Question: Help with both parts, please. Transcribed Text: Exercise 21-1 On January 1, 2017, Carla Corporation signed a 5-year noncancelable lease for a machine. The terms

Help with both parts, please.

Transcribed Text:

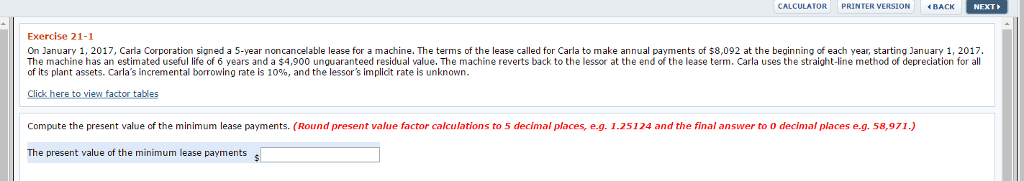

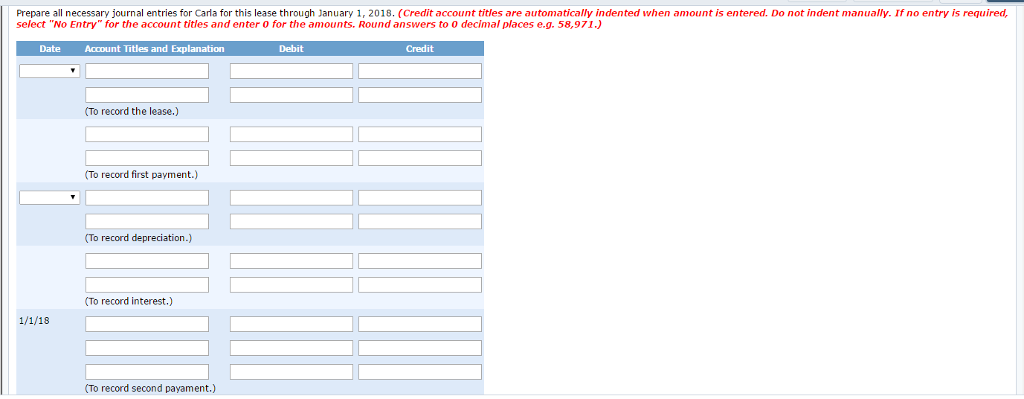

Exercise 21-1 On January 1, 2017, Carla Corporation signed a 5-year noncancelable lease for a machine. The terms of the lease called for Carla to make annual payments of $8,092 at the beginning of each year starting January 1, 2017. The machine has an estimated useful life of 6 years and a $4,900 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Carla uses the straight-line method of depreciation for all ot its plant assets. Carla's incremental borrowing rate is 10%, and the lessors implicit rate is unknown. factor tables Compute the present value of the minimum lease payments. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971J The present value of the minimum lease payments

CALCULATOR PRINTER VERSION BACK NEXT Exercise 21-1 On January 1, 2017, Carla Corporation signed a 5-year noncancelable lease for a machine. The terms of the lease called for Carla to make annual payments of $8,092 at the beginning of each year, starting January 1, 2017. The machine has an estimated useful life of 6 years and a $4,900 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Carla uses the straight-line method of depreciation for all of its plant assets. Carla's incremental bomowing rate is 10%, and the lessor's implicit rate is unknown. Click here to view factor tables Compute the present value of the minimum lease payments. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971) The presen value of the minimu lease payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts