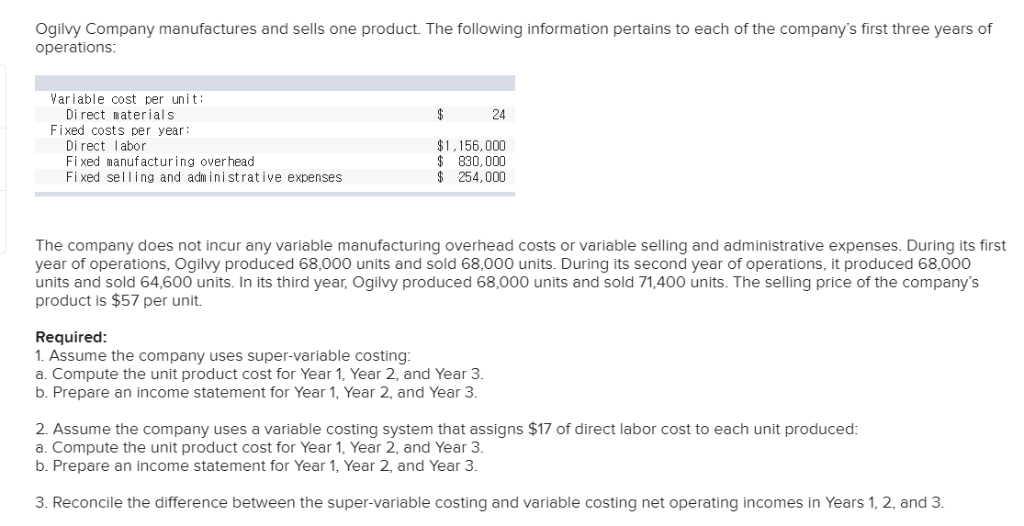

Question: Help with filling blank: 1. 2. 3. Req 1A Req 1B Req 2A Req 2B Req 3 Prepare an income statement for Year 1, Year

Help with filling blank:

1.

2.

3.

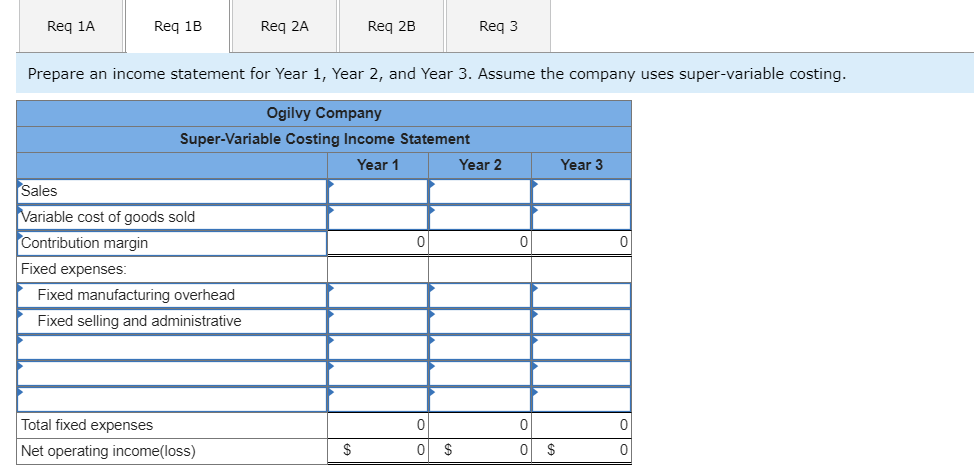

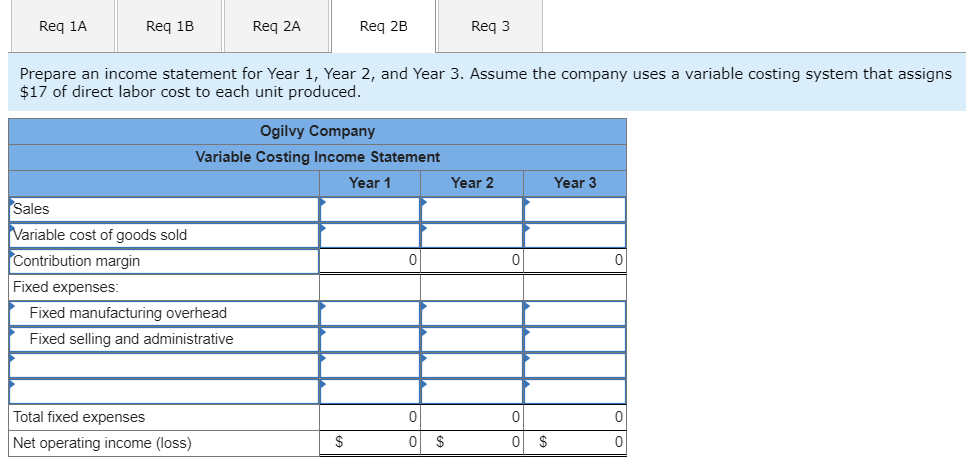

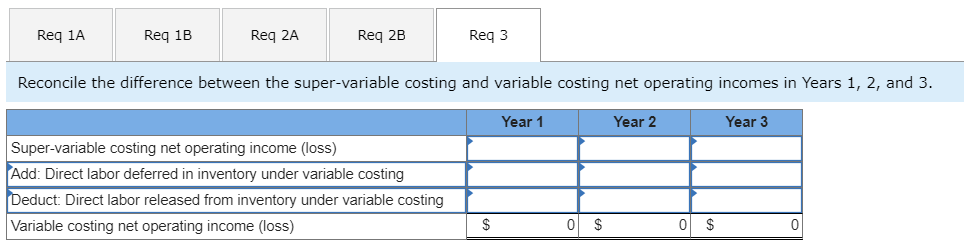

Req 1A Req 1B Req 2A Req 2B Req 3 Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses super-variable costing Ogilvy Company Super-Variable Costing Income Statement Year 1 Year 2 Year 3 Sales Variable cost of goods sold Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Net operating income(loss) Req 1A Req 1B Req 2A Req 2B Req 3 Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses a variable costing system that assigns $17 of direct labor cost to each unit produced. Ogilvy Company Variable Costing Income Statement Year 1 Year 2 Year 3 Sales Variable cost of goods sold Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Net operating income (loss) 0 O S Req 1A Req 1B Req 2A Req 2B Req 3 Reconcile the difference between the super-variable costing and variable costing net operating incomes in Years 1, 2, and 3. Year 1 Year 2 Year 3 Super-variable costing net operating income (loss) Add: Direct labor deferred in inventory under variable costing Deduct: Direct labor released from inventory under variable costing Variable costing net operating income (loss) 0 S 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts