Question: help with bonds Problem 15-09A a-c (Part Level Submission) On January 1, 2020, Blossom Company issued $2,200,000, 6%, 10-year bonds at $2,369,878. This price resulted

help with bonds

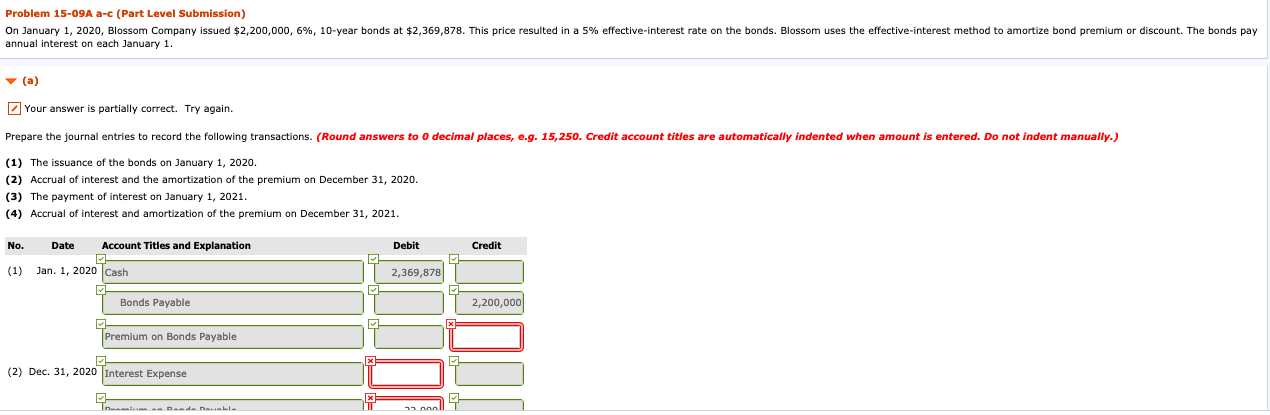

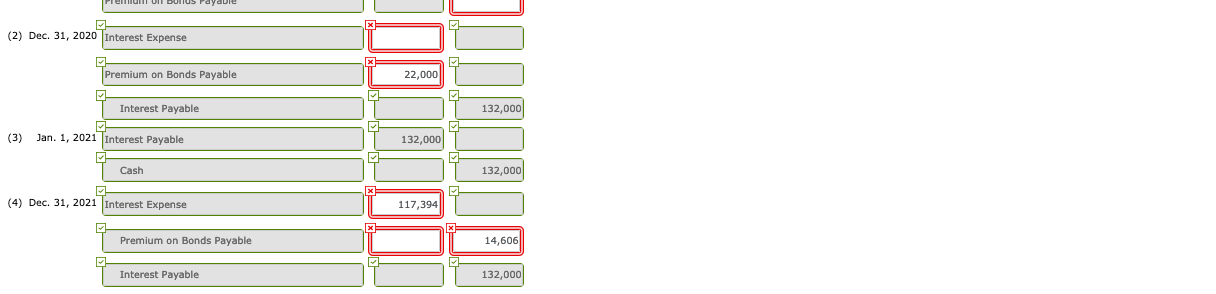

Problem 15-09A a-c (Part Level Submission) On January 1, 2020, Blossom Company issued $2,200,000, 6%, 10-year bonds at $2,369,878. This price resulted in a 5% effective interest rate on the bonds. Blossom uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest on each January 1. (a) Your answer is partially correct. Try again. Prepare the journal entries to record the following transactions. (Round answers to o decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (1) The issuance of the bonds on January 1, 2020. (2) Accrual of interest and the amortization of the premium on December 31, 2020. (3) The payment of interest on January 1, 2021. (4) Accrual of interest and amortization of the premium on December 31, 2021. No. Date Account Titles and Explanation Debit Credit (1) Jan. 1, 2020 Cash 2,369,878 Bonds Payable 2,200,000 x Premium on Bonds Payable (2) Dec. 31, 2020 Interest Expense X ITT q nama Band ausble nnn Piemnomon bonus rayable (2) Dec. 31, 2020 Interest Expense x Premium on Bonds Payable 22,000 Interest Payable 132,000 (3) Jan 1, 2021 Interest Payable 132,000 Cash 132,000 (4) Dec. 31, 2021 Interest Expense 117,394 x Premium on Bonds Payable 14,606 Interest Payable 132,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts