Question: Help with #6 please? Step 1 You work for Thunderduck Custom Tables Inc. This is the first month of operations. The company designs and manufactures

Help with #6 please?

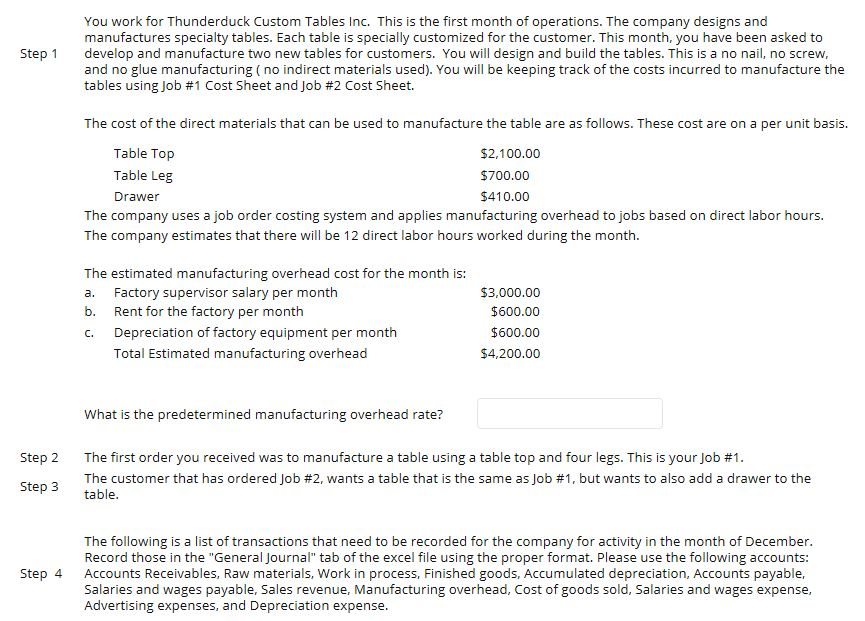

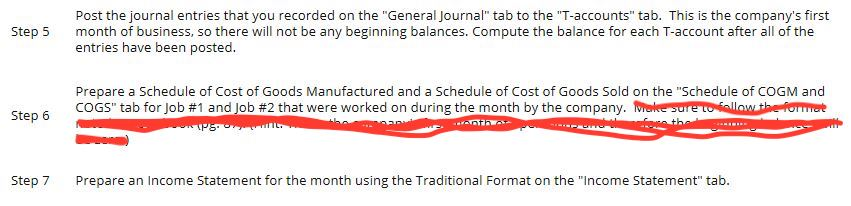

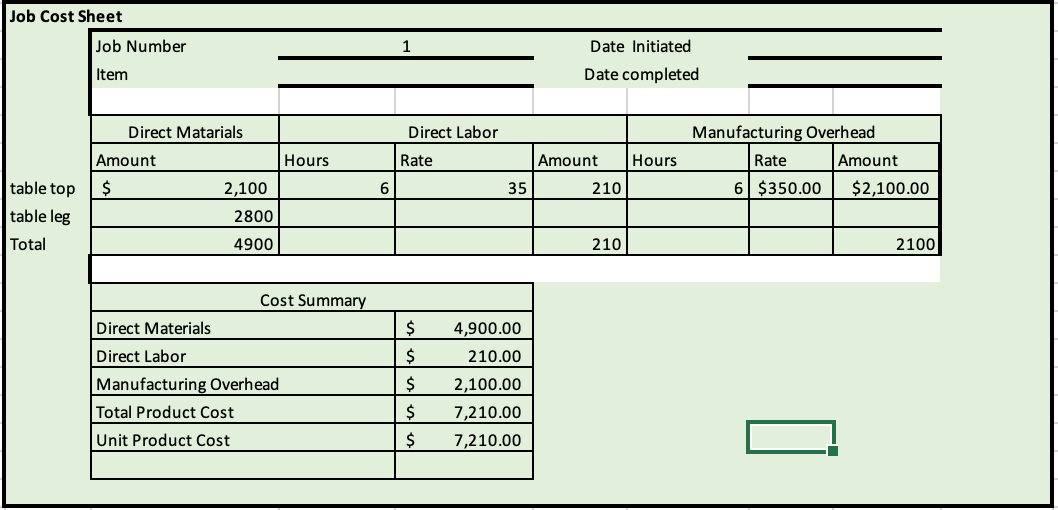

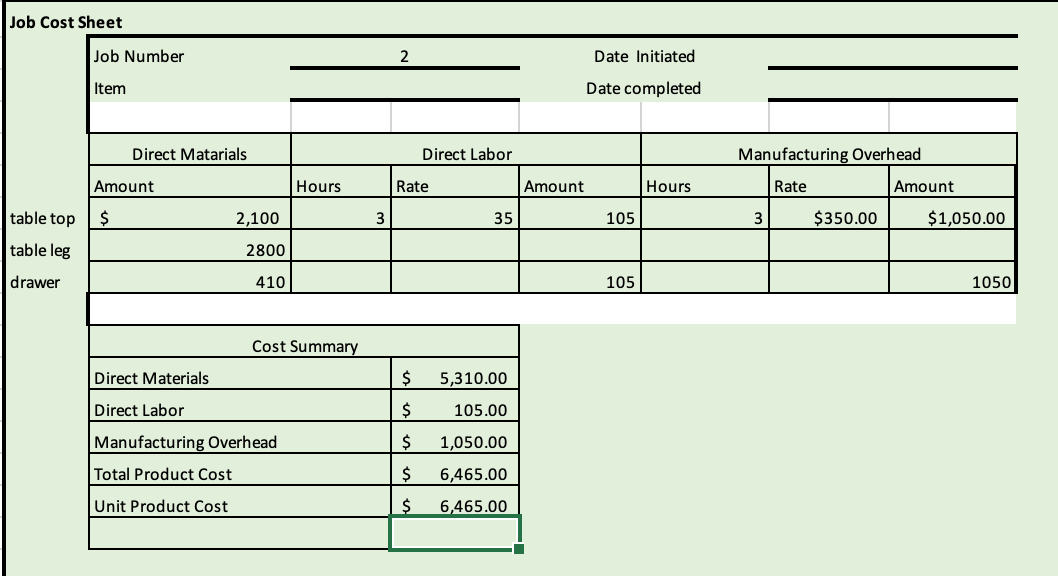

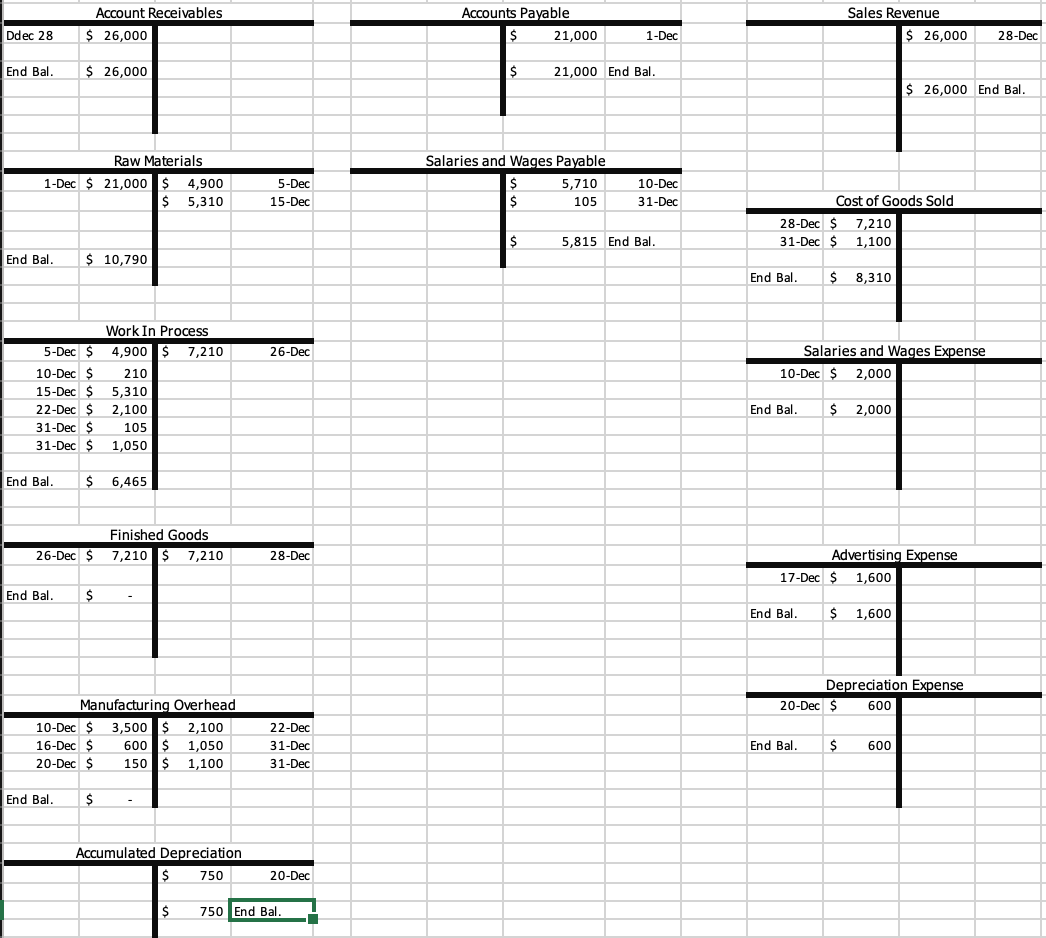

Step 1 You work for Thunderduck Custom Tables Inc. This is the first month of operations. The company designs and manufactures specialty tables. Each table is specially customized for the customer. This month, you have been asked to develop and manufacture two new tables for customers. You will design and build the tables. This is a no nail, no screw, and no glue manufacturing (no indirect materials used). You will be keeping track of the costs incurred to manufacture the tables using Job #1 Cost Sheet and Job #2 Cost Sheet. The cost of the direct materials that can be used to manufacture the table are as follows. These cost are on a per unit basis. Table Top $2,100.00 Table Leg $700.00 Drawer $410.00 The company uses a job order costing system and applies manufacturing overhead to jobs based on direct labor hours. The company estimates that there will be 12 direct labor hours worked during the month. The estimated manufacturing overhead cost for the month is: a. Factory supervisor salary per month b. Rent for the factory per month C. Depreciation of factory equipment per month Total Estimated manufacturing overhead $3,000.00 $600.00 $600.00 $4,200.00 What is the predetermined manufacturing overhead rate? Step 2 The first order you received was to manufacture a table using a table top and four legs. This is your Job #1. The customer that has ordered Job #2, wants a table that is the same as Job #1, but wants to also add a drawer to the table. Step 3 Step 4 The following is a list of transactions that need to be recorded for the company for activity in the month of December. Record those in the "General Journal" tab of the excel file using the proper format. Please use the following accounts: Accounts Receivables, Raw materials, Work in process, Finished goods, Accumulated depreciation, Accounts payable, Salaries and wages payable, Sales revenue, Manufacturing overhead, Cost of goods sold, Salaries and wages expense, Advertising expenses, and Depreciation expense. Step 5 Post the journal entries that you recorded on the "General Journal" tab to the "T-accounts" tab. This is the company's first month of business, so there will not be any beginning balances. Compute the balance for each T-account after all of the entries have been posted. Step 6 Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the "Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Ivoke sure to follow the format 150 th a t more the Step 7 Prepare an Income Statement for the month using the Traditional Format on the "Income Statement" tab. Job Cost Sheet Job Number Item Date Initiated Date completed Direct Labor Rate 3 Hours Direct Matarials Amount Hours $ 2,100 6 2800 4900 Amount 210 Manufacturing Overhead Rate Amount 6 $350.00 $2,100.00 table top table leg Total 5 210 2100| vaterials Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost Unit Product Cost $ $ $ $ $ 4,900.00 210.00 2,100.00 7,210.00 7,210.00 Job Cost Sheet Job Number Date Initiated Date completed Item natarials Direct Matarials Amount Hours Hou Direct Labor Rate 35 Amount Hours 105| Manufacturing Overhead Rate Amount 3 $350.00 $1,050.00 | $ 2.100 3 35 table top table leg drawer 2800 410 410 _11051 1050 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost $ $ $ $ $ 5,310.00 105.00 1,050.00 6,465.00 6,465.00 Unit Product Cost Credit Step 4 Journal entries General Journal Sr. No. Description 1-Dec Raw Materials To Accounts payable (Being Raw materials purchased on account) Debit $21,000 Dr. $21,000 Dr. $ 4,900 5-Dec Work in Process To Raw Materials (Being Raw materials issued for use in Job #1) $4,900 Dr. Dr. | 10-Dec Work in Process (2 hours* 3 employees*$35 per hour) Manufacturing Overheads Salaries and Wages Expense To Salaries and wages payable (Being employee cost incurred) $ $ $ 210 3,500 2,000 Dr. $ 5,710 Dr. $ 5,310 15-Dec Work in Process To Raw Materials (Being Raw materials issued for use in Job #2) $5,310 Dr. $600 16-Dec Manufacturing Overheads To Rent Payable (Being Rent for the factory building incurred) $600 Dr. $1,600 17-Dec Advertising Expenses To Advertising Expenses Payable (Being Advertising Expenses incurred) $1,600 $150 $600 Dr. 20-Dec Manufacturing Overheads Depreciation expense To Accumulated depreciation (Being depreciation charged on factory and office equipments) $750 $ 2,100 22-Dec Work in Process To Manufacturing Overheads (Being Manufacturing Overheads charged to job #1) $ 2,100 Dr. $ 7,210 26-Dec Finished Goods To Work in Process (Being job #1 completed) $ 7,210 Dr. $ 7,210 28-Dec Cost of goods sold To Finished Goods (Being goods sold transferred) $ 7,210 Dr. $26,000 28-Dec Account Receivable To Sales Revenue (Being goods sold on account) $26,000 105 31-Dec Work in Process (1 hour* 3 employees*$35 per hour) To Salaries and wages payable |(Being direct labor cost incurred) 105 $ 105 205 Dr. $ 1,050 31-Dec Work in Process To Manufacturing Overheads (Being Manufacturing Overheads charged to job #2) $ 1,050 Dr. $ 1,100 31-Dec Cost of goods sold To Manufacturing Overheads (Being underapplied overheads charged) $ 1,100 Account Receivables $ 26,000 Accounts Payable $ 21,000 Sales Revenue $ 26,000 Ddec 28 1-Dec 28-Dec End Bal. $ 26,000 $ 21,000 End Bal. $ 26,000 End Bal. Raw Materials 1-Dec $ 21,000 $ 4,900 $ 5,310 5-Dec 15-Dec Salaries and Wages Payable 5,710 $ 105 10-Dec 31-Dec Cost of Goods Sold 28-Dec $ 7,210 31-Dec $ 1,100 5,815 End Bal. End Bal. $ 10,790 End Bal. $ 8,310 26-Dec Salaries and Wages Expense 10-Dec $ 2,000 5-Dec $ 10-Dec $ 15-Dec $ 22-Dec $ 31-Dec $ 31-Dec $ Work In Process 4,900 $ 7,210 210 5,310 2,100 105 1,050 End Bal. $ 2,000 End Bal. $ 6,465 Finished Goods 7,210 $ 7,210 26-Dec $ 28-Dec Advertising Expense 17-Dec $ 1,600 End Bal. $ - End Bal. $ 1,600 Depreciation Expense 20-Dec $ 600 Manufacturing Overhead 10-Dec $ 3,500 $ 2,100 16-Dec $ 600 $ 1,050 20-Dec $ 150 $ 1,100 22-Dec 31-Dec 31-Dec End Bal. $ 600 End Bal. $ Accumulated Depreciation $ 750 20-Dec $ 750 End Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts