Question: Help with A including a detailed answer please !!!!!!!!!!! Wildhorse's Company builds custom fishing lures for sporting goods stores. In its first year of operations,

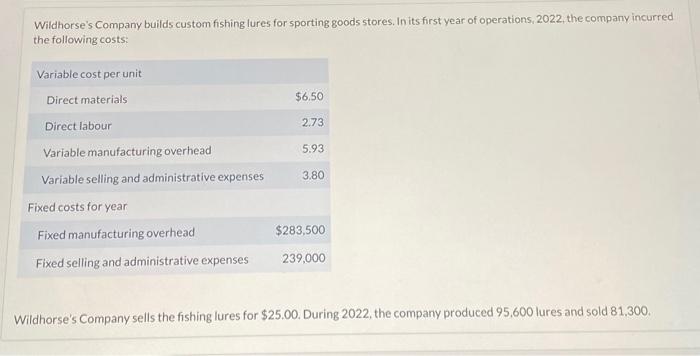

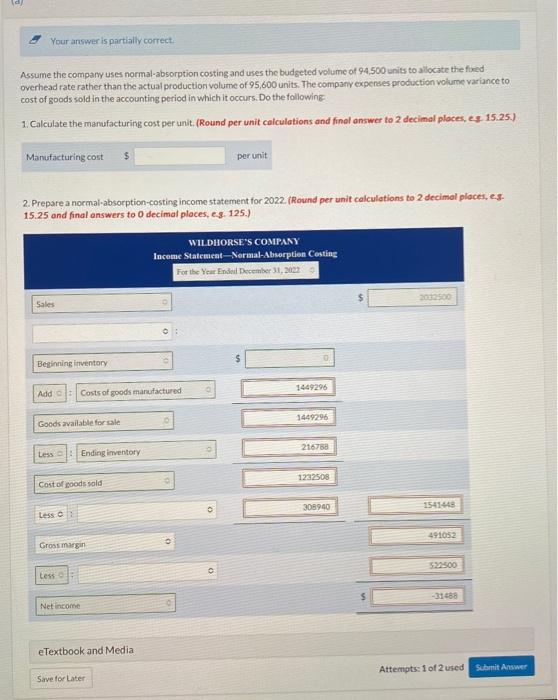

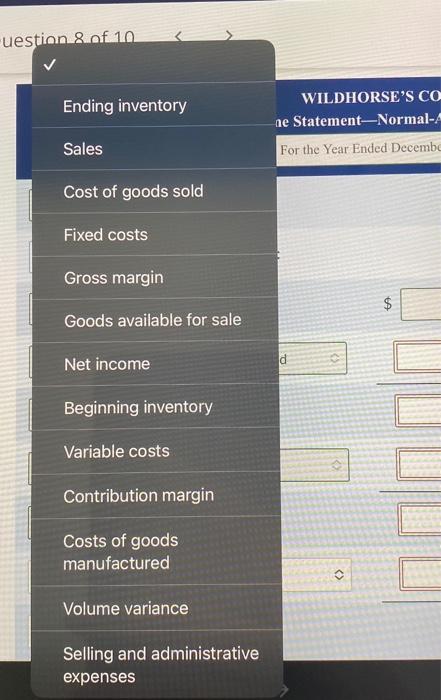

Wildhorse's Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2022, the company incurred the following costs: Nildhorse's Company sells the fishing lures for $25.00. During 2022, the company produced 95,600 lures and sold 81,300 . Assume the company uses normal-absorption costing and uses the budgeted volume of 9.4,500 units to allockate the fixed overhead rate rather than the actual production volume of 95,600 units. The company experses production volume variance to cost of goods sold in the accounting poriod in which it occurs. Do the following 1. Calculate the manufacturing cost per unit. (Round per unit calculations and finel answer to 2 decimal ploces, es-15.25.) Manufacturing cost perunit 2. Prepare a normal-absorption-costing income statement for 2022 . (Round per unit calculations to 2 decimal places, es. Ending inventory WILDHORSE'S CO ae Statement-Normal- Sales Cost of goods sold Fixed costs Gross margin Goods available for sale Net income Beginning inventory Variable costs Contribution margin Costs of goods manufactured Volume variance Selling and administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts