Question: Help with ethics case questions please ETHICS CASE Preston Enterprises uses the direct write-off method of accounting for uncollectible accounts. On October 12, a very

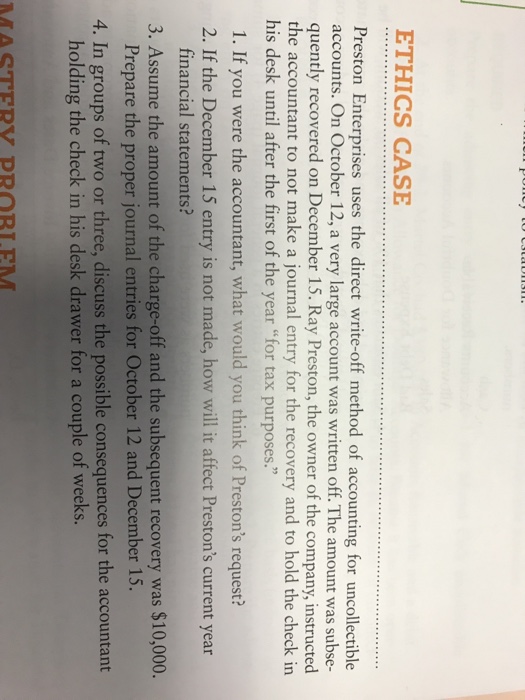

ETHICS CASE Preston Enterprises uses the direct write-off method of accounting for uncollectible accounts. On October 12, a very large account was written off. The amount was subse- quently recovered on December 15. Ray Preston, the owner of the company, instructed t to not make a journal entry for the recovery and to hold the check in his desk until after the first of the year "for tax purposes." 1. If you were the accountant, what would you think of Preston's request? 2. If the December 15 entry is not made, how will it affect Preston's current year financial statements? 3. Assume the amount of the charge-off and the subsequent recovery was $10,000. Prepare the proper journal entries for October 12 and December 15. 4. In groups of two or three, discuss the possible consequences for the accountant holding the check in his desk drawer for a couple of weeks. MASTERY PRORIEM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts