Question: Help with 1A & 1B please Required information Exercise 13-8 Analyzing and interpreting liquidity LO P3 [The following information applies to the questions displayed below.)

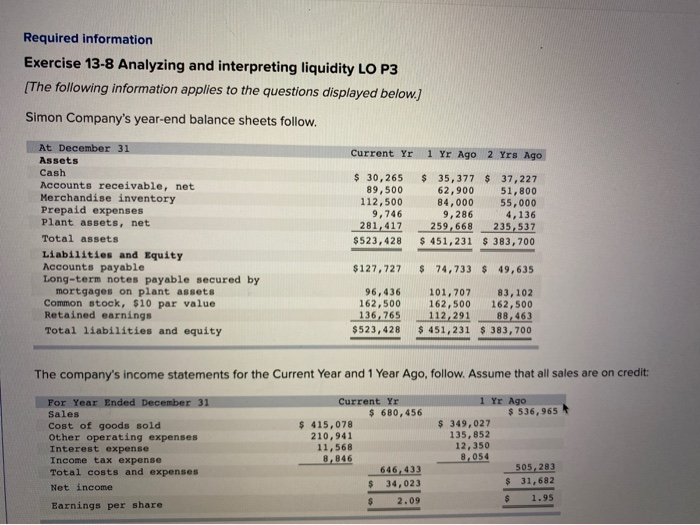

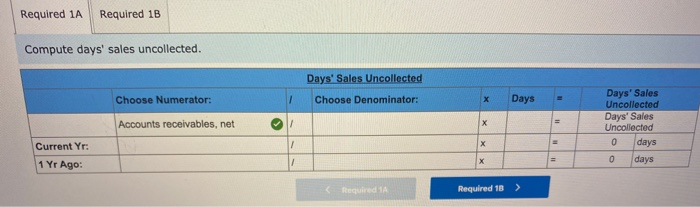

Required information Exercise 13-8 Analyzing and interpreting liquidity LO P3 [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow, Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 30,265 89,500 112,500 9,746 281,417 $523,428 $ 35, 377 $ 37,227 62,900 51,800 84,000 55,000 9,286 4,136 259, 668 235,537 $ 451,231 $ 383,700 $127,727 $ 74,733 $ 49,635 96,436 162,500 136, 765 $523, 428 101, 707 83,102 162,500 162,500 112,291 88,463 $ 451,231 $ 383,700 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $ 680, 456 $ 415,078 210,941 11,568 8,846 646, 433 $ 34,023 $ 1 Yr Ago $ 536,965 $ 349,027 135, 852 12,350 8,054 505,283 $ 31,682 $ 1.95 2.09 Earnings per share Required 1A Required 1B Compute days' sales uncollected. Days' Sales Uncollected Choose Numerator: Choose Denominator: Days Accounts receivables, net / X = Days' Sales Uncollected Days' Sales Uncollected 0 days 0 days Current Yr: X X 1 Yr Ago: Required Required 18 > Required 1A Required 1B For each ratio, determine if it improved or worsened in the current year. Days' sales uncollected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts