Question: help with both pls There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $34,000

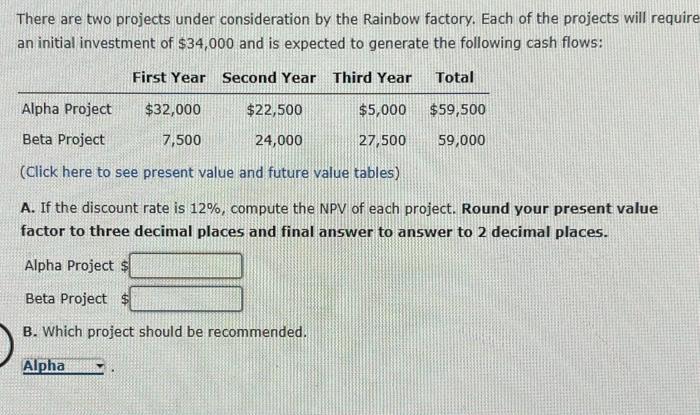

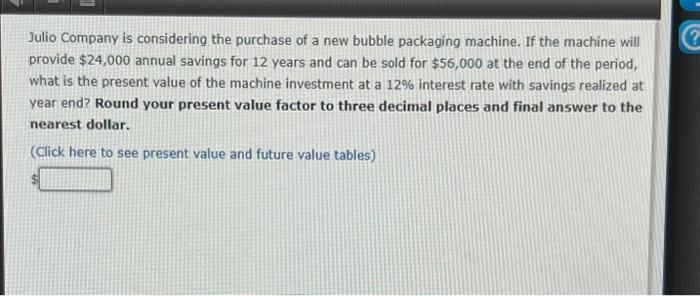

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $34,000 and is expected to generate the following cash flows: (Click here to see present value and future value tables) A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project \$ Beta Project \$ B. Which project should be recommended. Julio Company is considering the purchase of a new bubble packaging machine. If the machine will provide $24,000 annual savings for 12 years and can be sold for $56,000 at the end of the period, what is the present value of the machine investment at a 12% interest rate with savings realized at year end? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts