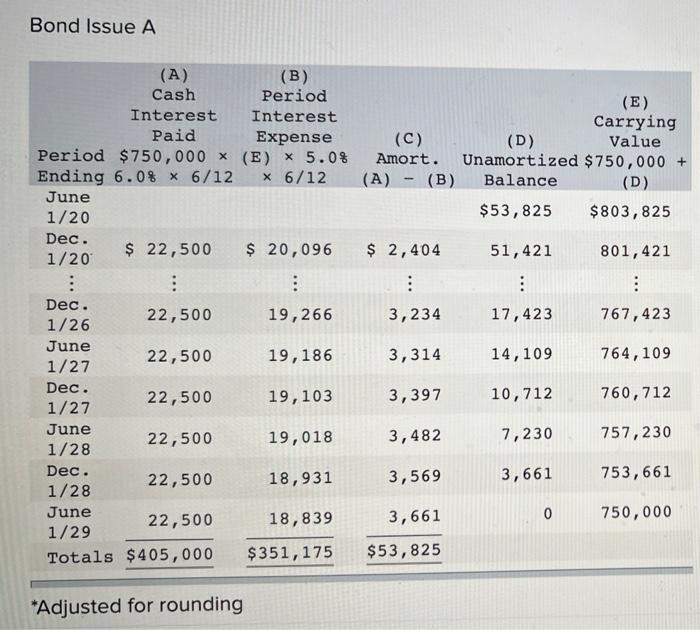

Question: help with g & h pls Bond Issue A (A) Cash (B) Period Interest Interest Paid Expense (C) Period $750,000 x (E) * 5.0% Amort.

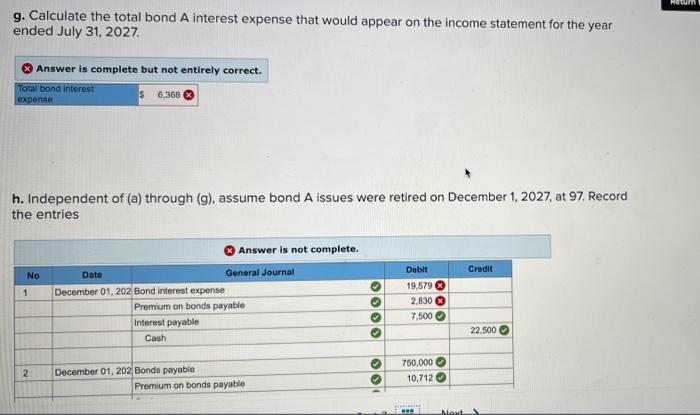

Bond Issue A (A) Cash (B) Period Interest Interest Paid Expense (C) Period $750,000 x (E) * 5.0% Amort. Ending 6.0% 6/12 6/12 (A) (B) June 1/20 Dec. 1/20 $ 22,500 $ 20,096 $2,404 : : Dec. 22,500 19,266 3,234 1/26 June 22,500 19,186 3,314 1/27 Dec. 22,500 19,103 3,397 1/27 June 22,500 19,018 3,482 1/28 Dec. 22,500 18,931 3,569 1/28 June 22,500 18,839 3,661 1/29 Totals $405,000 $351,175 $53,825 *Adjusted for rounding (E) Carrying Value Unamortized $750,000 + (D) Balance (D) $53,825 $803,825 51,421 801,421 : 17,423 767,423 14, 109 764,109 10,712 760,712 7,230 757,230 3,661 753,661 0 750,000 g. Calculate the total bond A interest expense that would appear on the income statement for the year ended July 31, 2027. Answer is complete but not entirely correct. Total bond interest $ 6,368 expense h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2027, at 97. Record the entries Answer is not complete. Debit Date Credit No December 01, 202 Bond interest expense 19,579 Premium on bonds payable Interest payable 22,500 Cash December 01, 202 Bonds payable Premium on bonds payable 1 2 General Journal O 100 2,830 7,500 750,000 10,712 fog Nort Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts