Question: HELP WITH ADJUSTING ENTIRES Read ALL instructions before getting started! ABC Corporation is a new company that buys and sells office supplies. Business began on

HELP WITH ADJUSTING ENTIRES

| Read ALL instructions before getting started! |

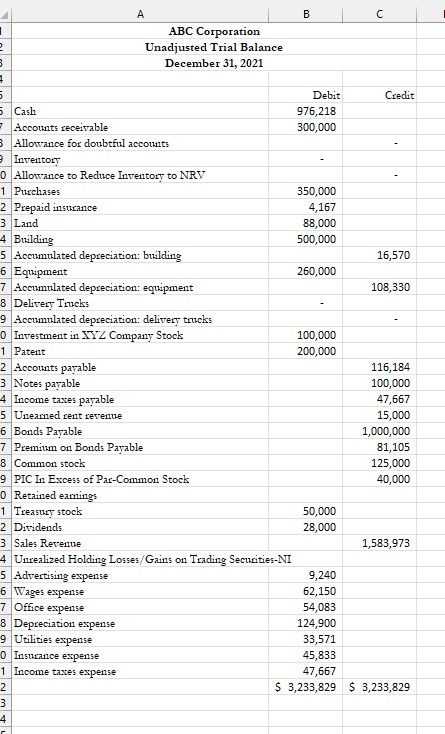

| ABC Corporation is a new company that buys and sells office supplies. Business began on January 1, 2021. |

| Given on the first two tabs are ABC's 12/31/21 Unadjusted Trial Balance and a list of needed adjustments. |

| 1. Make all 14 adjustments on the "Adjusting Journal Entries" tab. Remember to include a description under each journal entry. |

| 2. Post the adjustments to the general ledger on the "12-31-21 T-Accounts" tab. You may have to add T-Accounts for new accounts. |

| Link your T-Account entries to your Journal Entries. PLEASE NOTE THAT THE "BB" (BEGINNING BALANCES) FOR THE |

| T-ACCOUNTS REPRESENT THE BALANCES AS OF 12/31/21. |

| 3. Once the 12/31/21 T-Accounts are complete, prepare the Adjusted Trial Balance. There may be some accounts with zero dollars, and you |

| may have to insert lines for new accounts. Link the Adjusted Trial Balance to your T-Accounts. |

| 4. Use the Adjusted Trial Balance numbers to complete the Income Statement, Statement of Shareholders' Equity, and Balance Sheet. |

| For purposes of the Income Statement, prepare using the multiple step format and assume that Rent Revenue, any Unrealized Holding Gains/Losses, |

| Interest Expense, Interest Revenue, and any other Gains/Losses are NOT part of the major central ongoing operations of the company. For purposes |

| of the Balance Sheet, be sure to prepare a classifed Balance Sheet. Link your financial statements to your Adjusted Trial Balance. |

| If necessary, review financial statement preparation in Chapters 3 and 4 of your Intermediate Accounting textbook for a quick refresher. |

| 5. When the Financial Statements are complete, make the closing entries on the "Closing Entries" tab. |

| 6. When closing entries have been made, post the entries to the general ledger on the "Post-Close T-Accounts" tab. Make sure your adjusting |

| journal entries are also on your Post-Close T-Accounts. They will not automatically flow from tab-to-tab. (Helpful hint: After you have completed |

| and posted all of your adjusting entries, make a duplicate copy of your "12-31-21 T-Accounts" tab to replace the existing blank |

| "Post-Close T Accounts" tab by right clicking on the completed "12-31-21 T-Accounts" tab, select Move or Copy, |

| then click on "Create a Copy" and then place at the desired location. You can then delete the original "Post-Close T-Accounts" tab and rename the |

| newly duplicated tab as your "Post-Close T-Accounts" tab). |

| 7. The final step is the Post-Closing Trial Balance, which will use the ending balances from the Post-Close T-Accounts. |

| 8. Double-check your work. Here are a few things to check for: |

| -Adjusted Trial Balance: Make sure debit column and credit column total to the same figure at the bottom. |

| -Net income from the income statement will flow through to the Statement of Retained Earnings. |

| -Ending Shareholders' Equity balances will flow through to the Stockholders' Equity section of the Balance Sheet. |

| -The Post-Closing Trial Balance should not have any revenue, expense, gain, or loss (temporary) accounts. |

| -Check figure 1: Income from operations = $855,539. |

| -Check figure 2: Income before income taxes = $827,212. |

| -Check figure 3: Total Current Assets at 12/31/21 = $1,721,718. |

| -Check figure 4: Retained Earnings at 12/31/21 = $633,770. |

| -Check figure 5: Total Stockholders' Equity at 12/31/21 = $1,078,770. |

| -Check figure 6: Total Liabilities at 12/31/21= $1,525,558. |

| -Check figure 7: Total Other Income/Gains and (Expenses)/(Losses) for 2021= ($61,327). |

| -Remember: Neatness matters in Financial Statements. Print or Print Preview before submitting to make sure your statements are neat. |

| Otherwise, management may send back to you for revision! |

| -Include your work at the bottom of each tab as needed. |

| -Ask questions prior to the dayight before the due date. The due date is clearly indicated on the course schedule. |

| -Utilize formulas and worksheet linkings in your financial statements to improve accuracy and save time in completing the assignment. |

| -Please take advantage of Excel by using formulas to calculate groups of numbers (i.e. "Total Liabilities and Stockholders' Equity"). |

| -DO NOT force any cells to match check figures given. Any adjustments in the T-Accounts or financial statements not supported by |

| legitimate adjusting or closing entries will be considered financial statement misrepresentation sufficient to result in a failing grade. |

| Final comments: This project is intended to make sure that you understand the accounting cycle as well as several key financial accounting transactions that you have |

| studied during your Intermediate Accounting series. It is very important to take the necessary time on this project to master these concepts. The concepts mastered in this |

| comprehensive problem will serve you well in the rest of your accounting curriculum. |

| Please review the grading rubric tab as you start work on the assignment to make sure that you understand how your work will be evaluated. Please note that 50 points |

| of the total grade on this assignment (25%) is based on your overall presentation of work and your use of Microsoft Excel features (cell links, formulas, etc.) |

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock