Question: help with #5 apitalization Table Problems how all work in Excel 1) You have been asked to prepare a proforma capitalization table for your company.

help with #5

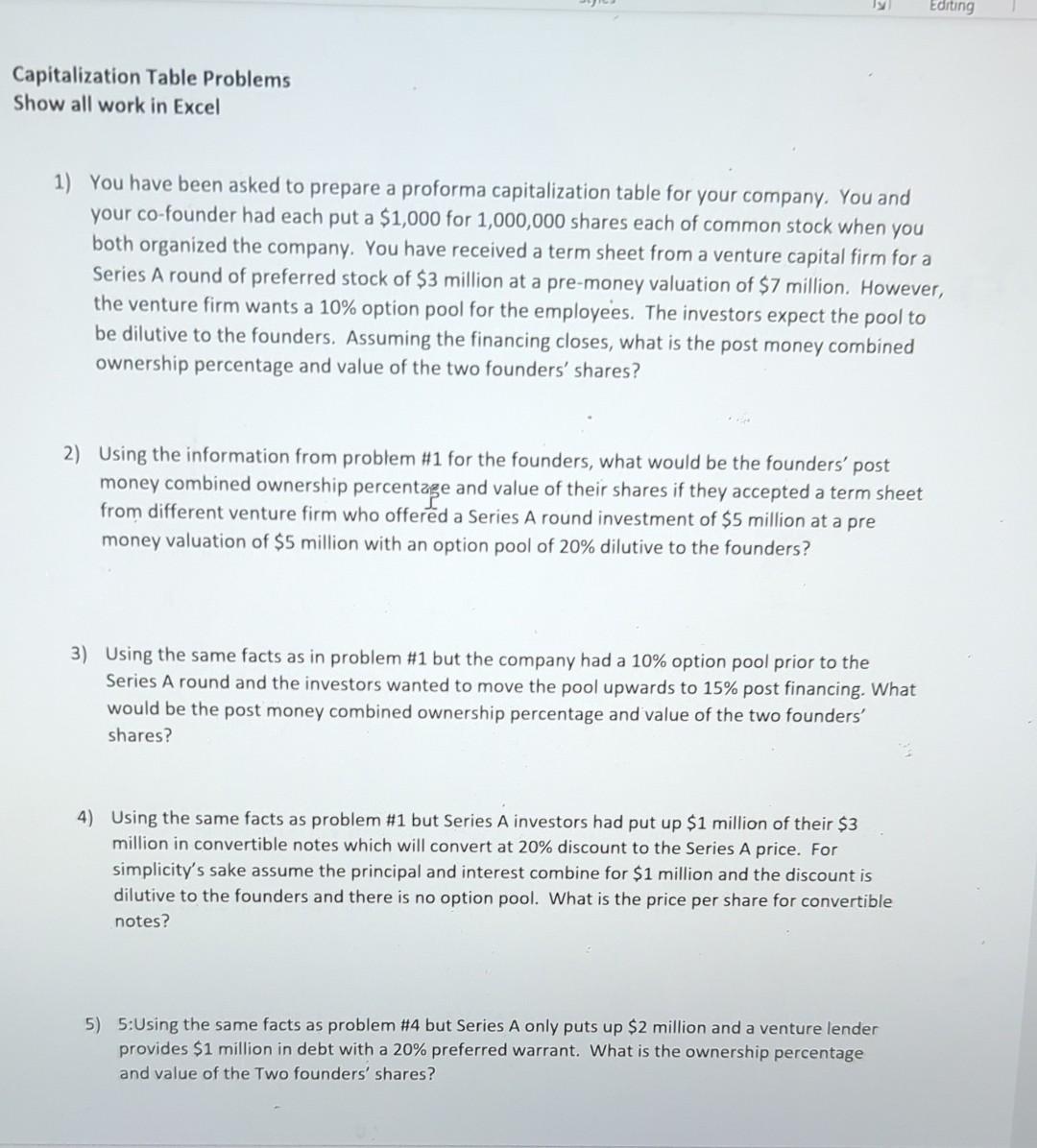

apitalization Table Problems how all work in Excel 1) You have been asked to prepare a proforma capitalization table for your company. You and your co-founder had each put a $1,000 for 1,000,000 shares each of common stock when you both organized the company. You have received a term sheet from a venture capital firm for a Series A round of preferred stock of $3 million at a pre-money valuation of $7 million. However, the venture firm wants a 10% option pool for the employees. The investors expect the pool to be dilutive to the founders. Assuming the financing closes, what is the post money combined ownership percentage and value of the two founders' shares? 2) Using the information from problem \#1 for the founders, what would be the founders' post money combined ownership percentage and value of their shares if they accepted a term sheet from different venture firm who offered a Series A round investment of $5 million at a pre money valuation of $5 million with an option pool of 20% dilutive to the founders? 3) Using the same facts as in problem \#1 but the company had a 10% option pool prior to the Series A round and the investors wanted to move the pool upwards to 15% post financing. What would be the post money combined ownership percentage and value of the two founders' shares? 4) Using the same facts as problem \#1 but Series A investors had put up $1 million of their $3 million in convertible notes which will convert at 20% discount to the Series A price. For simplicity's sake assume the principal and interest combine for $1 million and the discount is dilutive to the founders and there is no option pool. What is the price per share for convertible notes? 5) 5:Using the same facts as problem \#4 but Series A only puts up $2 million and a venture lender provides $1 million in debt with a 20% preferred warrant. What is the ownership percentage and value of the Two founders' shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts