Question: help with 24 and 25 please Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong

help with 24 and 25 please

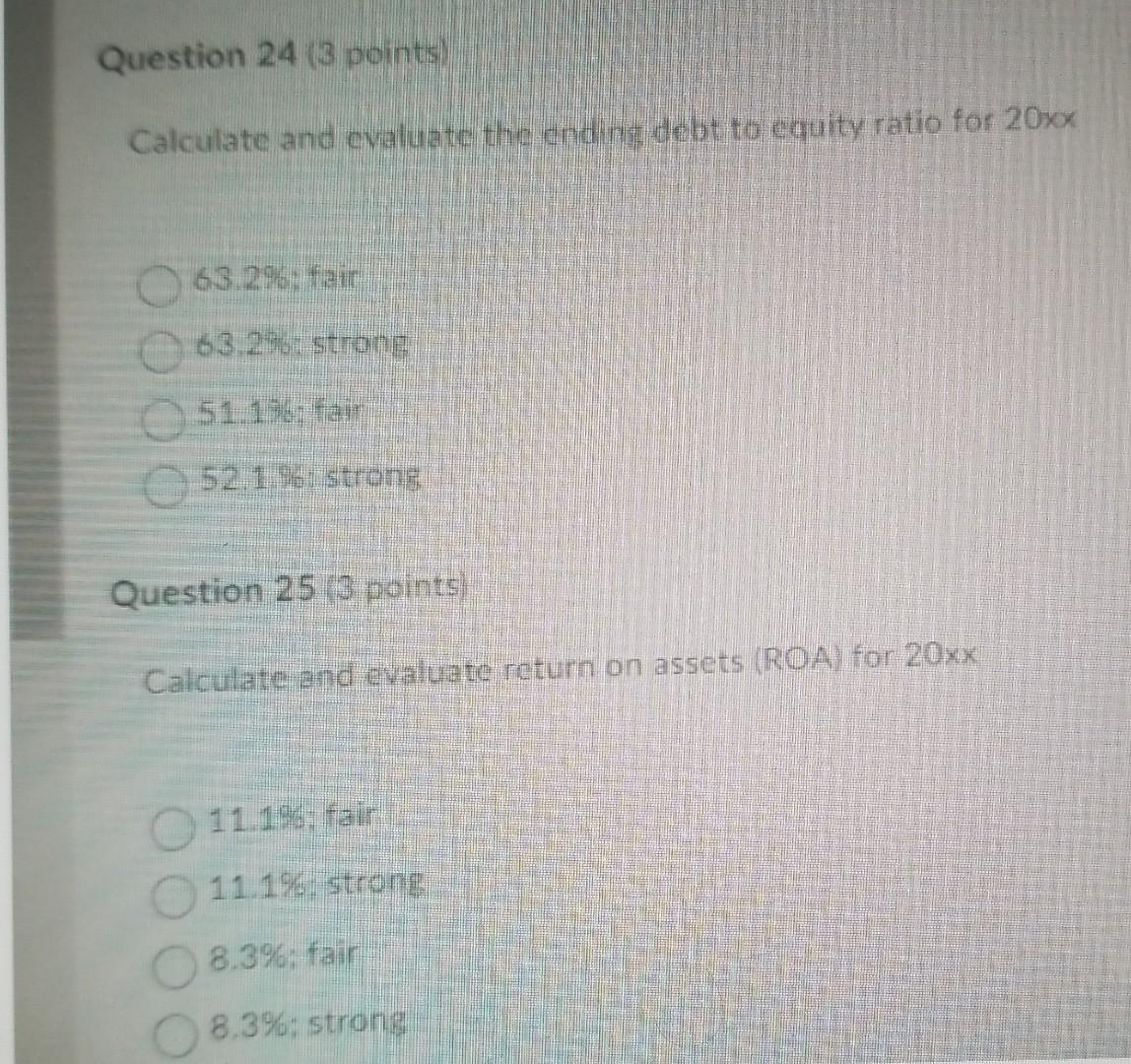

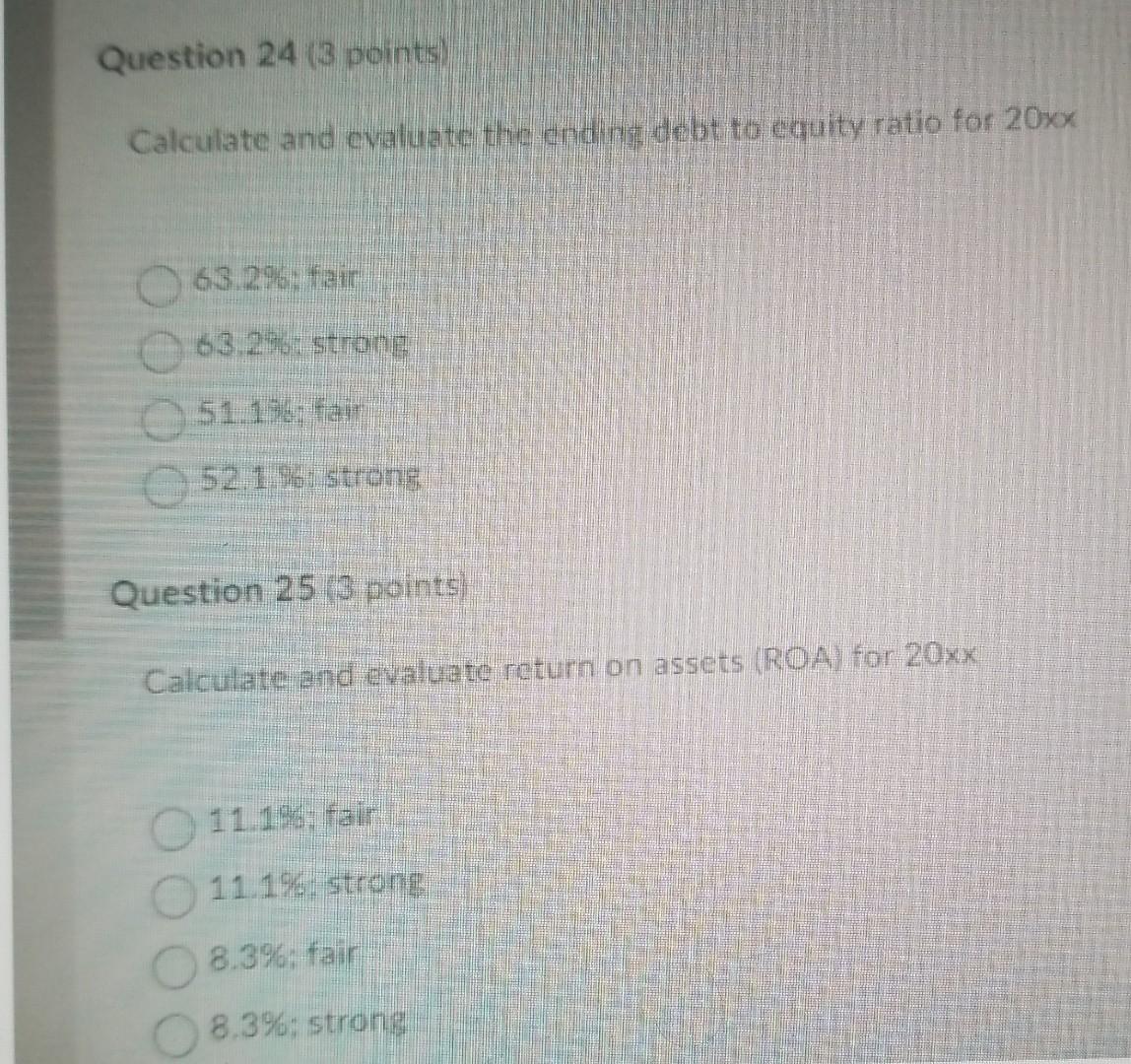

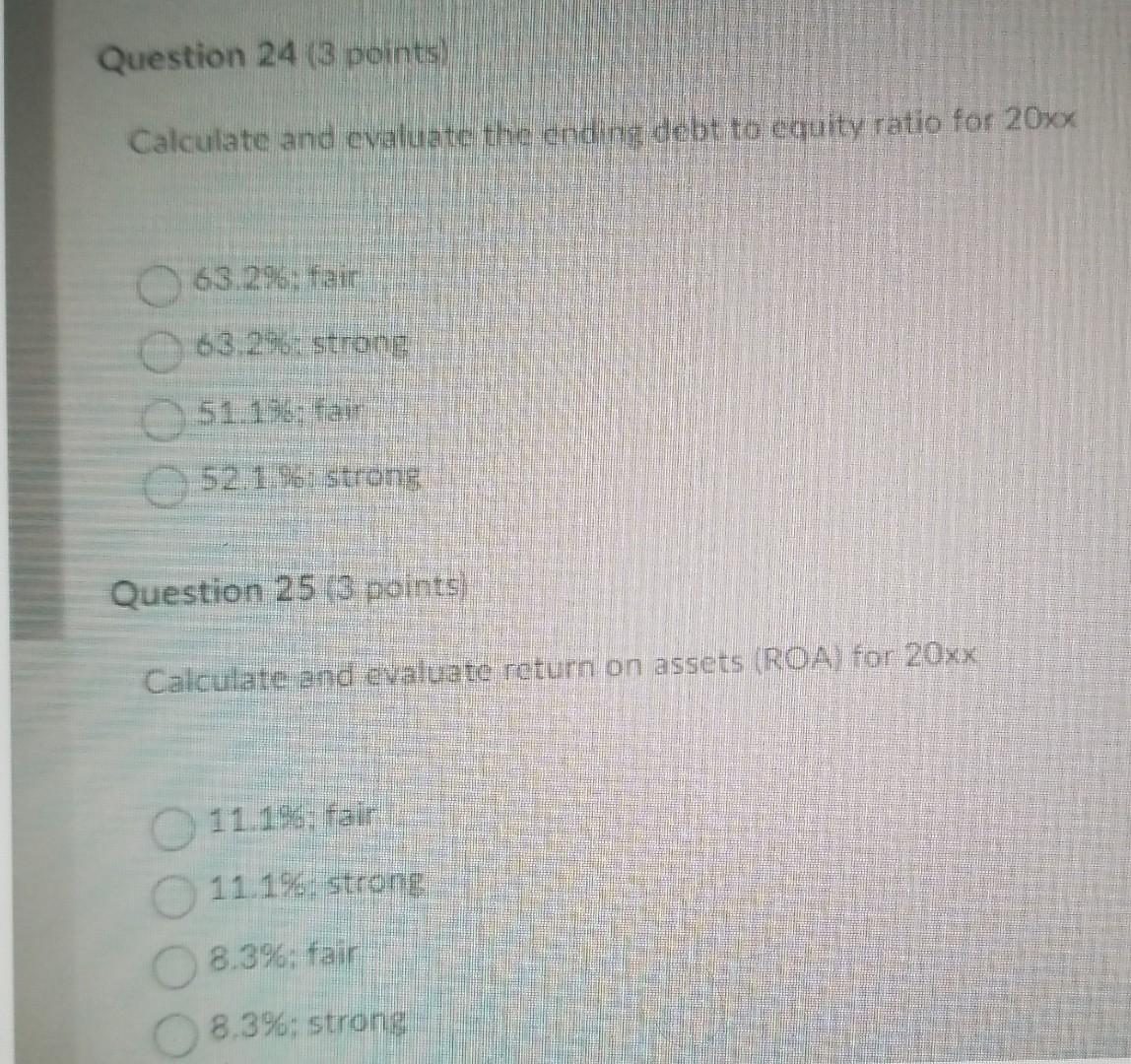

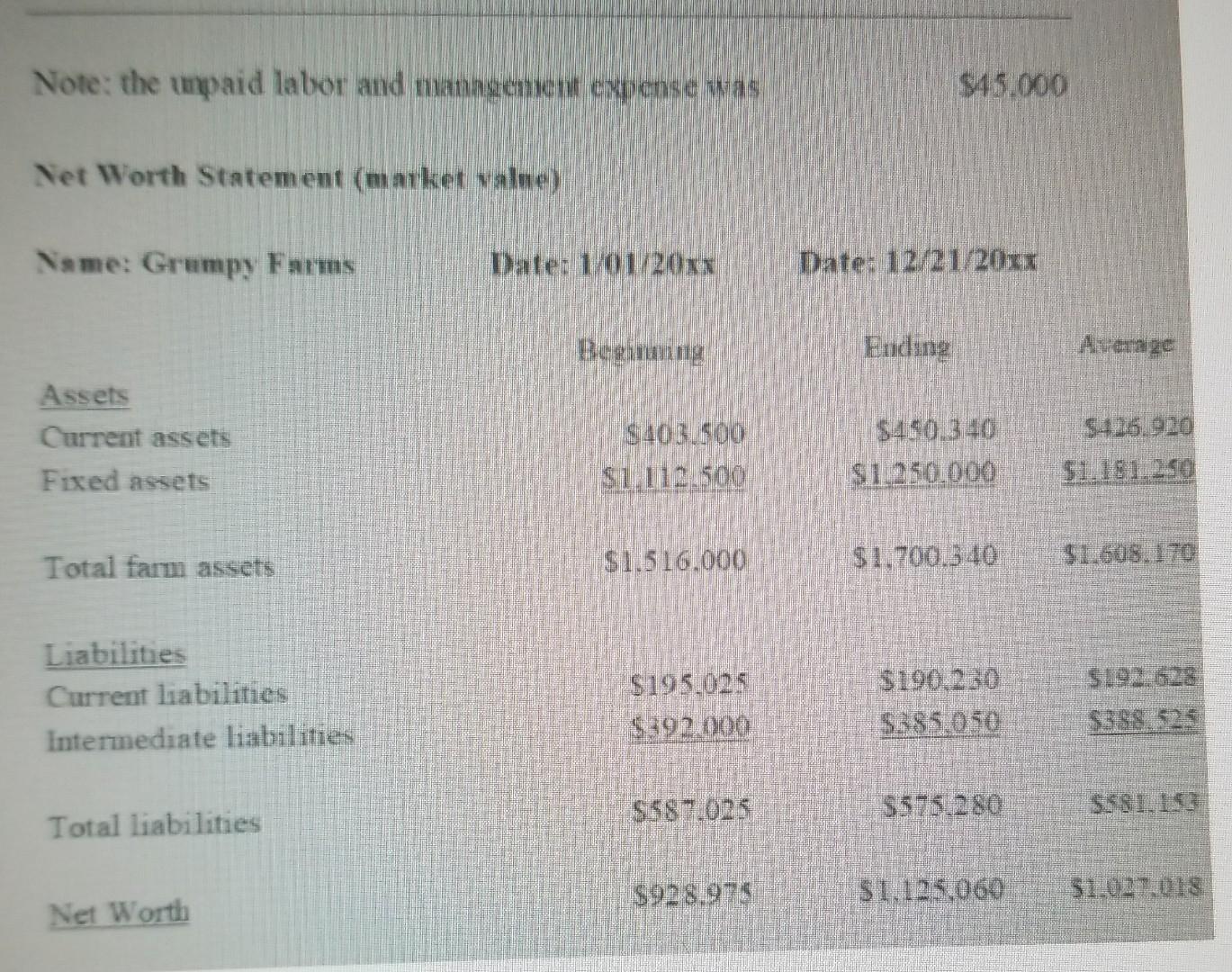

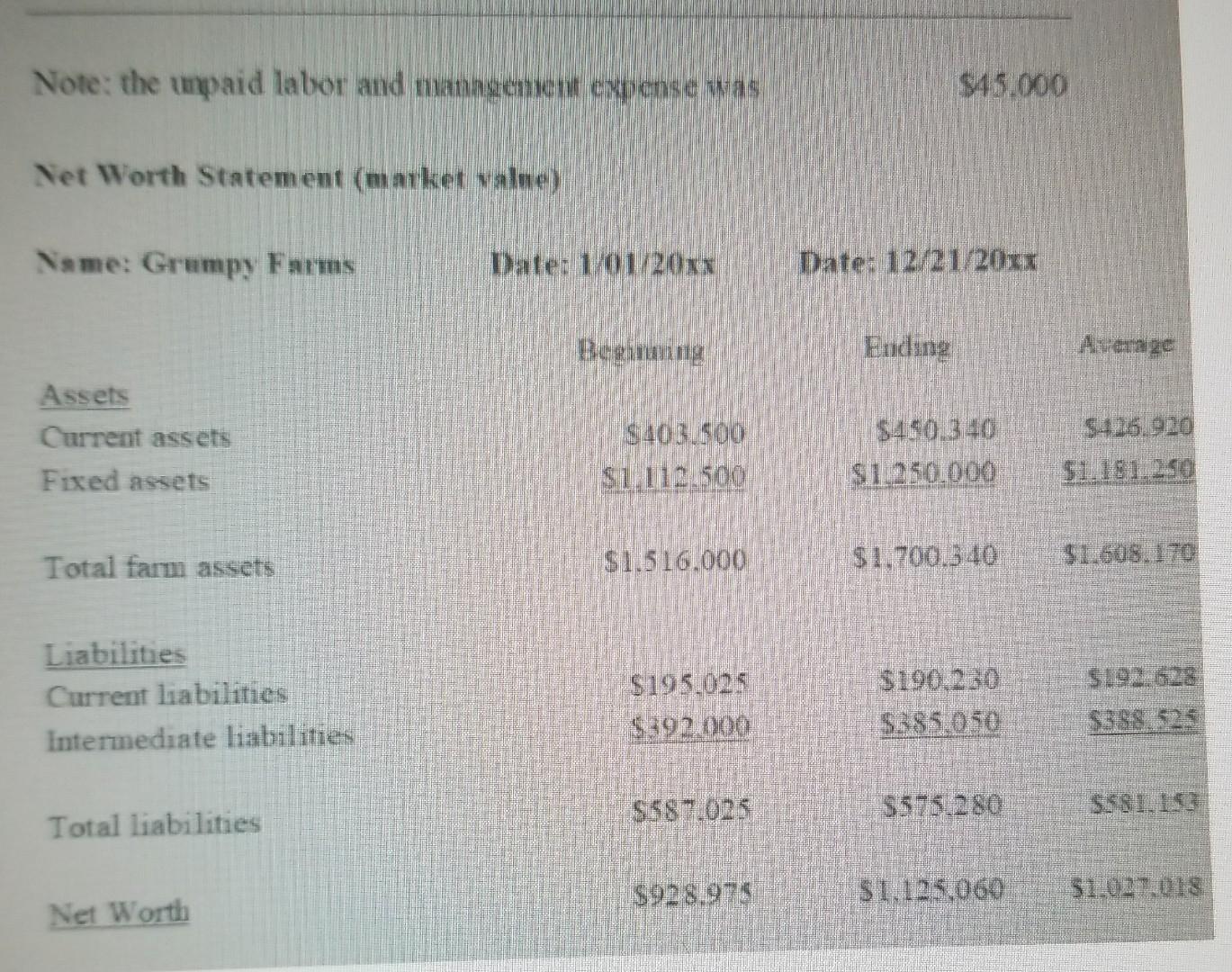

Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Note: the unpaid labor and manngement expense was $45.000 Net Worth Statement (market value) Name: Grumpy Farms Daler 1/01/20xx Date: 12/21/202x Beeinung Ending Average Assets Current assets Fixed assets $403_SOU $1,112.500 $450.340 SILO50.000 $4126.920 $1.181 250 Total fanm assets $1.516.000 $1.700.340 $1.608. 170 Liabilities Current liabilities Intermediate liabilities $195.025 $392.000 $190.230 $385.050 $587025 $575.280 Total liabilities $928.995 1.05.060 $1.02.018 Net Worth Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Question 24 (3 points) Calculate and evaluate the coding debt to equity ratio for 20xx 63.296, fair 63.2% strong 51 15. Fair 52.156 strong Question 25 (3 points) Calculate and evaluate return on assets (ROA) for 20xx 11.196, fair 11.196: strong 8.396, fair 8.396; strong Note: the unpaid labor and manngement expense was $45.000 Net Worth Statement (market value) Name: Grumpy Farms Daler 1/01/20xx Date: 12/21/202x Beeinung Ending Average Assets Current assets Fixed assets $403_SOU $1,112.500 $450.340 SILO50.000 $4126.920 $1.181 250 Total fanm assets $1.516.000 $1.700.340 $1.608. 170 Liabilities Current liabilities Intermediate liabilities $195.025 $392.000 $190.230 $385.050 $587025 $575.280 Total liabilities $928.995 1.05.060 $1.02.018 Net Worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts