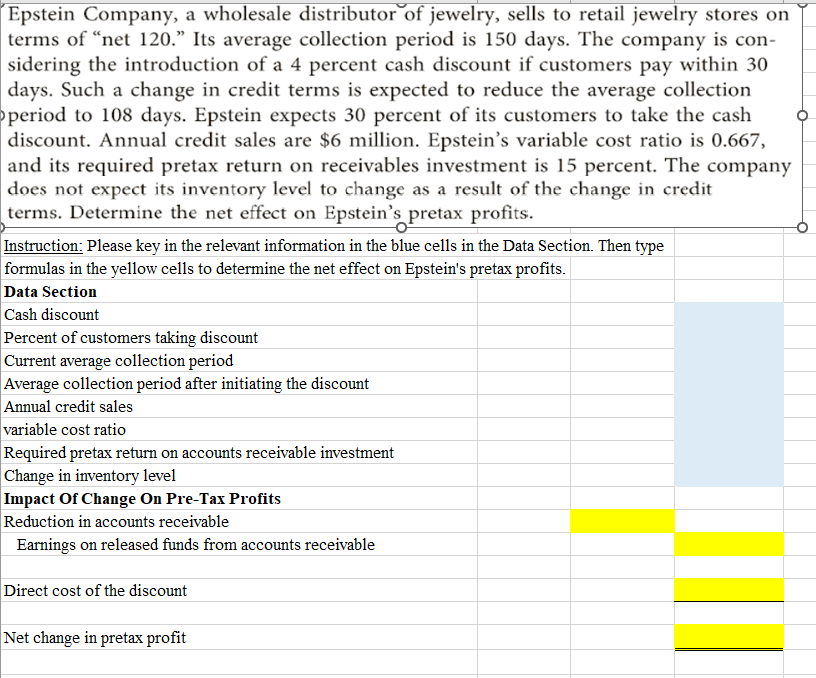

Question: Help with Excel formulas for the below question please . Epstein Company, a wholesale distributor of jewelry, sells to retail jewelry stores on terms of

Help with Excel formulas for the below question please

Epstein Company, a wholesale distributor of jewelry, sells to retail jewelry stores on terms of "net Its average collection period is days. The company is considering the introduction of a percent cash discount if customers pay within

days. Such a change in credit terms is expected to reduce the average collection

period to days. Epstein expects percent of its customers to take the cash

discount. Annual credit sales are $ million. Epstein's variable cost ratio is

and its required pretax return on receivables investment is percent. The company

does not expect its inventory level to change as a result of the change in credit

terms. Determine the net effect on Epstein's pretax profits.

Instruction: Please key in the relevant information in the blue cells in the Data Section. Then type

formulas in the yellow cells to determine the net effect on Epstein's pretax profits.

Direct cost of the discount

Net change in pretax profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock