Question: Help with G and H please a. ABC currently has outstanding 12-year bond with 7% coupon that pays semiannually, the current market price is $1075.

Help with G and H please

Help with G and H please

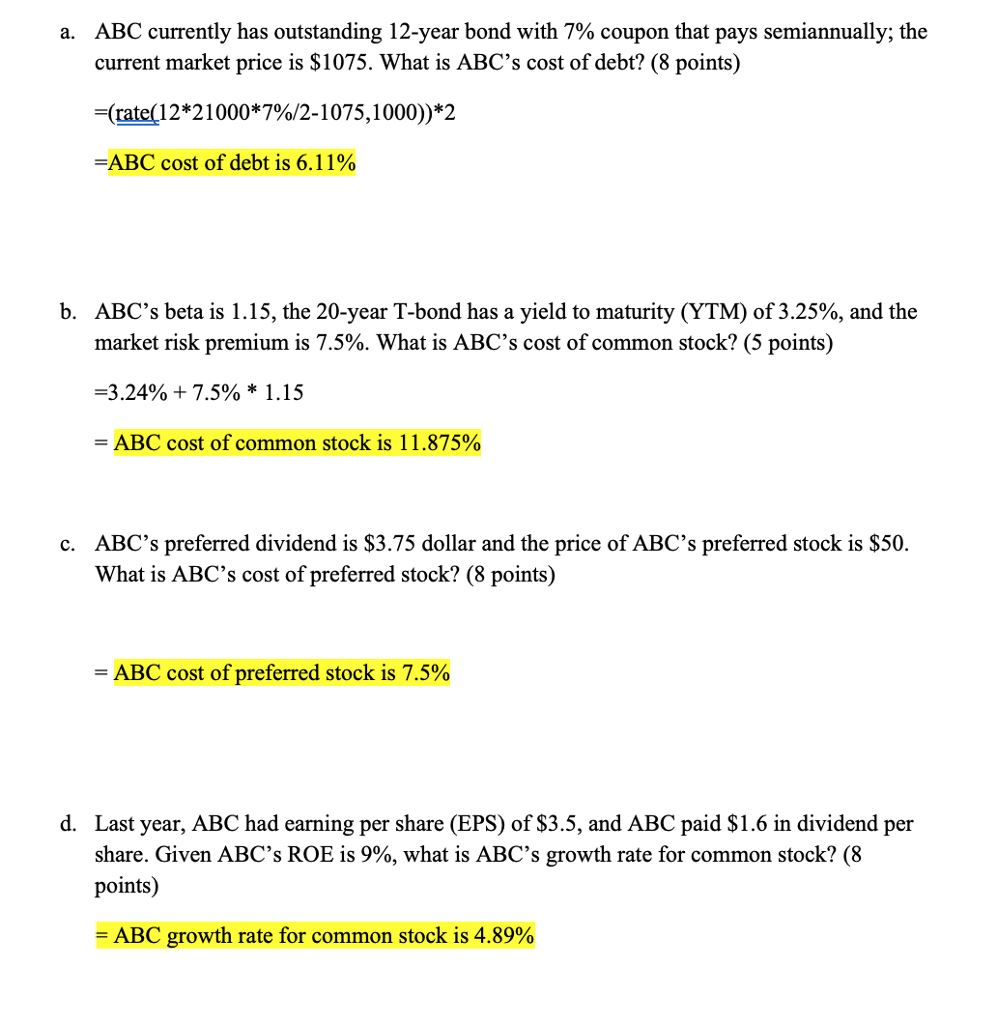

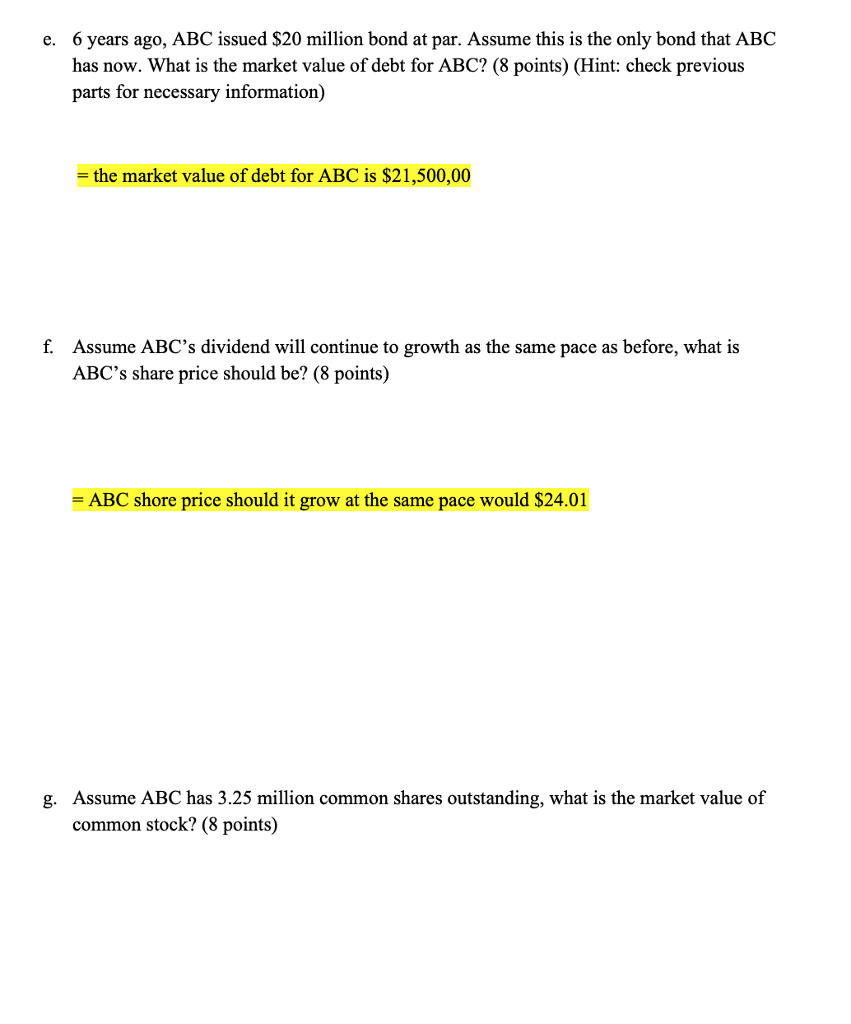

a. ABC currently has outstanding 12-year bond with 7% coupon that pays semiannually, the current market price is $1075. What is ABC's cost of debt? (8 points) : (rate(12*21 000*7%/2-1075, 1000))*2 -ABC cost of debt is 6.11% b, ABC's beta is 1.15, the 20-year T-bond has a yield to maturity (YTM) of 3.25%, and the market risk premium is 7.5%. What is ABC's cost of common stock? (5 points) -3.24% + 7.5% * 1.15 ABC cost of common stock is 1 1.875% ABC's preferred dividend is $3.75 dollar and the price of ABC's preferred stock is $50. What is ABC's cost of preferred stock? (8 points) c. ABC cost of preferred stock is 7.5% Last year, ABC had earning per share (EPS) of S3.5, and ABC paid S1.6 in dividend per share. Given ABC's ROE is 9%, what is ABC's growth rate for common stock? (8 points) d. ABC growth rate for common stock is 4.89% 6 years ago, ABC issued $20 million bond at par. Assume this is the only bond that ABC has now. What is the market value of debt for ABC? (8 points) (Hint: check previous parts for necessary information) e. - the market value of debt for ABC is $21,500,00 f. Assume ABC's dividend will continue to growth as the same pace as before, what is ABC's share price should be? (8 points) ABC shore price should it grow at the same pace would $24.01 Assume ABC has 3.25 million common shares outstanding, what is the market value of common stock? (8 points) g. Assume ABC has $8 million preferred stock, what are market value weighted for debt, preferred stock and common stock? (9 points) h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts