Question: Help with 1 & 2 please AutoSave OFF DA S U w margins_example-2 Q Search in Document Home Insert Draw Design Layout References Mailings Review

Help with 1 & 2 please

Help with 1 & 2 please

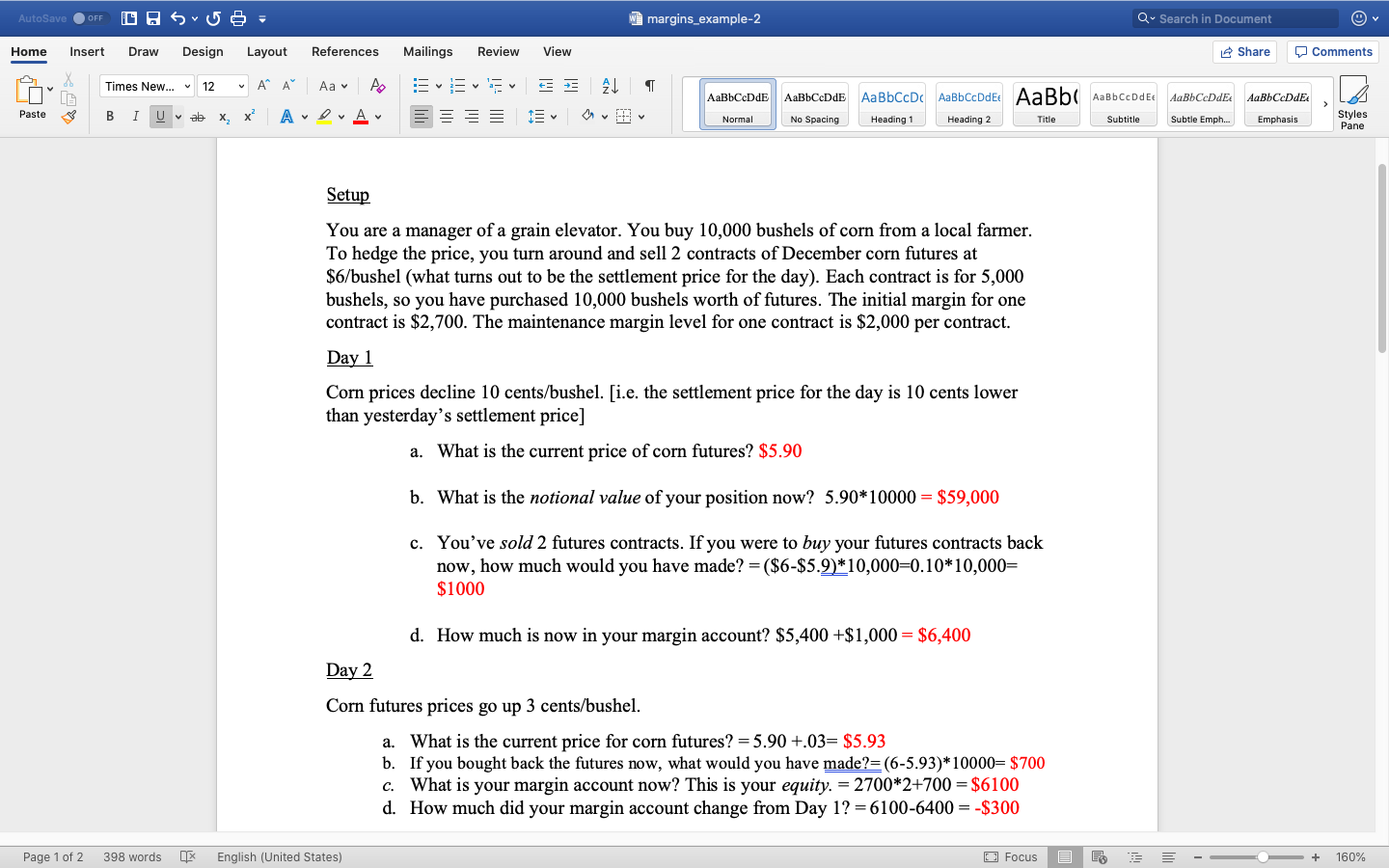

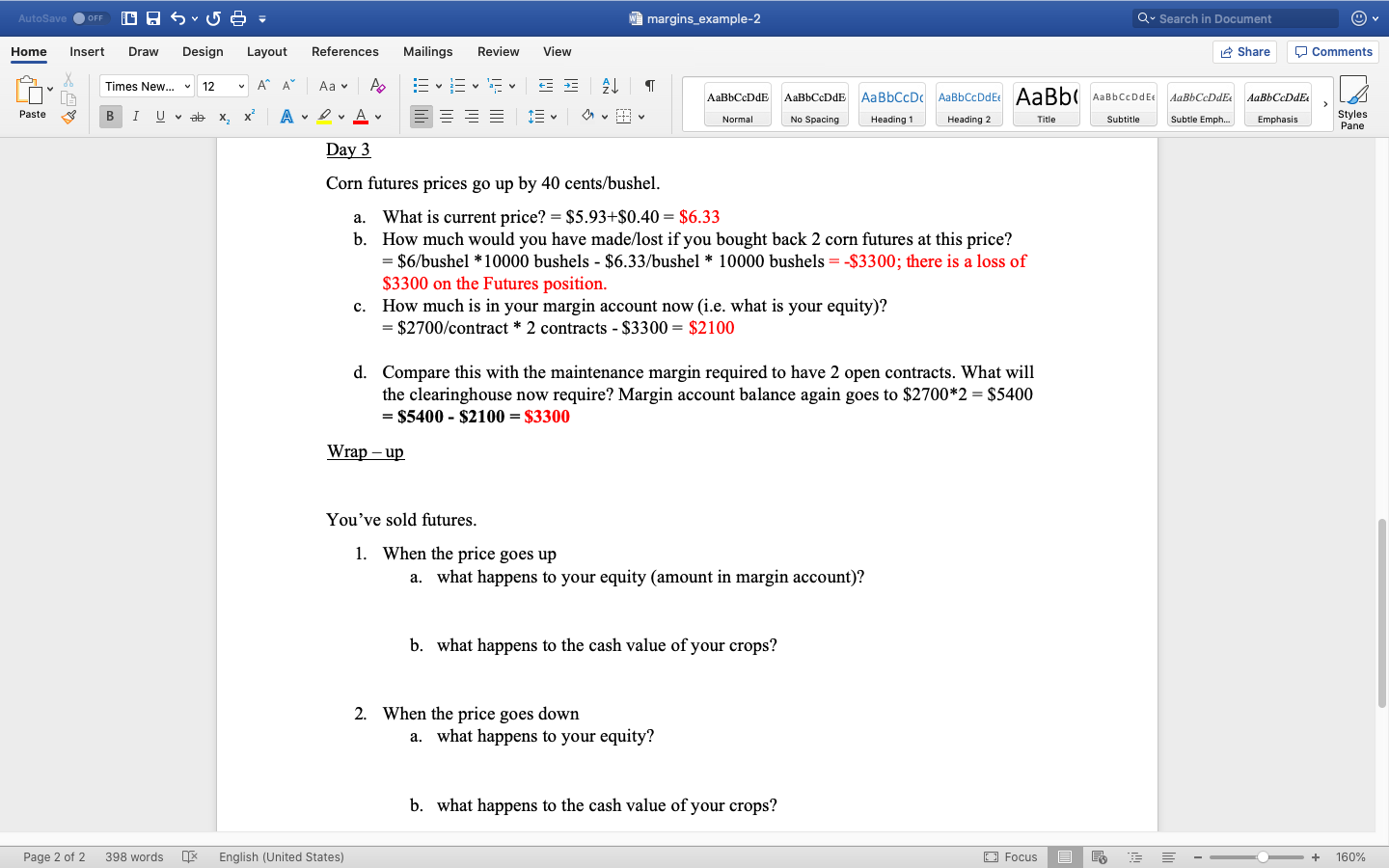

AutoSave OFF DA S U w margins_example-2 Q Search in Document Home Insert Draw Design Layout References Mailings Review View Share Comments Times New... 12A A Aa A BI U vele x? Ave A ESE Z E 13 AaBbCcDdE Paste E av 9 AaBbCcDdE AaBbCcDc AaBb CcDdEt AaBb No Spacing Heading 1 Heading 2 Title AaBb CcDdEt Subtitle AaBb CcDdEt S ubtle Emph... AaBbCcDdEx Emphasis Normal Styles Pane Setup You are a manager of a grain elevator. You buy 10,000 bushels of corn from a local farmer. To hedge the price, you turn around and sell 2 contracts of December corn futures at $6/bushel (what turns out to be the settlement price for the day). Each contract is for 5,000 bushels, so you have purchased 10,000 bushels worth of futures. The initial margin for one contract is $2,700. The maintenance margin level for one contract is $2,000 per contract. Day 1 Corn prices decline 10 cents/bushel. [i.e. the settlement price for the day is 10 cents lower than yesterday's settlement price] a. What is the current price of corn futures? $5.90 b. What is the notional value of your position now? 5.90*10000 = $59,000 c. You've sold 2 futures contracts. If you were to buy your futures contracts back now, how much would you have made? =($6-$5.9*10,000=0.10*10,000= $1000 d. How much is now in your margin account? $5,400 +$1,000 = $6,400 Day 2 Corn futures prices go up 3 cents/bushel. a. What is the current price for corn futures? = 5.90 +.03= $5.93 b. If you bought back the futures now, what would you have made?=(6-5.93)*10000= $700 C. What is your margin account now? This is your equity. = 2700*2+700 = $6100 d. How much did your margin account change from Day 1? =6100-6400 = -$300 Page 1 of 2 398 words x English (United States) | Focus E E ES = - = - + 160% AutoSave OFF DA S U w margins_example-2 Q Search in Document View Share Comments Home Insert Draw Design Layout References Times New... - 12 A A Aav to B I Uvab X, X? ADA Mailings Review v Ev EU AaBbCcDde AaBbCcDdE AaBbCcDc AabbCcDdEt AaBbc Aabbccddee AaBbCcDE AaBbCeDdE, LA Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Emphasis Styles Paste Pane Day 3 Corn futures prices go up by 40 cents/bushel. a. What is current price? = $5.93+$0.40 = $6.33 b. How much would you have made/lost if you bought back 2 corn futures at this price? = $6/bushel *10000 bushels - $6.33/bushel * 10000 bushels = -$3300; there is a loss of $3300 on the Futures position. How much is in your margin account now (i.e. what is your equity)? = $2700/contract * 2 contracts - $3300 = $2100 c. d. Compare this with the maintenance margin required to have 2 open contracts. What will the clearinghouse now require? Margin account balance again goes to $2700*2 = $5400 = $5400 - $2100 = $3300 Wrap up You've sold futures. 1. When the price goes up a. what happens to your equity amount in margin account)? b. what happens to the cash value of your crops? 2. When the price goes down a. what happens to your equity? b. what happens to the cash value of your crops? Page 2 of 2 398 words English (United States) Focus E B = - - + 160%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts