Question: help with both tabs please! it is one long problem/project A local theater company sells 1500 season ticket packages at a price of $250 per

help with both tabs please! it is one long problem/project

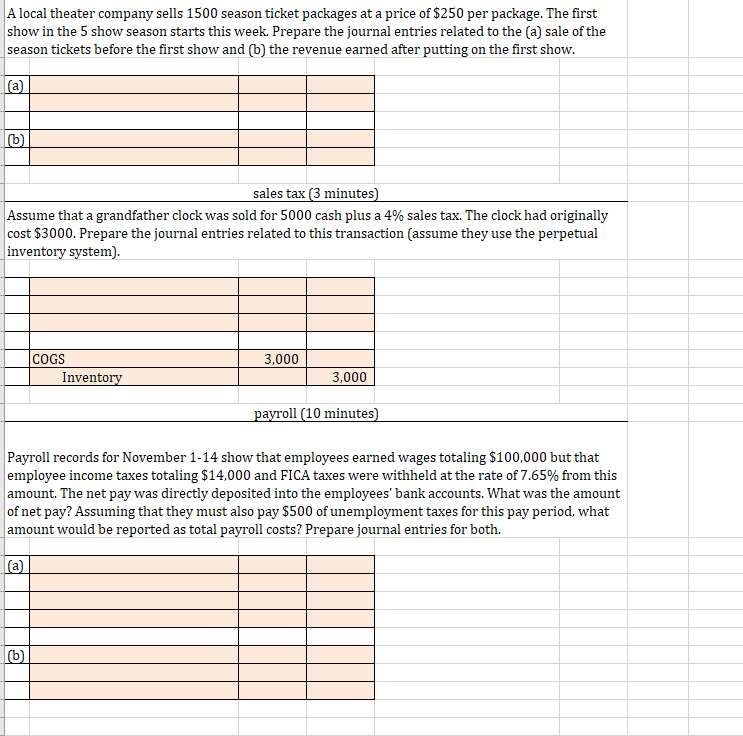

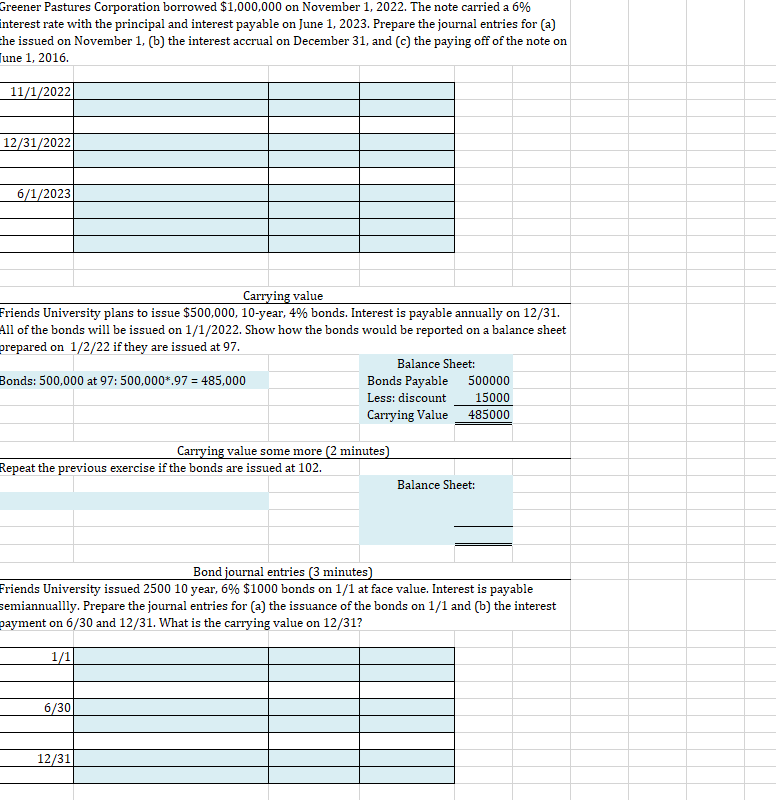

A local theater company sells 1500 season ticket packages at a price of $250 per package. The first show in the 5 show season starts this week. Prepare the journal entries related to the (a) sale of the season tickets before the first show and (b) the revenue earned after putting on the first show. (a) (b Sales lax ( 0 munutes) Assume that a grandfather clock was sold for 5000 cash plus a 4% sales tax. The clock had originally cost $3000. Prepare the journal entries related to this transaction (assume they use the perpetual inventorv svstem). Payroll records for November 114 show that employees earned wages totaling $100,000 but that employee income taxes totaling $14,000 and FICA taxes were withheld at the rate of 7.65% from this amount. The net pay was directly deposited into the employees' bank accounts. What was the amount of net pay? Assuming that they must also pay $500 of unemployment taxes for this pay period, what amount would be reported as total payroll costs? Prepare journal entries for both. Greener Pastures Corporation borrowed $1,000,000 on November 1, 2022. The note carried a 6% interest rate with the principal and interest payable on June 1, 2023. Prepare the journal entries for (a) the issued on November 1, (b) the interest accrual on December 31, and (c) the paying off of the note on une 1,2016. \begin{tabular}{|r|l|l|l|} \hline 11/1/2022 & & & \\ \hline & & & \\ \hline & & & \\ \hline 12/31/2022 & & & \\ \hline & & & \\ \hline & & & \\ \hline 6/1/2023 & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Carrying value Friends University plans to issue $500,000,10-year, 4% bonds. Interest is payable annually on 12/31. All of the bonds will be issued on 1/1/2022. Show how the bonds would be reported on a balance sheet prepared on 1/2/22 if they are issued at 97 . \begin{tabular}{|l|l|} \hline Bonds: 500,000 at 97:500,000.97=485,000 & \multicolumn{2}{|c}{ Balance Sheet: } \\ & Bonds Payable 500000 \\ & Less: discount r48500015000 \\ \hline \end{tabular} Carrying value some more ( 2 minutes) Repeat the previous exercise if the bonds are issued at 102. Balance Sheet: Bond journal entries ( 3 minutes) Friends University issued 250010 year, 6%$1000 bonds on 1/1 at face value. Interest is payable semiannually. Prepare the journal entries for (a) the issuance of the bonds on 1/1 and (b) the interest payment on 6/30 and 12/31. What is the carrying value on 12/31 ? \begin{tabular}{|r|l|l|l|} \hline 1/1 & & & \\ \hline & & & \\ \hline 6/30 & & & \\ \hline & & & \\ \hline & & & \\ \hline 12/31 & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts