Question: help with inputing values into IRR function on excell, All answered EXCEPT G and H. company's required rate of return is 14%. The initial cost

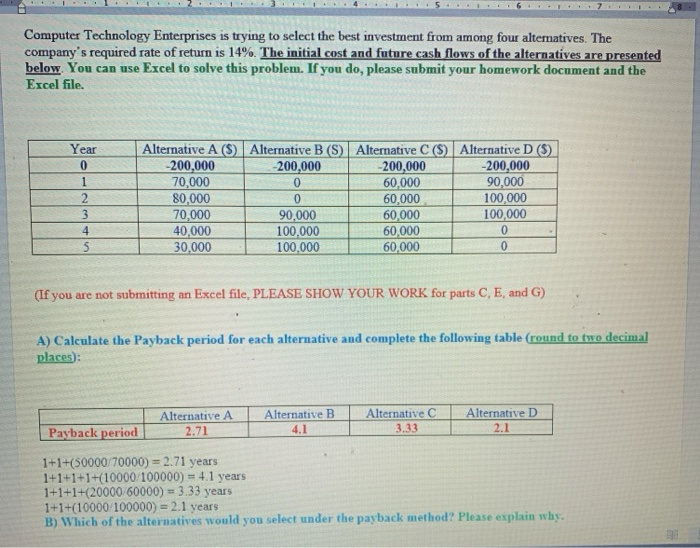

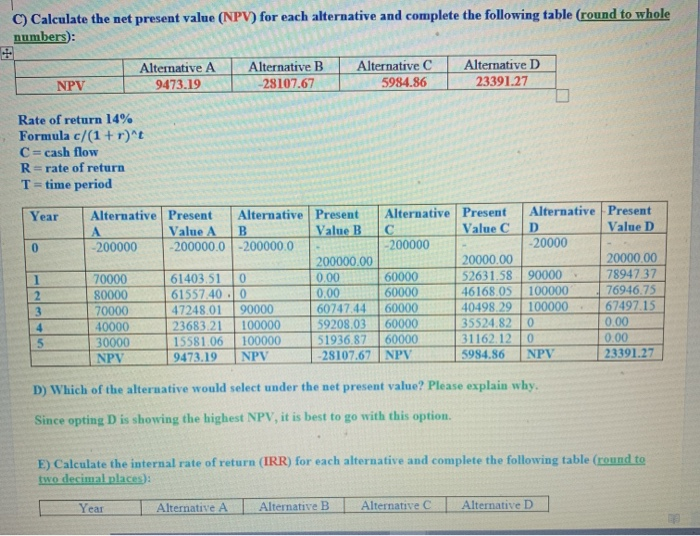

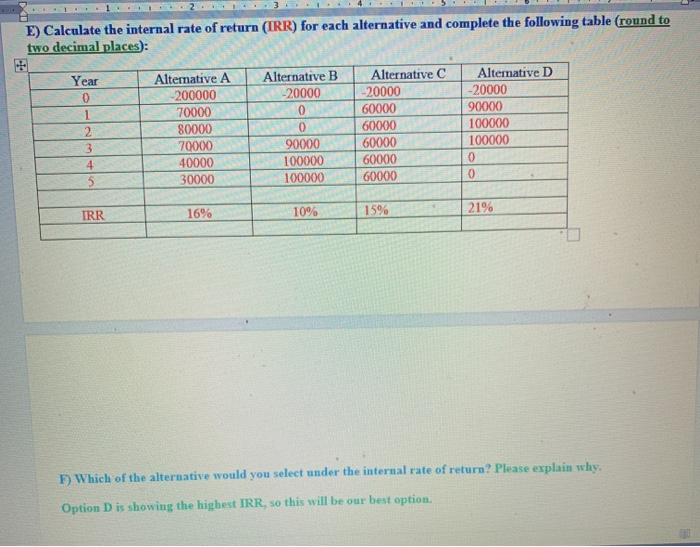

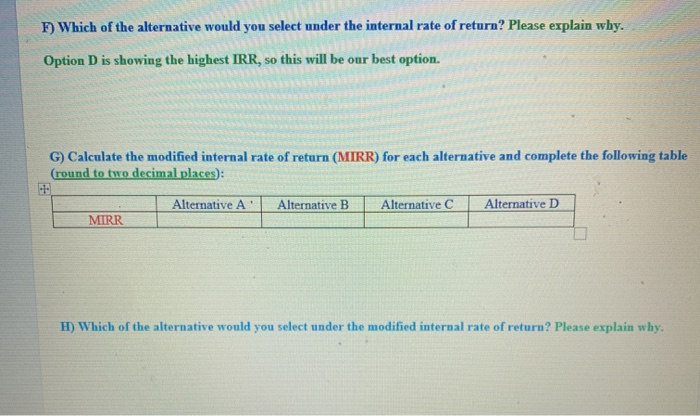

company's required rate of return is 14%. The initial cost and future cash flows of the alternatives are presented below. You can use Excel to solve this problem. If you do, please submit your homework document and the Excel file. Year 0 Alternative A ($) Alternative B (S) Alternative C($) Alternative D (5) -200.000 200.000 -200.000 -200,000 70,0000 60,000 90,000 80,0000 60,000 100.000 70.000 90.000 60,000 100.000 40,000 100.000 60,000 0 30,000 100,000 60,000 (If you are not submitting an Excel file, PLEASE SHOW YOUR WORK for parts C, E, and G) A) Calculate the Payback period for each alternative and complete the following table (round to two decimal places): Alternative B Alternative Alternative D Alternative A 2.71 333 Payback period 1+1+(50000/70000) = 2.71 years 1+1+1+1+(10000/100000) 4.1 years 1+1+1+(220000 60000) 3.53 years 1+1+(10000/100000) = 2.1 years B) Which of the alternatives would you select under the payback method? Please explain why. C) Calculate the net present value (NPV) for each alternative and complete the following table (round to whole numbers): Alternative A 9473.19 Alternative B -28107.67 Alternative C 5984.86 Alternative D 23391.27 NPV Rate of return 14% Formula c/(1+r)^t C = cash flow R=rate of return T=time period Year Alternative Present Alternative Value AB -200000.0 -200000.0 -200000 70000 80000 70000 40000 30000 NPV 61403.510 61557.400 47248 01 90000 23683.21 100000 15581.06 100000 9473.19 NPV Present Alternative Value B -200000 200000.00 0.00 60000 0.00 60000 6074744 60000 59208.03 60000 51936.87 60000 -28107.67 NPV Present Alternative Present Value C Value D -20000 20000.00 20000.00 52631.58 90000 7 894737 46168.05 100000 76946.75 40498 29 100000 6749715 35524.820 0.00 31162.12 10 0.00 5984.86 NPV 23391.27 D) Which of the alternative would select under the net present value? Please explain why. Since opting D is showing the highest NPV, it is best to go with this option. two decimal places): Year Alternative A Alternative B Alternative Alternative D E) Calculate the internal rate of return (IRR) for each alternative and complete the following table (round to two decimal places): Year 0 Alternative A 200000 70000 80000 70000 40000 30000 2 3 Alternative B -20000 0 0 90000 100000 100000 Alternative --20000 60000 60000 60000 60000 60000 Alternative D -20000 90000 100000 100000 IRR 16% 10% 15% 21% F) Which of the alternative would you select under the internal rate of return? Please explain why. Option D is showing the highest IRR, so this will be our best option. F) Which of the alternative would you select under the internal rate of return? Please explain why. Option D is showing the highest IRR, so this will be our best option. G) Calculate the modified internal rate of return (MIRR) for each alternative and complete the following table (round to two decimal places): Alternative A' MIRRELL Alternative B Alternative Alternative D H) Which of the alternative would you select under the modified internal rate of return? Please explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts