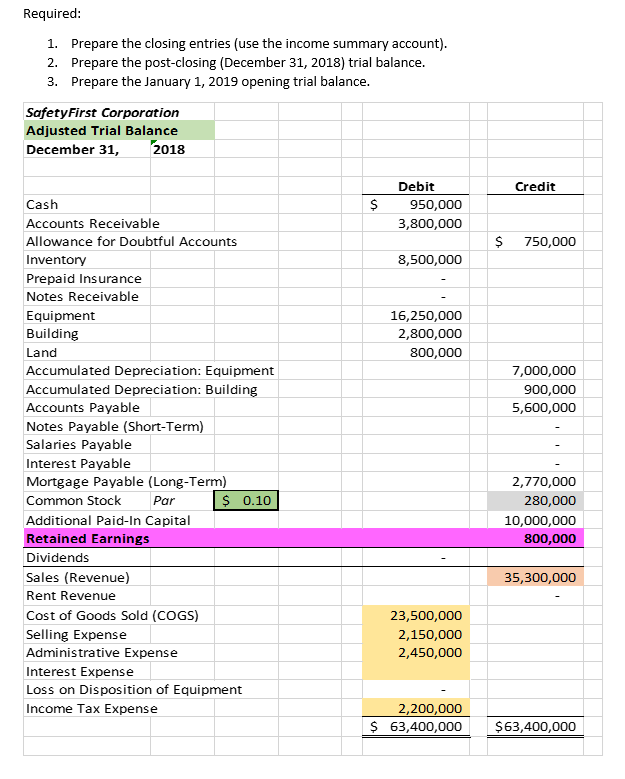

Question: Help with 1, 2, and 3 please. Required: 1. Prepare the closing entries (use the income summary account). 2. Prepare the post-closing (December 31, 2018)

Help with 1, 2, and 3 please.

Required: 1. Prepare the closing entries (use the income summary account). 2. Prepare the post-closing (December 31, 2018) trial balance. 3. Prepare the January 1, 2019 opening trial balance. Safety First Corporation Adjusted Trial Balance December 31, 2018 Credit $ Debit 950,000 3,800,000 $ 750,000 8,500,000 16,250,000 2,800,000 800,000 7,000,000 900,000 5,600,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Notes Receivable Equipment Building Land Accumulated Depreciation: Equipment Accumulated Depreciation: Building Accounts Payable Notes Payable (Short-Term) Salaries Payable Interest Payable Mortgage Payable (Long-Term) Common Stock Par $ 0.10 Additional Paid-In Capital Retained Earnings Dividends Sales (Revenue) Rent Revenue Cost of Goods Sold (COGS) Selling Expense Administrative Expense Interest Expense Loss on Disposition of Equipment Income Tax Expense 2,770,000 280,000 10,000,000 800,000 35,300,000 23,500,000 2,150,000 2,450,000 2,200,000 $ 63,400,000 $63,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts