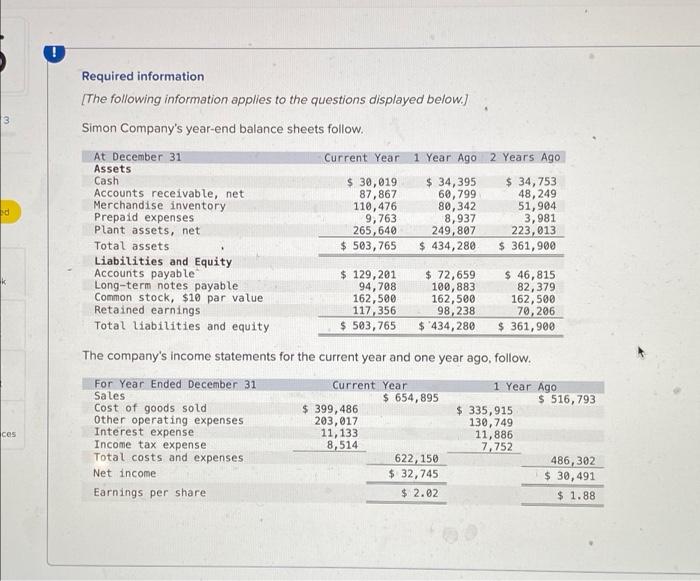

Question: help with all please 3 ed k ces Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow.

![information applies to the questions displayed below.] Simon Company's year-end balance sheets](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67184beedd6cf_55067184bee4e541.jpg)

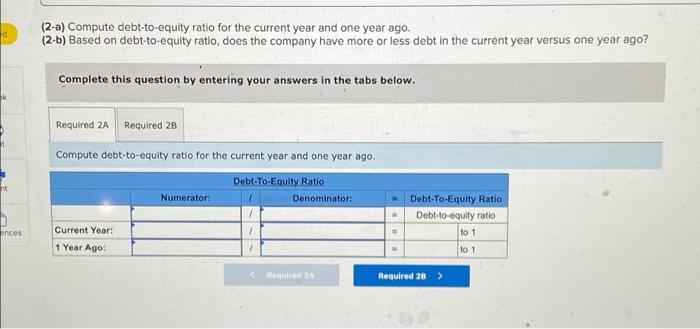

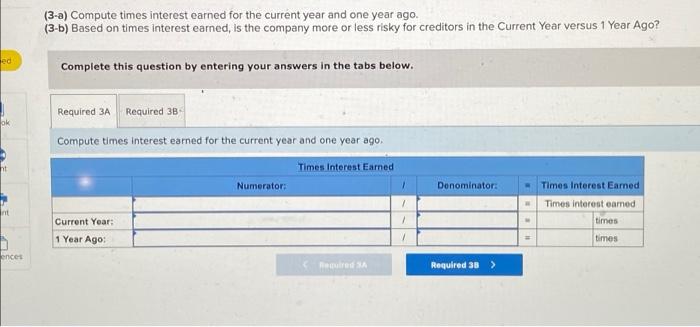

3 ed k ces Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory. Prepaid expenses Plant assets, net Total assets Current Year 1 Year Ago 2 Years Ago $ 34,395 $ 34,753 $ 30,019 87,867 60,799 80,342 8,937 249,807 48, 249 51,904 3,981 223,013 $ 434,280 $361,900 Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share 110,476 9,763 265,640 $503,765 Liabilities and Equity Accounts payable Long-term notes payable. Common stock, $10 par value Retained earnings Total liabilities and equity The company's income statements for the current year and one year ago, follow. Current Year 1 Year Ago For Year Ended December 31 Sales $ 129,201 94,708 162,500 117,356 $ 503,765 $ 399,486 203,017 11,133. 8,514 $ 72,659 100,883 162,500 98,238 $ 434,280 $ 654,895 622,150 $ 32,745 $ 2.02 $ 46,815 82,379 162,500 70,206 $361,900 $ 335,915 130,749 11,886 7,752 $ 516,793 486,302 $ 30,491 $ 1.88 ces (1) Compute debt and equity ratio for the current year and one year ago. Current Year: 1 Year Ago: Current Year: 1 Year Ago: Numerator: Numerator: Debt Ratio Denominator: Equity Ratio 1 Denominator: = 11 = Debt Ratio Debt ratio Equity Ratio Equity ratio % % % d ht ences (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? Complete this question by entering your answers in the tabs below. Required 2A Required 28 Compute debt-to-equity ratio for the current year and one year ago. Debt-To-Equity Ratio Current Year: 1 Year Ago: Numerator: 1 1 Denominator: Required 2A Debt-To-Equity Ratio Debt-to-equity ratio Required 20 > to 1 to 1 ed ok ht nt ences (3-a) Compute times interest earned for the current year and one year ago. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 3A Required 38 Compute times interest earned for the current year and one year ago. Times Interest Earned Current Year: 1 Year Ago: Numerator: Required 3A 1 1 7 Denominator: Required 38 > Times Interest Earned Times interest earned. times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts